Stepping into a brand new real estate market isn’t easy. Your local market is like that childhood friend you grew up with. You knew him, his parents, his third grade teacher, that embarrassing incident in the cafeteria in the fifth grade, and every awkward step all the way through high school.

Stepping into a brand new real estate market isn’t easy. Your local market is like that childhood friend you grew up with. You knew him, his parents, his third grade teacher, that embarrassing incident in the cafeteria in the fifth grade, and every awkward step all the way through high school.

You know him like the back of your hand. You could not talk to him for years, but meet him for coffee right now and pick up where you left off.

But a new market? There’s so many years you’ve missed out on! So much history you don’t know! How can you ever hope to catch up to people who’ve known that market for years and years?

Here’s the thing: it’s not a lost cause. Plenty of real estate investors successfully invest in out-of-state markets and go beyond their own local areas all the time. Is it more work? Yes. But it’s very, very possible, especially in our Information Age.

If you’ve confined yourself to local markets up until now, you may be a little nervous about breaking into a new real estate market for the first time. But don’t worry: we have tips!

6 Tips for Investors Looking to Break Into a New Real Estate Market

1. Check the Criteria

First and foremost, look at the markets. Why do you want to be in a particular market? What kind of real estate do you want to invest? Do you want to be in that market because of its solid job growth and the strength of its local economy? Are the projections for its rental market (or other real estate sector, like CRE) particularly stellar?

Consider your strategies and goals and why a market would fit those goals in particular. Let that guide your decision.

2. Hit the Internet

Before you make travel plans, dig into some data. Check out what you can online through Realtor, Zillow, Trulia, and similar sites to get some market data. City-Data provides overviews and statistical data on U.S. cities in just about every category, making it a great resource for quick information on areas and even neighborhoods.

3. Hunt Down Local Connections

After you’ve done preliminary research, start digging deeper for real properties and networking connections that you may need: think brokers, other investors, agents, and more. BiggerPockets is a good place to start for networking, as always. Once you start making those on-the-ground connections, you’ll start to truly get a feel for the market.

4. Visit for Yourself

Nothing compares to being there for yourself. For any market outside of your local one, visit it. Not only will this prevent you from getting potentially scammed (there are people out there who will try to put fake real estate listing up for remote buyers. Don’t be fooled), but you’ll be able to really see and feel the vibe of your new market. Go visit. Stay for awhile. Meet with some of your contacts and chat with them about the market, face-to-face.

5. Build Up Your Network

Continue to make contacts in the area: contractors, managers, agents, inspectors, legal and tax advisors (particularly if you’re in another state where laws are different from what you’re used to). You’re going to want a Rolodex you can refer to with plenty of contacts.

6. Identify a Top Notch Management Company

For any investor that chooses to invest out-of-state, your number one most important asset is a trusted, top notch property management company. You need someone who’s going to take care of your properties and your tenants so that you don’t have to worry about anything while you’re away.

Bonus: Partner with a Turnkey Real Estate Company

The simplest, cleanest way to invest in a remote real estate market? Go turnkey. You save so much time and energy spent researching and locating professionals when you instead can lean on the experience of an established, well-vetted, experienced turnkey real estate investment company. They already know the market, they already have investment properties ready to go, usually with tenants and generating cash flow, and they often have their own property management teams.

Everyone reading this should understand that the word TURNKEY means nothing! It is a marketing term without much of a definition. Many companies use the word to attract investors, yet they may be stretching it - big-time! - by using it to describe their services. Investors should always do thorough due diligence when vetting a turnkey opportunity. Not all opportunities are created equally and not all turnkey companies are equal!

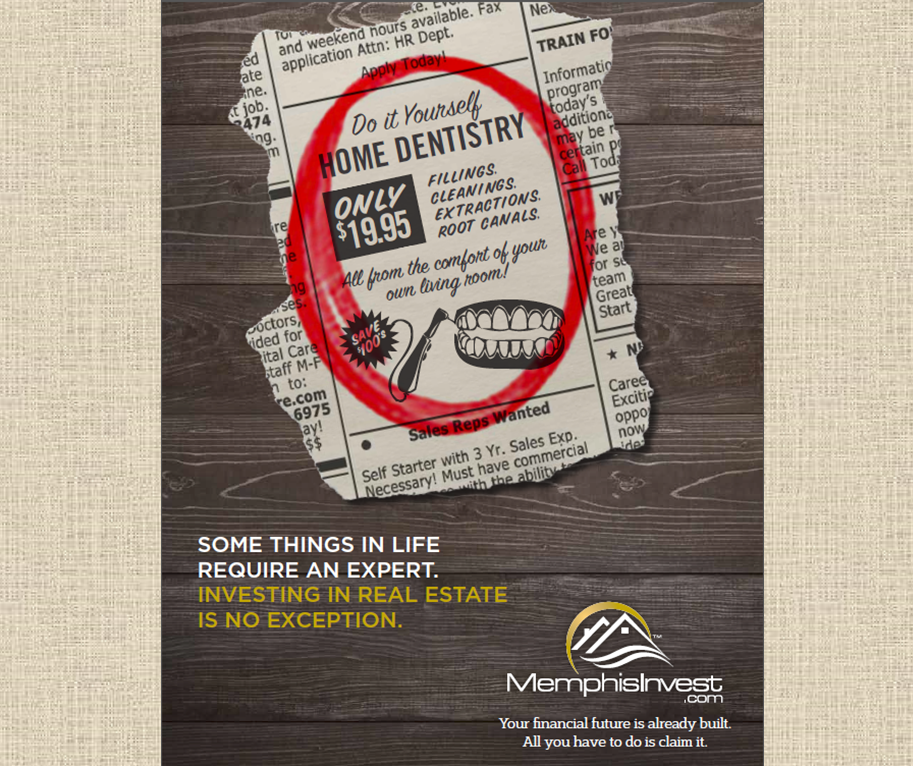

Learn More About Getting started with Memphis Invest today!