Over the years, Memphis Invest has slowly diversified the markets in which we operate. As we identify real estate markets that offer an abundance of opportunities for our investors, it only makes sense to grow. From our hometown of Memphis to Dallas and Houston, we’ve now added two new cities to the Memphis Invest family: Little Rock, Arkansas and Oklahoma City, Oklahoma.

Over the years, Memphis Invest has slowly diversified the markets in which we operate. As we identify real estate markets that offer an abundance of opportunities for our investors, it only makes sense to grow. From our hometown of Memphis to Dallas and Houston, we’ve now added two new cities to the Memphis Invest family: Little Rock, Arkansas and Oklahoma City, Oklahoma.

As we bring these wonderful cities into the fold, we have a prime opportunity to properly introduce these new markets and satisfy some of the curiosity about their history and the investment opportunities they provide.

We don't just present any market to our investors. We thoroughly investigate and vet our markets to ensure that they offer not only great opportunities in the present but the best chance for long-term, sustainable investments. These markets have to meet certain standards!

What Buy-and-Hold Investors Look for in a Market

If you’re a buy-and-hold investor of any kind, there are certain factors—certain criteria—that any market you choose to invest in should meet. There are exceptions to these rules when particularly hot or once-in-a-lifetime opportunities come along, but these are not an investor’s bread-and-butter. So what should investors look for?

Sustainable and Diverse Local Economy

Just as an investment portfolio has to have diversity to hedge against risk, so does a city’s economy. When a local economy is diverse and varied, it allows for fluctuations in supply and demand, dips in certain industries, and even loss of businesses in the community without devastation or disruption.

When an economy hinges on a single industry or business, any blow to that industry is felt by the whole community. A small town that relies on the jobs provided by an automobile plant would collapse economically if that plant were to relocate. In turn, any real estate investor in that town would find themselves battling vacancies, a drop in rental rates, and decreasing property values.

Stable Growth in Real Estate Sector

It is easy to get excited when growth is fast-paced and explosive. In the world of real estate investment, we’re always looking for the next big thing. But for real estate investors, truly effective investments—the ones you can count on to last and really support your passive income—are found in stable, steady real estate markets.

These markets usually experience modest growth rather than explosive growth. They’re less “hot” and more even-tempered. After all, we look primarily to long-term success—not flash-in-the-pan real estate trends.

Job Opportunities & Population Growth

The health of a real estate market can be gauged quickly by looking at some quick economic statistics. First, buy-and-hold investors can look and see what job opportunities are on the market. Is new industry moving in? Has unemployment been on a downward trend? Job opportunities are crucial to the health and growth of the real estate market.

Investors also want to see a consistent upward tick in population in their market. Population growth increases housing demands and, naturally, rent prices.

With these criteria in mind, though they are not the only measures of a healthy and viable investment market, we can begin to assess any given real estate market.

Related Article: Real Estate Market Overview: 3 Things to Know About Little Rock, AR

Introducing Oklahoma City

With the criteria for evaluating a real estate market in mind, we turn our attention to Oklahoma City, Oklahoma. Does it fit the bill? How does Oklahoma City measure up against some of the modern challenges of our times, like market turmoil, rent affordability, inventory issues, and economic stability?

Is this city a good pick for real estate investors? We think so—and we’ll tell you why.

As the 27th largest city in the United States with a population of just over 630,000, Oklahoma City had an explosive population growth following the 2010 census. It’s the largest city in the Great Plains region and hosts one of the world’s largest livestock markets in addition to a diverse industry.

The Economy of Oklahoma City

Oil Industry

Oklahoma City doesn’t stop with livestock. Even with nearly 80,000 farms in the state and $2,560,265,000 in a yearly value of production from livestock and farming in 2016, it isn’t the only valuable industry in the state or the city. The oil and energy industry has a strong and growing presence that has greatly impacted the market’s health, especially in the past decade or so.

Oil, gas, and wind energy make up nearly a quarter of industry in Oklahoma, directly or indirectly. Though energy has always played a role in Oklahoma’s economy, it has grown in its role recently and was integral in shielding not only Oklahoma City but the state as a whole from the impact of the 2009 recession that left much of the country in a tailspin.

Economic Diversity

Livestock and energy are two of the state’s heavy hitters, but when we zoom in on Oklahoma City, we find the investment of some major employers. Two Fortune 500 companies have their headquarters in Oklahoma City, including Chesapeake Energy Corporation and Devon Energy Corporation.

A notable selection of employers have their headquarters in Oklahoma City, each employing a significant number of employees:

- State of Oklahoma (40,000+ employees)

- Integris Health (5,000+)

- Hobby Lobby (5,000+)

- City of Oklahoma City (3,000+)

- Mercy Health Center (3,000+)

- Chesapeake Energy Corporation (3,000+)

- OG+E Energy Corp (3,000+)

- Devon Energy Corp (3,000+)

- SSM Health Care (3,000+)

- Sonic Corp. (3,000+)

- The Boeing Company (Regional HQ) (1,000+)

- LSB Industries, Inc. (1,000+)

- American Fidelity Assurance (1,000+)

There are other major employers in the city that do not headquarter there, including Dell, Hertz, AT&T, and the University of Oklahoma Medical Center. Within the Oklahoma City MSA, there is also the United States Air Force Tinker Air Force Base, which employs 27,000 people, and the University of Oklahoma, which employs 11,900.

Overall, Oklahoma City has a diverse economy with its strengths in the energy sector, information technology, healthcare, government, services, and administration. As discussed, a diverse economy is key in hedging a market against risk. In the case of a downturn in one sector of the economy, other industries are able to support and maintain it. The evidence of Oklahoma City’s diversification is not only seen in the list of big-name employers, but in the numbers that come directly from the Chamber of Commerce.

At the turn of the century, Oklahoma City’s economic diversification efforts truly began and, as a result, the metropolitan area's economic output grew by 33 percent between 2001 and 2005. The gross metropolitan product has been on the rise ever since: $43.1 billion in 2005, $61.1 billion in 2009, and $73.8 billion in 2016.

This was not always the case in Oklahoma. Like Houston, which once relied vastly on the oil industry to keep its economy afloat, Oklahoma City once struggled with one of the worst job and housing markets in the country during the 1980’s. Thanks to the bankruptcy of the Penn Square Bank in 1982 prior to the 1985 oil bust, the economy was one of the worst to be found, largely to a lack of diversification.

We can see now that the market has learned from these mistakes and has taken measure to prevent a repeat performance.

“The most recession-proof city in America"?

In 2008, Forbes called Oklahoma City the most “recession-proof city in America.” This was in the beginning of the recession that devastated many markets nationwide, where unemployment reached unfathomable heights, real estate prices bottomed out, foreclosures hit record numbers, and hope was nowhere in sight. It was a bad time for a lot of people.

But at the time, Oklahoma City was experiencing something different. Unemployment was falling, the housing market was among the country’s most formidable, and the local economy was holding strong as energy, manufacturing, and agriculture continued to grow on schedule.

Of all the cities in America, Oklahoma City seemed to be in the best position to ride out the storm that was devastating so many other cities. At the time (2008), median home prices were up 8.2%, unemployment sat at a meager 3.5% (which was actually down from the previous year), and the city saw key growth in both construction and leisure and hospitality sectors. By 2012, the economy surpassed its pre-recession performance.

But why?

The recession began in 2007 and officially ended in 2009 (though its effects were felt long after). In Oklahoma City, the effects of the recession were not felt until 2009. Make no mistake, the city was affected by the economic downturn—however, it was heavily insulated by a series of factors that greatly reduced the impact that such a recession could have had.

Most of the jobs lost were in the manufacturing sector, where they decreased by an average of 3,000 (8.5%) annually. Other industries suffered losses as well. What helped the economy, however, was that one of the city’s main employers is the federal, state, and local government. Combined, they added thousands of jobs each year that helped offset the losses.

By 2012, Oklahoma City was no longer suffering job losses but was back to see gains. A diverse and essential economy kept Oklahoma City going strong through the economic trials.

The Best Place for Business

The excellent track record for Oklahoma City’s economy didn’t stop with the recession era. In the years since OKC has consistently topped lists for business and career. In 2013 and 2014, Forbes named the city in the Top 10 in best places for businesses.

In 2017, WalletHub ranked Oklahoma City number one on its list of “Best Large Cities to Start a Business,” citing factors like business environment (which included criteria like length of work week, average number of small businesses, startups per capita, average growth of business revenue, five-year business survival rate, and variety), cost (factoring in labor costs, office space affordability, cost of living, and corporate taxes), and access to resources (including financing, venture investment, investors, human capital, population with college education, working-age population, and higher education assets).

Oklahoma City ranked particularly well in terms of business environment.

Nonfarm payrolls are at a record high with a 1.3% growth between March 2015 and 2016. It is worth noting, however, that while payrolls are at these great heights, job growth has slowed largely in part to the hit that the oil and gas industry has taken in the past few years.

It’s safe to say that with the diversity of employment opportunities and steady population growth, Oklahoma City has positioned itself as a strong economic market not only in theory but in practice. It not only survived but thrived through one of the most devastating economic downturns of our generation. A consistently low unemployment rate is a testament to its consistency and stability. That sets the stage for a promising real estate scene.

With the economic welfare of the city covered, we have to then consider the implications for Oklahoma City real estate and real estate investors.

What About Oklahoma City Real Estate?

After the recession, OKC saw the same uptick that many others around the country saw in their real estate market health. Median homes prices were fairly steady from 2012 until 2015, where they fluctuated somewhere around $130,000 and $140,000. In 2015 median prices broke $150,00 and experienced a jump to $170,000.

Median prices peaked in November of 2015 at $188,500—still a relatively affordable price compared to other markets of a comparable size around the nation. For example, Portland, Oregon, which ranks 26th largest in the United States (Oklahoma City is 27th), had a median price of $335,000 at the time. Las Vegas, which ranks 28th, had a median price of $205,000.

Since that peak high in 2015, median home prices have evened out and dropped down to around $150,000 as of August 2017. Out of the homes in the city, 41% of them sit in the $113,001 to $226,000 range, with the rest of the majority coming in at lower price ranges.

The Affordability Factor

With the fluctuation in prices over the past few years and, as some have noted, how prices are lagging behind that of prices in other markets around the country, some are concerned that Oklahoma City's market is weaker than the rest. In reality, it's simply more affordable, and that price point is not a bad thing, especially for real estate investors.

There’s a chain reaction that happens when there’s a unique combination of a healthy local economy and an affordable real estate market, and it leads to a lot of investment opportunities. Ultimately, not only can investors afford to invest more readily in a market like Oklahoma City’s, but they will not be faced with the issues that a lack of housing affordability is raising in other markets.

Affordability doesn’t eliminate rental demand, either.

According to a government study in 2016, a 3-year forecast expects a need for 6,875 new market rate rental units by 2019, most of which are expected to be 1 and 2 bedroom. In the 9 months between September or 2016 and April of 2017, the number of rental units increased from just over 950 to just under 2,800. Rental costs have been steadily growing over the past year as well, as the median rent has climbed from a low of $950 to $995 over the course of 2017.

Proportionally, these are fairly affordable rental rates as well. Vacancy rates are down from 2010 (where they had barely budged from 2000) from 10.4% to 7%.

Single-family investors can expect to be at home in Oklahoma City, too—47% of all rental in OKC are single-family properties versus multifamily units.

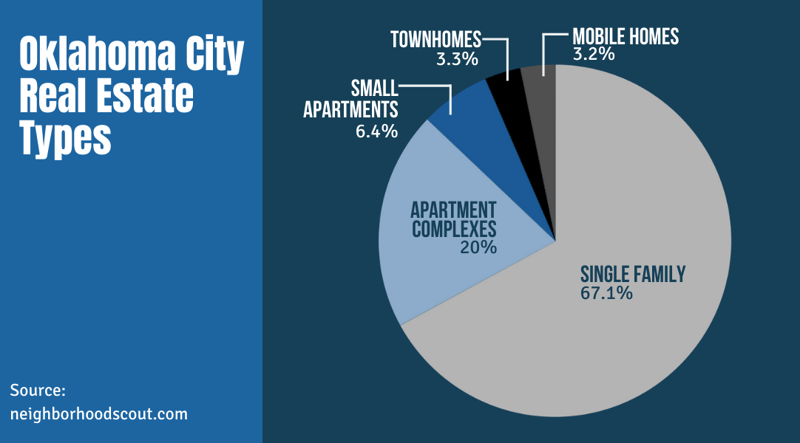

In fact, if you break down all of the types of homes in the city, the data shows that single-family properties dominate.

Overall, the rental market in Oklahoma City shows great promise. Where the early 2000’s and even 2010’s showed weakness in the market due to competition from the homebuying market, a less robust local economy, and the overbuilding of apartment buildings, a balanced rental market has emerged in recent years (as evidenced by the decreasing vacancy rates).

Southern Charm Brings a Strong Real Estate Forecast

A trend is emerging with the new year that every investor should be attentive to when looking for new investment opportunities. Remember the criteria for market evaluation discussed at the very beginning of this piece? Circling back to that is the idea of the importance of the economy in our real estate investment decisions.

So when we’re thinking about which markets are worthy of investing in, it’s a lot about considering which markets are going to create a sustainable environment that includes low unemployment, job opportunities, population growth, and affordable cost of living and business.

Right now, businesses and corporations are noticing that states in the South and Great Plains, like Oklahoma, offer a much more affordable, business-friendly environment than that of states where people have traditionally picked to set up shop—places like New York City, San Francisco, or other big-name cities that come with big price tags.

The housing affordability of Southern and South-adjacent states is attracting industry. That industry brings jobs. Then people. Then housing demand. Then investment opportunities. It’s up to investors to get ahead of that demand!

Potential Pitfalls in Oklahoma City Real Estate

The Growing Pains in a Sprawling City

Naturally, no market is perfect. In Oklahoma City, a primary concern has emerged as the population and need for construction grows. It is the fact that this city is sprawling. While the population of Oklahoma City ranks it 27th in the nation, it’s geographic size plants it in the number 4 spot. Why? Because it spans a jaw-dropping 621 square miles. That’s bigger than any city in Texas.

Only Jacksonville, Florida tops Oklahoma City in both geographical square mileage and in population.

It has become an issue because servicing this vast area, much of which can be rural, takes a toll on city services, especially as the city grows. There’s a need for infrastructure, police attention, fire stations, and extending roads and highways. Efforts over the past several years, however, have been investing in building apartments, neighborhoods, and making over city schools on the city’s fringes. Ultimately, that isn't something that is sustainable in light of needs at the city’s center, which like many urban areas is being invested in to attract young professionals and tourism.

It’s to the point where de-annexing parts of the city may be on the table. That sort of spread out growth isn’t sustainable when it stretches a city’s resources to its limits. It puts a question of needing to make cuts or raise taxes on the table, or even de-annex areas.

Ultimately, the “sprawl” of the city has the potential to seriously strain the city’s resources.

However, it’s also given developers a chance to create sustainable neighborhoods and mixed-use spaces that include trails, parks, and help preserve ecosystems. In a city with rural areas like Oklahoma City, there’s no better place for creative developers to flourish. The sprawl, in some ways, can be engineered for good.

Real Estate Investment in Oklahoma City

For real estate investors, Oklahoma City is rife with opportunity. With an extremely affordable housing market comprised primarily of single-family properties, growing rental demand, and a tested and proven local economy, there’s little doubt that a real estate investment here would be balanced.

While you wouldn’t be getting something explosive or dynamic—this is not one of those markets—there are many signs that point to a reliable and steady market that attracts businesses and a diversity of industries that you can rely on to hedge your investments against unnecessary risk.

For investing in a property out-of-state, there’s no better method than through a turnkey real estate investment partner. Through Memphis Invest, you can access premier services and a lifelong relationship with professionals that have a combined lifetime of real estate industry experience.

From premier property management to helping strategize your next steps, Memphis Invest makes sure you never have to sweat the small stuff.

Let us invest in your success! Check out our Guide to Turnkey Success.