Real estate investing, at least investing successfully, has always been about finding good opportunities and understanding what is driving that opportunity. We always hear about investors who land the big deal and take home an enormous payday. Sometimes those scenarios are luck and others they are a mix of luck and skill.

Real estate investing, at least investing successfully, has always been about finding good opportunities and understanding what is driving that opportunity. We always hear about investors who land the big deal and take home an enormous payday. Sometimes those scenarios are luck and others they are a mix of luck and skill.

We also hear about the investors who land the bad deals. It is almost always someone else's fault that their deal went bad and when it is not, well it certainly must be bad luck. Either way, if you walk into a local REIA meeting across the country you can hear the hard luck stories mixed with the big fish tales in every corner.

What you hardly ever hear though is the investor who says "all I do is hit singles". The consistent investor who makes his or her own luck by looking at data, finding great teams and partners to work with and then making good decisions based on information. You hardly ever hear from the consistent real estate investor who never gets greedy and is simply looking for high-quality in the middle of mediocrity. This is the investor who takes information like job growth and analyzes what it means for their investment properties. These are the investors who never brag about how good they are, instead preferring to take as many of the "average", everyday deals and turn them into a constantly performing portfolio.

Strong Job Markets Equal Strong Real Estate Markets

Using Data to Drive Your Real Estate Investing

Unemployment rates have unfortunately become a joke here in the U.S. as local, state and federal governments play with the numbers and calculations to make things look rosier than they are in reality. Recently, I came across an article where a group analyzed 13 different data points to come up with job market scores. They are a real estate investment company as well and we have worked with them in the past so I was impressed with the data they put together. It encompasses data such as job openings, per capita income, health care benefits as well as the distribution of jobs across different sectors.

What the data showed was something that we had already known from visiting cities across the country. We have been keeping our eyes open looking for opportunities as we expand our companies and search for quality companies and partners. We continue to come back to the fact that we are already in some of the strongest housing markets in the country and our moves into Texas will continue to pay off. The job growth and job market strength report only confirmed those findings.

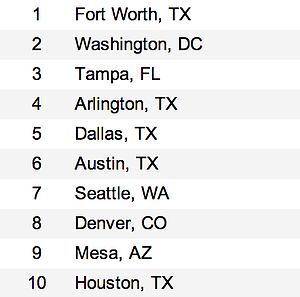

Four Cities in the Top 10

We are currently buying, renovating, renting and managing investment property for investors in four cities that are ranked as tops in the country for job markets including the top city. Fort Worth, TX. is ranked number one and has an incredibly affordable housing market. Many of you have seen Ft. Worth when reviewing investment properties with our team. When we entered the Dallas/Ft. Worth market, we chose to concentrate on the West side of the metroplex first. That led us to two cities as great starting points for our growth in Texas - Fort Worth and Arlington.

If you recognize Arlington, that is because it is home to "Jerry World", the incredible football stadium where the Dallas Cowboys play their home football games. It also boasts the country's fourth most affordable housing stock as well as the #4 ranking on the list of best job markets. So two of the top four job markets also score top four on the housing affordability index. Do you think it was coincidence that we chose these markets as a starting point?

Rounding out the top five is the city of Dallas itself. Some of the things that make Dallas such a strong market also make it very tricky for real estate investors. While Dallas real estate continues very strong, the dynamics of a hot job market can play havoc with the housing. The staring salaries are higher, the jobs tend to be better and in higher demand, which pushes the pricing for everything higher. Dallas is a great investment city, but we are very careful in Dallas to choose the best properties that still provide quality value to investors.

Houston rounds out the top ten on the list. That makes it sound like it is a ho-hum city when you ralize that the Dallas/Ft. Worth market has three cities in the top five, but Houston is a very high-quality investment market itself. The strong job market just helps to solidify this city as a great place for real estate investors to make money. The city continues to grow in the health care sector as well as the energy sectors and all of the ancillary jobs and industries that are grown off of each. Houston is a great city for investment and its strong job market shows why.

We continue to look at other Texas markets and may be investing in San Antonio at some point in the near future. At number 23 on the list, the job markets in San Antonio mixed with low-cost housing, military base presence and high affordability index all point to the fact that we need to be exploring opportunities in this city for our investors and ourselves! We will keep you posted on any further growth in Texas.

Memphis Top 30 Cities in U.S. Job Market Strength

Memphis is also on the list although not in the Top 10. Memphis has a strong job base and a very strong job market, just not the same job growth as the four cities I mentioned in Texas. Not even close. But, I was very encouraged to see Memphis so high on the list and in front of other Midwest cities that are being touted as great rental property investment cities. I have written for years that it is not just the job market or the housing market that makes a city strong, but your choice of partner as well. This is obviously where I see Memphis having a major advantage over most other cities. Memphis real estate is very strong, but having Memphis Invest and Premier Property Management Group as partners make this a great city for consistent investment returns.

Our presence, and I am not being boastful, gives a major advantage to Memphis over other markets. Further down the job market strength list are cities like Jacksonville, Chicago, Cleveland, St. Louis and Indianapolis. So far, we have no plans to work in any of these cities for multiple reasons and the biggest is that we are already licensed and staffed to work in Tennessee and Texas. Our growth needs to happen in those two states simply from a standpoint of ease of doing business. So I do not see us expanding outside of our current states and possibly only to one or two other markets.

The Job market and housing markets are simply too strong in our current locations and with our teams in place and all of our cities on the list of top job markets in the country, I think we have plenty of demand and opportunity where we are!

Would you like to learn more about investing in real estate? Download our 'Jump Start Packet' here and learn simple steps to get started today...