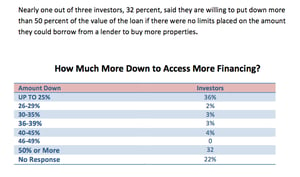

According to Real Estate Investment Realities, a new study co-sponsored by BiggerPockets.com and Memphis Invest released on September 20th, 32% of real estate investors would be willing to make a down payment of 50% of the purchase price if they could finance more properties.

How Many Properties Can You Finance

So first, let me clear up a common mis-conception that we get asked about all the time. As an investor, there is no Federal, mandated limit to the number of properties you can own. There is not a limit to the number of properties that you can own with financing. As an investor you can own and finance as many properties as you can get financing for, which is where the mis-conception comes in. Real estate investors who are investing in Memphis real estate or investing in Dallas real estate or real estate in any city, are limited as to the number of properties they can have financed with a FNMA of Freddie Mac mortgage. They each limit the number of properties an investor can own. Since between the two mortgage financiers, they basically fund 90% of the purchases in America, their rules tend to be the ones everybody knows.

The reality is that real estate investors can get financing from any number of locations and institutions and each are apt to have their own rules. Small local banks, farmers bank, credit unions and even Thrift banks are all going to have their own rules as to how many loans they will allow an investor to have. They will also have their own down payment criteria and will set their own rates. Often, they are holding the loans on their books and not selling to FNMA so they are writing to their own guidelines and not those of FNMA.

So, when buying investment real estate, you are able to purchase more than 10 properties and you can finance as many as you would like depending on who you are using for the financing.

Why 32% of Investors Would Pay 50% Down Payments

So real estate investing is not a complicated endeavor and most investors understand the 'Time Value of Money' concept and they want to get their money working for them. They also understand that using some of their money to leverage with borrowed money to purchase more real estate improves their TVM and allows them to acquire more assets. The fact that a real estate investor would have to put higher down payments into a property in order to finance more at FNMA's competitive rates should not come as a surprise. After all, today's individual real estate investor is not the same investor who got in the game in 2004.

So real estate investing is not a complicated endeavor and most investors understand the 'Time Value of Money' concept and they want to get their money working for them. They also understand that using some of their money to leverage with borrowed money to purchase more real estate improves their TVM and allows them to acquire more assets. The fact that a real estate investor would have to put higher down payments into a property in order to finance more at FNMA's competitive rates should not come as a surprise. After all, today's individual real estate investor is not the same investor who got in the game in 2004.

There is a tremendous difference between real estate investing and real estate speculating. Real estate investors today clearly want to build a property portfolio that can provide returns for many years to come and in many cases, they want to have a generational impact. If that is the case, then leveraging $1 to make two purchases makes absolute sense. Investors recognize that with leverage, even at 50% down, they are able to acquire and build assets faster. So even though investors can get money from many different locations and institutions, FNMA still has an easy process and the most competitive rates. If investors could acquire more properties with FNMA back mortgages, it would be easier, less expensive and they would be willing to make higher down payments.

The Ball Is In The Treasury's Court

The real message on this key point from the report is that federal lending policy makers have an opportunity to speed up the housing correction and increase neighborhood stabilization programs without having to commit any more tax payer funds. The data shows very clearly that if they were to raise the limits that they have imposed on investor purchases with FNMA and Freddie Mac, while simultaneously raising the criteria to qualify for those raised limits, they could spur real estate investors to take action in larger numbers and much faster.

There are investors who are sitting on the sidelines today unwilling to make all cash purchases in single-family real estate because they already have portfolios built. They would be more than willing to continue purchasing, renovating and stabilizing neighborhoods by investing their dollars if they could get a little help with the financing. Their willingness to raise their down payments to 50% should be the first sign to the Treasury Department that this may be an avenue worth exploring.

Download the full BiggerPockets.com/Memphis Invest Real Estate Investor Trends Survey