Out of all the ways to prepare for your financial future, investing in real estate has grown increasingly in popularity over the past few decades. There are compelling reasons for that. For one, real estate investment offers flexibility that other types of investments, like stocks and bonds, just don’t. You direct the course of your real estate investments yourself—choosing what properties to buy, where to buy them, how and when to scale, what types of properties to choose, how to leverage capital, and more.

With Turnkey Real Estate investing gaining in popularity as investor realize there is a way to be passive and invest in long-term buy & hold at the same time, real estate as an option has grown even more. Passive options like investing in turnkey properties have attracted many investors, both experienced and inexperienced, both flush with resources and just starting out. The one thing in common among passive investors is that they know they do not have the time to devote to learning how to actively learn real estate.

There are endless variations on strategy and practice when it comes to building your financial...

future through real estate investing. It’s exciting, and it offers greater returns than most of your other options out there.

But all of those endless options, all of that freedom to direction your investments yourself?

That comes with risk.

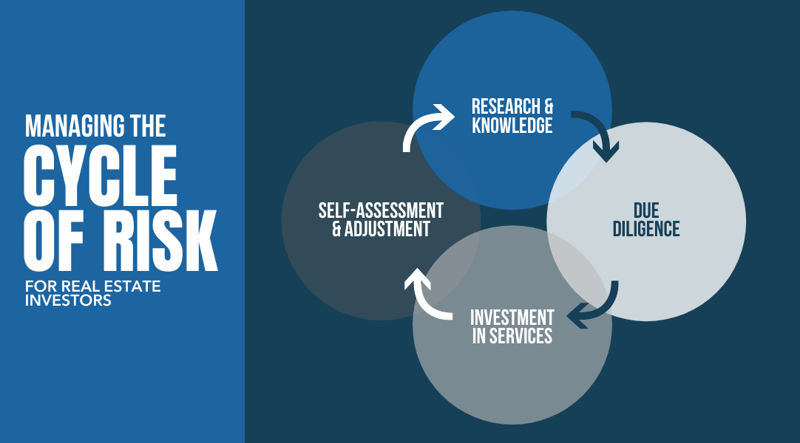

Every investment carries risk. We know that. We accept that. Some of us embrace it. None of us, however, like when a risk turns into a loss. Risks are inevitable, but that doesn’t mean that real estate investors have to take them sitting down. No, risks can be managed and mitigated: no matter what we encounter through the whole process of real estate investment, we can ensure that we are making the most of our profits and minimizing our risks.

We shouldn’t fear risk. Instead, real estate investors should focus on mastering it!

If you’re letting a fear of risk hold you back from the success that can come with investing in real estate, you don’t have to fear anymore. We’re about to break down some of the top risks in every major stage of investing and how you can diminish your risk and keep your positive cash flow strong. When you have a sustainable, trusted real estate strategy regarding risk, you’re setting yourself up for success.

Minimizing Risk at Each Stage of Real Estate Investment

Stage 1: Risks Before You Buy an Investment Property

Buying an investment property is arguably one of the most grueling parts of being a real estate investor. You not only have to go through the process of negotiating with the seller, dealing with Realtors, working through home inspections, and sorting through the financing with your lender, but you have to locate the right market, neighborhood, and do the right research, too.

It’s a long process, and there’s quite a bit of room for error. The risk exposure starts with the very first element: you.

Risk #1: A Lack of Experience

For first-time real estate investors, it’s the lack of experience that creates a lot of initial risk. That risk goes away with time, but in the beginning, it can create a lot of problems and cost a lot of money in careless mistakes. Not necessarily even careless. They’re just things you didn’t know about, think about, or have the experience to consider.

When everything is in theory, not practice, there’s a lot more real-time troubleshooting that takes place. A lack of experience is going to lead to mistakes. It’s going to cost you money. You’re going to buy the wrong properties, you’re going to pay too much money, you’re going to trust the wrong people and make the wrong calls.

But the good thing about this risk? You grow out of it as you go along.

The Solution: Learning Along the Way

Hear us now: experience will teach you more about investing in real estate than a thousand seminars, books, articles, or podcasts ever will. You have to gain experience to learn better. That’s the only true way to eliminate the risk that comes with a lack of experience. The experience of investing in real estate, all of the hiccups, challenges, and thrills: it can’t be replicated by reading about other people’s experiences.

All you can do is risk it yourself and cut your teeth on your own investments. You learn to adjust and manage if not reduce risk as you grow as a real estate investor.

Risk #2: A Lack of Knowledge

If a lack of experience is a risk, know that lack of knowledge is right there with it. No one expects you to be a real estate investment genius right when you start out. Few people are, even after years in the business! Investing in real estate does have a learning curve, however—especially if you want to get the most out of it.

There are laws to learn regarding tenants and landlords, insurance and properties, taxes and tax breaks, financing, and more. You’ll want to learn the ins-and-outs of how to identify what makes a good investment and what doesn’t, what signs point to a good investment market, and how to navigate, negotiate and make educated, responsible decisions.

If you go in blind, you can’t expect to do anything except go by your gut. And while your gut can be helpful in certain situations, it can’t be trusted if it’s not operating in tandem with good information!

When you go into real estate investment without adequate information: whether that’s a lack of your ground-level basic information of the business as a whole or it’s lack of information about a particular market, neighborhood, or deal; making major decisions without enough of the full picture is bound to cause problems.

The Solution: Consuming Information

The best way to guard against the problem of not having enough information is simply to acquire information. There are many resources new investors can turn to when they’re just starting out: the easiest and most accessible are blogs and podcasts. They’re free to consume and easily accessed.

We have compiled several lists of recommended blogs and podcasts worth checking out:

Naturally, these are just the tip of the iceberg! For investors, podcasts and blogs are only two resources. Another, and certainly essential, are book. Surprise, we also have lists of recommended reading there, too:

9 Essential Business and Real Estate Investing Books

You can also attend seminars, sign up for webinars, and join forums and online communities like the one over at BiggerPockets, where real estate professionals, many of whom are investors, gather and exchange their advice and experiences from all across the country.

In the end, real estate investing requires an investor to have a start with a solid foundation. If you work to reduce your risk from the very beginning, starting with your own due diligence to properly prepare yourself to handle the rigors of real estate investment, you will be primed for success.

Stage 2: Risks During the Buying Process

Risk #1: Putting Your Trust in Bad Calculations

When you’re buying real estate, numbers play a massive role in the process. For real estate investors specifically, you’ve got to primarily consider your profit margins. What’s your price-to-rent ratio? There are a lot of costs that factor into buying real estate—and it doesn’t end when the deal closes. You’ve got to think about the property inspection, the closing costs, taxes, potential survey costs, the down payment...and that’s just the costs associated with buying.

Beyond that, you’ve got to run the numbers to see if the property is going to actually generate cash flow for you: and if the cash flow it generates is going to be worth it.

The simple formula for your cash flow is the money in minus the money in. Or, “total income - total expenses.”

But your expenses can get complicated in real estate investment. We all know it’s not as easy as your mortgage. There’s insurance costs, taxes, water, sewage, garbage, electric, natural gas and propane, general maintenance, repairs, landscaping, city taxes, property management, HOAs, various business expenses, appliance replacements...And everything else unexpected, potentially even the ever-costly vacancy.

What happens is that real estate investors either skip over the valuable process of calculating their projected cash flow (and thus, they run the risk of overpaying for property and winding up with a bigger mortgage, which hurts their profit margins, if it doesn’t destroy them completely) or they run the wrong numbers. Why would an investor run the wrong numbers?

It might be a simply case of rushing and getting sloppy, or it might be that they’re so set on wanting a property to work out that they fudge a little to convince themselves it’s a good buy.

It’s never a good idea in the end, and it only increases your risk.

The Solution: Only Running Real, Trusted Numbers

For a real estate investor that wants to reduce their risk when they’re looking to purchase an investment property, they’ve simply got to run the numbers, and run the right ones, and run all of them. Check them twice. Make the right estimates. Even overestimate those estimates.

It’s so important to be able to trust your numbers in this business. You’ve got to be able to fall back on them—real, solid numbers. When there are emotions, or when there is uncertainty, you know that there are always numbers that prove whether or not you’re making the right decision.

Risk #2: Neglecting Due Diligence

Due diligence: as a buyer, this is your investigative duty to make sure that there are no nasty surprises waiting for you in your new investment property. Due diligence is a process: it starts before you make an offer and then the meat of it kicks in between entering into a contract and closing.

This is where you have a home inspection done, negotiate the resolution of any property issues, take care of surveys and appraisals, deal with insurance and financing, and generally get everything sorted out so that you can smoothly acquire the property.

There are a few ways to go wrong here: one is hiring the wrong people to inspect and appraise your property. This is no time to skimp, because if they don’t do their job right, you could be paying for it in a massive way down the road. You want quality here, not a bargain.

The Solution: Disciplining Yourself to Follow Procedure

There’s a certain rhythm to acquiring real estate. After you’ve been in the game for awhile, you get used to it. It becomes a habit. When you’re new, there’s a chance you may skip some steps, either due to a lack of knowledge or just plain being overwhelmed by all of it. But on the flip side, when it’s all old hat, you may find yourself getting complacent.

You keep your risk under control by always following procedure. You don’t allow yourself to ever believe that skipping steps are worth it—no matter what the seller insists, no matter how badly you want the deal to close. No excuses. You always mind your due diligence.

Risk #3: Ignoring a Bad Gut Feeling

Gut feelings are difficult to quantify. They’re also difficult to accurately speak on. You really can’t say “always go with your gut” because your gut feeling can be completely wrong. What you can trust is your gut when it’s combined with hard facts. Think about the numbers you run. When they’re solid and trusted, and you’ve done your due diligence—you’re doing absolutely everything right as a real estate investor—and you start having a bad feeling about something?

You might need to listen to your gut.

Your intuition shouldn’t be ignored, especially when it’s backed up by hard facts. If you don’t feel confident in your decisions, if things seem off...there’s probably a reason for it. Ignoring those instincts may lead to regret or worse, a bad deal.

The Solution: Resolve Every Red Flag

A bad gut feeling is usually the result of a red flag. Something somewhere is not sitting right. Maybe you don’t consciously know it yet, but it’s there. The best thing you can do for your investment future is to identify that red flag.

Ask yourself:

What’s bothering me about this deal?

Is it a serious issue?

How can I address and resolve it?

Look for things like unusual terms in a deal, odd behavior, too-good-to-be-true scenarios, and totally inflexible sellers. Red flags should warn you of danger. To proceed with caution. If your gut is telling you something is wrong, you need to stop and work through why.

It might be nothing, and things might be fine. But wouldn’t you rather pause and figure it out before you make a huge mistake? Remember, you’re the one in control of your deals. You don’t have to let anyone bully you into a decision you don’t want to make. Listen to yourself. You have the knowledge and education to lean on to know what path you need to take.

Stage 3: Risks Once You Buy Your Investment Property

So, you’ve gone through the process of finding the right real estate market, narrowing in on the right property, closing an incredible deal for yourself and now you feel like you can finally breathe and start earning the passive income you’ve been after.

Not so fast! Your exposure to risk doesn’t end after you’ve acquired your investment property.

There are steps owners must take at this stage in the game to ensure that they’re well-equipped to handle anything that comes their way. As a real estate investor, you don’t want to be in the position where you’re worrying all the time about the details of your investments.

As a passive investor, you should be able to let your investments effectively run themselves. If you’re going to do that, you need to ensure that you’re protecting those investments with the right defenses and the right people so that they can run themselves.

Risk #1: Hiring the Wrong Property Manager

As a passive real estate investor, you need someone who will take over all of the landlord responsibilities that you would otherwise be dealing with on your own. A property manager is not only the time-saving solution, they’re the smarter solution. Too many real estate investors jump in on the assumption that being a landlord will be a piece of cake without understanding that it is a separate job that demands not just time and energy, but an entirely different set of skills.

Your property manager is a person equipped to handle any and all risks associated with the day-to-day operations of your investment properties. That means everything from dealing with bad tenant behavior and burst pipes to break-ins and pest problems. They also handle your income, tenant screening, and even marketing.

Your property manager makes or breaks your investments. So hiring a bad property manager, or even one that you don’t work well with? One that can’t be trusted? That’s a huge risk!

The biggest issue with hiring a unsuitable property manager is that they themselves open you up to hundreds of risks that a good property manager would protect you from. Whether it is by incompetence, inexperience, laziness, or malice doesn’t really matter: a bad manager equals big risks that you can avoid with a good one.

The Solution: Make your manager a crucial piece of the puzzle.

The solution to the risks that bad property managers expose you to? It may not be as simple as “hire a good property manager.” In some cases, you may not realize a property manager is bad until after they’ve been hired. It’s not as simple as trusting your gut or going over their resume a few extra times.

There is due diligence involved when you’re hiring, of course: check into the reputation of the management company. You’re not looking for the cheapest option, you’re looking for the option that is going to provide the best services, both for you and for your tenants.

It also means staying engaged and vigilant. Some owners check out after their managers take over. Don’t ignore the issues that may crop of down the line if your manager’s performance starts taking a dive. Just because they’ve been doing a good job doesn’t mean they’ll always do a good job—you need to be on guard for red flags. Don’t be afraid to replace a manager who stops doing their job or betrays your trust.

You have to think about the health of your investments and your exposure to risk first and foremost.

Risk #2: Bad Property Renovations & Poor Maintenance

Following management, there are the risks associated with renovations, repairs, and maintenance. The risk here is similar to that of the property manager. Investors who value speed or cost over quality end up exposing themselves to a higher risk than investors who prioritize quality.

A bad renovation may break building codes, and could potentially cause an injury or a lawsuit down the line. Best case scenario, you’ll have to get someone else in in a few years to fix bad craftsmanship. And honestly, the same can be said for repairs. Quick-fixes aren’t lasting solutions, and they can do further damage to your property.

Don’t allow managers of maintenance works to leave real problems unaddressed...or allow them to address them poorly.

The Solution: Put quality over convenience.

The solution here is much the same as when you’re dealing with your managers. When you’re hiring contractors, vet them thoroughly. Do a lot of shopping around and look at their reputations. Talk about the timelines and check in on the progress as you go along to ensure that everything is up to your standards.

And when it comes to maintenance and repairs? You should make it clear that you expect problems to be handled quickly and correctly. That might mean making some extra room in your budget to deal with situations like these, but it does close off your risk down the line.

Risk #3: Inviting in the Wrong Tenants

As a real estate investor, your tenants are effectively your customers and partners in this business. The difference between a good tenant and a bad tenant can be night and day. And “bad” doesn’t necessary mean lease-breaking disaster tenants! When it comes to tenants, you have to think about where risk comes into play.

Yes, there are extreme examples. But one of the biggest risks when it comes to tenants is just tenant turnover. After all, vacancies are the most expensive time for real estate investors. You need to be targeting tenants that will stick around, versus transient tenants.

There’s also tenants who don’t pay rent on time, or tenants who don’t take very good care of your property. Small risks like that add up in big ways. Bad tenants come in many different forms: and they’re not all the kind of tenants that your manager ends up calling the police on.

The Solution: Hedge against trouble from the beginning.

The best line of defense against “bad” tenants is good management. It’s a domino effect! Your property management is responsible for vetting tenants and deciding who your occupants should be—and if they’re savvy at their jobs, they’re going to make the right pick for your properties.

If you’re not able to trust your managers to do background checks, verify employment, or be good judges of character, how can they possibly find good tenants for you?

You have to start with the management. If you make management the biggest decision you make, if you invest in it well, you will save yourself and your investments from a lot of unnecessary risk.

Why Risk It At All?

We’ve been talking a lot of about risk in real estate investment. When we hear so much about everything that can go wrong, we start wondering—is it even worth it? If there’s all of this risk, all of this room for error, why would anyone even bother with investing in real estate investment?

We’ll tell you why: because it works.

A recent Better Homes and Gardens Real Estate survey revealed that 80% of U.S. investors surveyed believe that a real estate investment portfolio is one of the best financial legacies they can leave their families.

Nearly all of the investors who had invested in real estate (96%) said that they believe their decision has helped them achieve financial success of some kind: be it financial stability, long-term net worth, or increasing monthly cash flow.

Despite the overwhelming approval of real estate investment, not just through this survey but in decades of proven results, many people interesting in investing are still skeptical to take the plunge. According to the same survey, 89% of non-real estate investors are concerned and skeptical about the investment: 28% of which feel it’s “too risky.”

But in many cases, it boils down to this: 30% of those would-be investors say they would be likely to invest if they had access to a real estate professional for advice, or a place to start!

And here’s the thing: you can find that kind of advice in so many places. Real estate investment doesn’t have to be scary or intimidating. In fact, part of what makes turnkey real estate investment so appealing is the fact that you don’t have to know everything to get started.

Turnkey providers like Memphis Invest are here to help you get started and succeed: you can lean on our decades upon decades of combined experienced in real estate, finance, and investing. So many risks, from acquiring properties and handling renovations, to property management and finding tenants, are taken care of when you trust a turnkey real estate provider.

For real estate investors worrying over risk, there’s no better option available than turnkey real estate investment.

Start building your passive investment portfolio in world-class markets with the essential turnkey partner.