At the tail end of 2007, America rang in a recession alongside the new year. This economic downturn officially lasted until June of 2009...though many negative effects having continued to linger well into 2015. As it’s been one of the most significant economic crises in the United States in the last century, many now call it “The Great Recession.”

As real estate investors, it’s vital to pay attention to the economic climate—not just in our local markets, but in the U.S. as a whole.

We still struggle with the aftershocks of the recession. Its causes, recovery, and future are intrinsically tied to the real estate market, unlike that of recessions past. Especially as so much is hinging on the housing market, now more than ever, we should strive to understand how it happened and where we need to go from here.

Leading Up to the Great Recession

The circumstances that contributed to the recession in the first place are rather complex: but in many ways, it can be lead back to several major factors:

The “Great Moderation”

Prior to the recession, the Great Moderation, caused by years of steady growth and low inflation, contributed to a mindset of complacency. Things were going well, so economic risks became easier and easier to take, until risk was overlooked entirely. Because we were so used to a stable, reliable economy, it left room for mistakes to be made will little thought to the consequences. Low interest rates caused banks, hedge funds, and investors to seek high-risk deals that promised big returns. In turn, they’d borrow and spend more money on these investment opportunities, assuming that it would all pay off in the end. Though the Great Moderation was no doubt a good time economically, it set the stage for the costly mistakes that lead up to the 2007-2009 U.S. recession.

So what mistakes lead to it all?

Irresponsible Financiers

The most obvious cause of the recession was the rampant and irresponsible lending of financiers. In the years leading up the recession, financiers began to dish out “subprime” loans to borrowers with less than stellar credit history. Predictably, these borrowers struggled with repayment.

In turn, these mortgages were given to financial engineers who pooled them into what they called “low-risk securities,” hoping that the diverse ebb and flow of the country’s various housing markets would diversify risk enough, with the justification that the housing markets were all independent of one another. Unfortunately, they were wrong: in 2006, a nationwide price slump took hold, effectively killing their strategy.

The pooled mortgages were then used to back collateralized debt obligations (CDOs), which were sliced into tranches for investor purchase. Investors then were too cavalier; purchasing “safer” tranches when they were assigned positive, triple-A credit ratings. Their trust, however, was misplaced. Their safe CDOs turned out to be worthless. Assets became nearly impossible to move.

Trust, the most valuable assert to any financial institution, dissolved. Links began to break as debts piled up and trust vanished. The Lehman Brothers bankruptcy was just one of many. AIG followed, collapsing under the weight of a bloated, poorly devised credit-risk protection.

Regulator Inaction

While the ill-devised actions of financiers sit at the core of the recession, regulators didn’t maintain the checks and balances necessary to reign in bloat, check for oversights, and allowed bankruptcies that ultimately caused widespread panic. Global account imbalances, housing bubbles, and bankruptcies were all handled in a way that ultimately drove the economy further into the ground. These regulator and central bank deficiencies weren’t unique to the U.S. either—it was a global issue that took hold overseas as well.

Because trust was killed with the fall of Lehman Brothers, even non-financial companies seized up, afraid to borrow and finding themselves unable to pay suppliers and employees.

Spending froze, and so did the economy.

Related Article: The Role of an Investment Company In The Recovering Economy

A Look at the U.S. Housing Bubble

Naturally, the housing market both contributed to and was deeply scarred by the economic downturn. The state of the U.S. economy affects virtually every industry, and the world of real estate investment was infamously affected with the coinciding burst of the housing bubble. What burst it?

As you may predict, it all falls right back to the same irresponsible lenders: offering mortgages to a wider range of consumers as the demand for homeownership through government-sponsored programs increased. Programs through Fannie Mae and Freddie Mac, among others, put mortgages in the hands of people who otherwise wouldn’t (and shouldn’t). These irresponsible homeowners would go on to default on their payments en masse and, by 2006, these subprime mortgages made up a whopping 20% of the market.

Real estate, like other investments, couldn’t keep up year-over-year in terms of appreciation: thus, the bubble burst.

Some banks foolishly made subprime mortgages the entirety of their businesses, and by the time late payments and defaults started rolling in in 2008, it was too late to keep these banks from collapsing. That’s not all: the many pools of these subprime mortgages used for investments defaulted, too, bringing down AIG, who insured many of these mortgages, and institutions like Lehman Brothers and Bear Sterns who underwrote, owned, and sold these investments went under and dragged their investors down with them.

On top of the consequences to banks, investors, and institutions, the sweeping wave of foreclosures caused property values to drop dramatically—putting homeowners in jeopardy as one of their primary assets was no longer something they could hang their hats on. Consumer trust towards banks reached an all-time low and homeowners desperately held on to their properties, forgoing selling their homes at a fraction of what they had once been worth.

Some would argue that the recession, even now, isn’t truly over—despite economic growth beginning in 2009, the overall unemployment rate has yet to reach pre-recession levels and it would be even higher if labor force participation hadn’t declined as much as it has.

Knowing what caused this new Great Recession, then, what were the effects? What’s holding our economy back from a full recovery and what has brought about the recovery we have had?

Key Results of the 2007-2009 Great Recession

High Unemployment

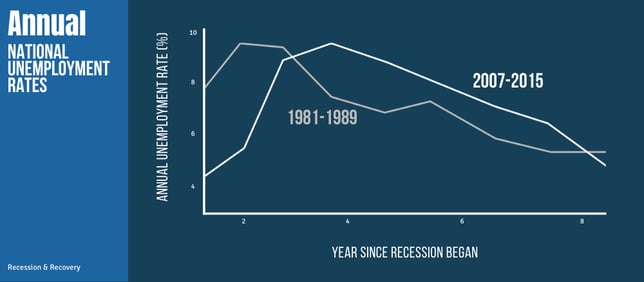

As previously mentioned, the unemployment spiked higher than the two previous U.S. recessions and and at a greater over increase than the deep ‘81-82 recession. The lingering issue, of course, is that unemployment rates aren’t decreasing as they should. The recession supposedly ended in 2009 with increased economic growth. Our gross domestic product had fully recovered by 2011. But in 2015, six years after the supposed end of the recession, the National Association of Counties reports that only a meager 65 of over 3,000 U.S. counties have recovered from the recession.

Measures of recovery included jobs, unemployment rate, economic output, and home prices. These recovered counties are usually in energy-rich areas with smaller populations. 24 of these recovered counties are in Texas and 16 are in North Dakota.

Still, on a positive note, Emilia Istrate, the association’s director of research, notes that “The national numbers show growth continued in 2014, but it still remains fragile and sluggish in different parts of the country. On the positive side, we find out that 72 percent of county economies recovered on at least one of the indicators we analyzed.”

A side-by-side comparison of the last significant recession shows just how much ours is lingering:

According to the Bureau of Labor Statistics, the 1981-82 recession (the most recent prior depression of comparable scale) peaked in 1982 with an annual unemployment rate of 9.7%. Just one year prior, the annual rate sat at 7.6%: a 2.1% increase.

In the 2007-2009 recession, we started with a 5.1% unemployment rate in 2007 and peaked in 2010 with an annual rate of 9.6%: a 4.5% increase.

By 1984, the national annual unemployment rate was down to 7.2%, under levels at the beginning of the recession. At the end of 2014, our national annual unemployment rate was at 6.2%: 1.6% higher than that of the lowest annual rate in 2006 and 2007. High unemployment just keeps lingering long after supposed recovery. The latest national unemployment rate of 2015 is 5.1%: still not at pre-recession levels.

An estimated 8.7 million jobs were lost between December 2007 and early 2010. It’s the modest pace of job growth from 2009 onwards that’s kept the unemployment rate so high. It’s caused the recession to linger on the whole, with very few parts of the country experiencing anything close to full recovery.

Foreclosures En Masse

During the recession, everyone was someone, knew someone, or heard of someone who experienced a bank foreclosure. Neighborhoods very simply emptied out. In 2009, 2.14 million homes entered the process of foreclosure and 1.05 million foreclosures were completed. To put that in perspective, in the midst of the 2007-2009 recession, it took less than a year for the percentage increase in foreclosures since the previous peak to grow twice as high as during any other recession in recent history. Between 2007 and this year, a whopping 5 million Americans lost their homes to foreclosure.

Thankfully, foreclosures have been on the decrease from their peak since and has turned from a national crisis to more of a local market concern. While some larger metropolitan areas such as New York City and San Diego still experience elevated foreclosure rates, things have ebbed down to the lowest levels since the recession nationwide.

Real Estate Values Bottom Out

Due to the staggering amount of foreclosures at the height of the recession, home values bottomed out. Since the first quarter of 2006, U.S. homeowners have experienced a $7 trillion total loss in home equity. This loss in value put many homeowners underwater: having more due on their outstanding mortgages than their home was actually worth.

This loss in home equity was unprecedented: even in prior deep recessions, the housing market was never this profoundly impacted. A housing collapse is not typical of most recessions. The two-fold crisis in both labor and housing is what makes this Great Recession so distinct from others.

So Where’s the Recovery?

While many would argue that the U.S. economy has not recovered from this Great Recession, recovery has indeed happened: albeit not at the rate at which most of us would like. Recovery has come in several forms, and understanding where it comes from and what’s holding it back is integral to understanding where we need to go from here.

Despite stock performance breaking records in 2014, along with the lowest unemployment rate since 2008, things aren’t really as recovered as they seem.

The things that are helping the economy as a whole and the housing market within it are also being held back by significant challenges that continue to pose a threat to the economy and, at the very least, keep us in a slog.

What’s Helping

Real Estate Investors

In 2011, real estate investors were responsible for the 64.5% increase in investment home sales, which contributed immensely to helping the real estate market get back on its feet. Homes in foreclosure were on the market and for sale at an all-time low. There was never a better time for real estate investors to jump into the pool and snatch up quality properties at bottom-of-the-barrel prices. Mortgages rates were favorable and the state of the housing market meant demand for renting was only on the upswing. Not only was it prime time to profit as a real estate investor, but when investors began to purchase properties it stimulated the market sooner rather than later, giving recovery a toehold.

Job Creation

Post-recession, the U.S. has seen an job recovery that has helped ease the astronomical loss during the recession. According to the Bureau of Labor Statistics, we lost some 8.8 million jobs during the recession. Though a staggering number, in 2014 it was reported that we had recovered all of the jobs lost. This, however, left the unemployment rate largely unchanged and a closer examination revealed that a majority of the jobs added were low-wage.

During the recession, only 21% of lost jobs were low wage, but they accounted for 58% of jobs created. It was mid-wage that took the biggest hit, making up 60% of jobs lost but only 22% of post-recession jobs created. While job creation certainly helped ease the burden of the recession, it hasn’t been as effective as we would like.

What’s Hurting

Wage Stagnation

“Wage stagnation” is a term that a lot of economists have been throwing around post-recession. But what does it really mean? According to the Economic Policy Institute, wage stagnation has much to do with the current income inequality crisis. Wage growth is not advancing the quality of life for low- and middle-income families and hourly wage growth is at a standstill while productivity goes through the roof.

Those with very high wages have seen a 41% increase in hourly wages since 1979, while middle wages have only grown 6% since...and low wages have actually decreased 5%. As we mentioned earlier, these low-wage jobs also represent a majority of those created post-recession. Wage stagnation hinders the ability of families to save and spend; holding back the economy overall as they find difficulty purchasing homes (either in saving enough for a down payment of receiving mortgage approval) and think twice before spending on non-necessities.

It’s not just about buying homes, either: wage stagnation has negatively impacted those in the rental market, too. The recession caused demand for rentals to skyrocket, and low vacancies have only caused prices to increase. For families that are experience wage stagnation, then, renting takes a much bigger piece of their income pie than it used to.

Experts conservatively project renters to grow by 4 million over the next 10 years. With current vacancies at 7%, half of renters spending 30% of their salaries on housing, and a quarter of renters spending over 50% on housing, researchers on expect things to get worse for renters if these trends continue.

When families spend a such a burdening portion of their income on housing, it creates a crisis: they are unable to spend and save in ways that have the potential to positively impact the economy and their quality of life. Some renters even have to forgo their savings, retirement planning, and healthcare. Not being able to spend and save holds us back, and the problem only seems to continue to grow.

Student Debt Crisis

Millennials make up roughly 40% of the unemployed. 13.8% of 18- to 29-year-olds are out of work (2015), way above the latest national jobless rate of 5.1%. With 86 million millennials total, that’s a significant portion of the work force. Since 2009, this is the longest sustained period of unemployment for that age range ever recorded since the Bureau of Labor Statistics began collecting data after World War II.

Common misconceptions about millennials are that they are lazy or entitled: thus they are unemployed, settle for less, or can’t stay in a job. The truth of the matter is, however, that millennials are succumbing to layoffs and underemployment, if they can find employment in the first place.

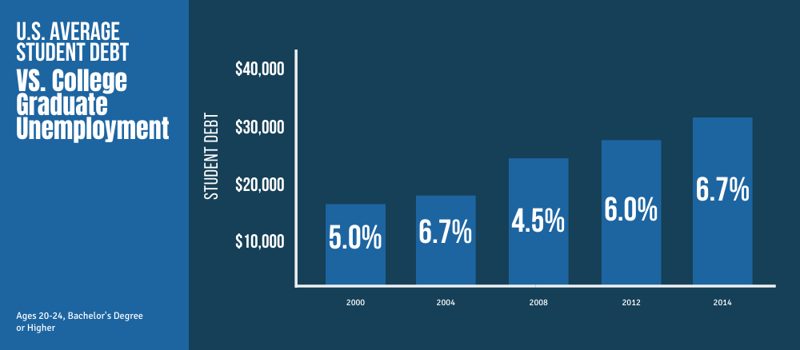

Meanwhile, Bloomberg reported in 2013 that the cost of college has risen by 538% since 1985. National student debt topped $1 trillion in 2014. 69% of college graduates were burdened with the average student loan debt of $28,400. That may not even account for the amount of private loans students may have that are unreported by the schools.

On top of that, graduates are actually earning $3,200 less than they did in 2000, while, since last decade, the number of college graduates earning minimum wage increased by 70%. Underemployment, according to Investopedia, is at 50% for millennials.

Adding insult to injury, there’s been a 22% decrease in employers that offer healthcare coverage to recent college graduates since 2000.

Millennials are in the middle of a growing crisis in which finding sustainable jobs that pay a living wage is more and more difficult, which only compounds the problem of student debt:

So if we take into account that millennials are in the middle of a debt crisis while also dealing with growing unemployment and wage stagnation, what does it mean for recovery? What does it mean for the housing market? A few things:

21.6 million millennials were living with their parents in 2012. That’s up from 18.5 million in 2007. Generally, this means that a significant number of millennials can’t afford to either buy a home or rent while also paying back their student loans.

Millennials are reluctant to take on more debt. For many millennials, their meager salaries are going strictly to debt and essential day-to-day costs of living: not savings. As a result, millennials aren’t swooping in as the next generation of first-time homebuyers that the economy was hoping for. Not only does a lack of savings mean it takes much longer to save for a down payment, but outstanding debts mean that this up-and-coming generation is less interested in taking out a mortgage on top of their already burdensome student loans. As a result, they’re becoming late starters in achieving the milestones of yesteryear: buying homes, getting married, and having children.

A Ned Davis research report says that millennials are being held back from 3 million homes’ worth of property demand.

“Underemployment and low salaries combined with high student debt and uncertainty about the future are a reality that is affecting the housing market. The demand is there, but until this age group sees higher salaries, lower debt levels and feelings of settlement, millennial participation in the housing market will be slow.”

— Doug Lebda, LendingTree founder and CEO

The growing millennial crisis can’t be ignored by economists or real estate investors, as their active participation in the economy and housing market is integral to sustaining and increasing recovery from the recession.

What’s Next?

In order for recovery to truly happen, the United States must more seriously tackle the issues that are, in tandem, crippling the economy: wage stagnation, income inequality, and student debt. For real estate investors specifically, a close watch must be kept on how the rising demand of rental properties and apartments has lead to a choke-hold on many low- and middle-class renters.

While it may be a prosperous time to invest in real estate, we must think ahead as to how our businesses make a collective impact on the economy and the housing market. Through real estate investors played an integral role in jumpstarting the home values and demand after the slew of foreclosures, we alone can’t sustain and grow the flagging housing market.

Now more than ever, investors must be diligent in wisely managing risk: that means looking at only the best assets in the best conditions for the best value. Even though things are looking up in many regards, now is the wrong time to be cavalier in real estate investment. What renters want and need in a property is changing—and investors must adapt to keep pace with it all.

Recovery has come a long way in many regards: but we’re not out of the woods yet.