This pink painted house in Memphis, TN is this week's Turnkey Transformation! As you can tell, there were quite a few bright features of the home we wanted to neutralize, as well as get rid of some of the outdated exterior elements. Find out how our Memphis team was able to get this property renovated for $45,500 and in an amazing 80 day timeline!

This pink painted house in Memphis, TN is this week's Turnkey Transformation! As you can tell, there were quite a few bright features of the home we wanted to neutralize, as well as get rid of some of the outdated exterior elements. Find out how our Memphis team was able to get this property renovated for $45,500 and in an amazing 80 day timeline!

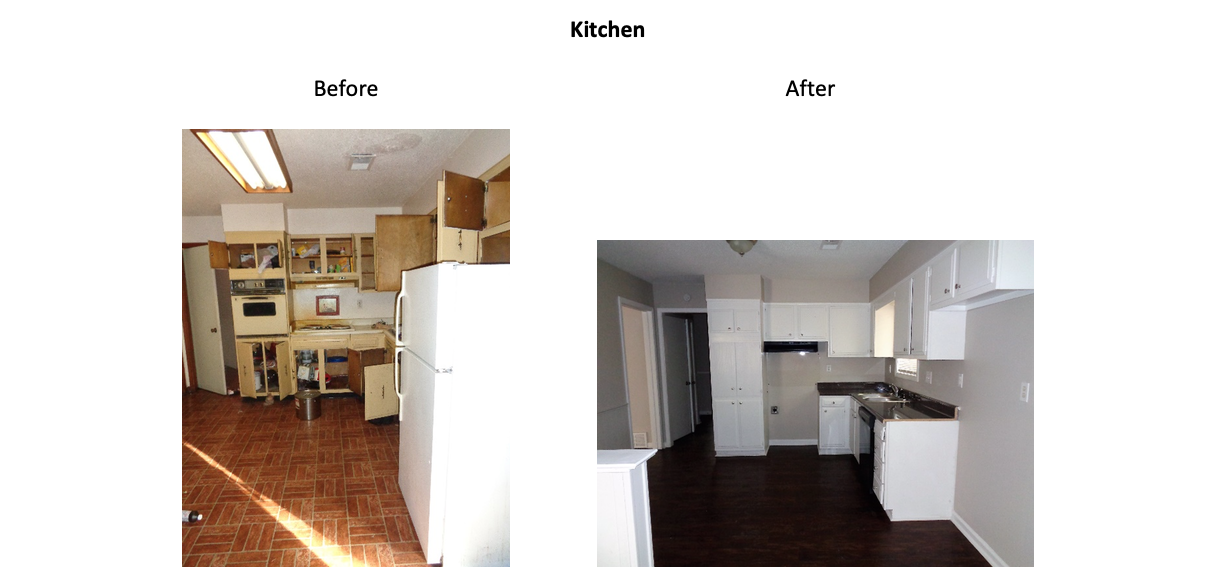

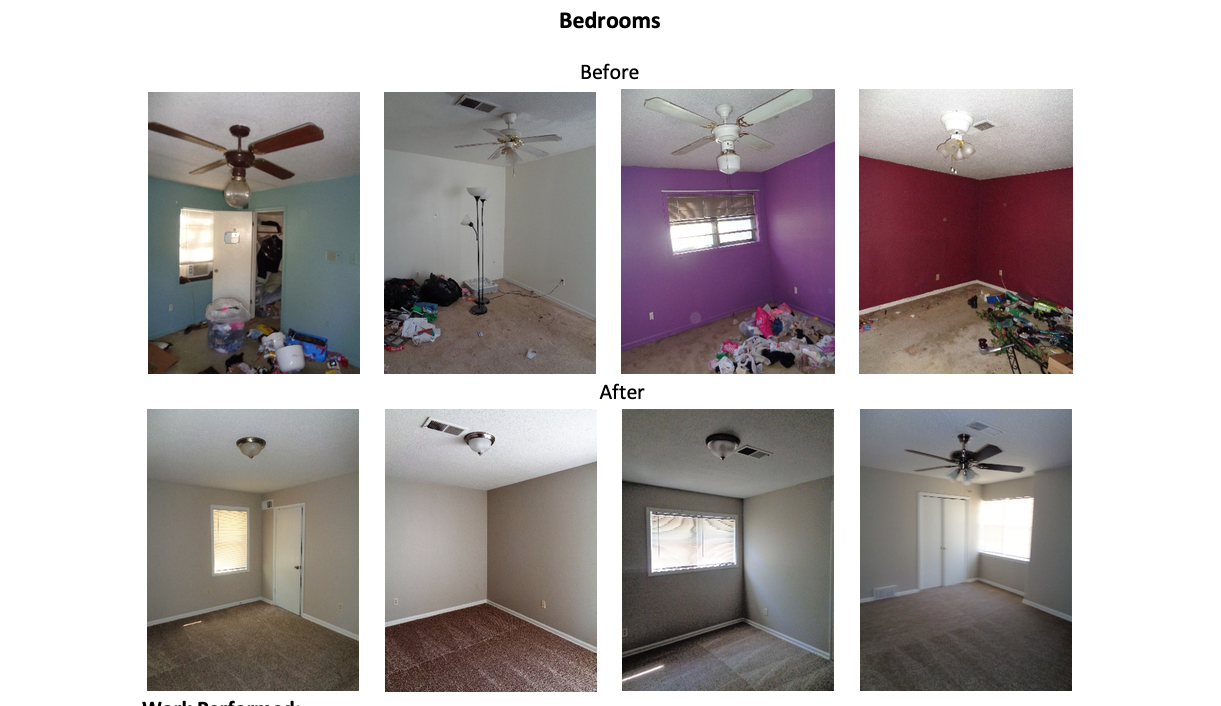

Just by looking at the outside of this home, you can tell some landscaping and paint already made a world of difference. But on the interior, there was a lot of cleaning up to do, as far as garbage and just cosmetic improvement. Some extremely bright paint colors and dingy walls and cabinets get cleaned up and a fresh coat of paint. New flooring, new major appliances, and a new roof also make this house look better and a solid investment.

The clients for this Turnkey Transformation are buying 2 properties (one in Memphis and one in Little Rock) using conventional financing for both. There's a variety of purchase methods investors may use for their turnkey properties, depending on the type of capital they have available, and their financial goals. Conventional financing follows the guidelines of Freddie Mac or Fannie Mae and is not backed or insured by the federal government. Typically with conventional financing, the standard loan down payment is anywhere between 20-30% of the home's purchase price, depending on the lender requirements and the buyers' preference.

Your credit score and credit history will help determine your eligibility for a conventional loan, and these items can also dictate what kind of interest rate will be applied to the home's mortgage. Additional factors that can effect your interest rate can be things like home location, purchase price, loan amount, loan term, and rate type (fixed or adjusted rate). Lenders typically look at income and assets to ensure that the borrower can afford not only their existing mortgage(s) if applicable, but also the monthly loan payments for the property they are wanting to acquire.

In fact, many investors are unaware that it's possible to hold up to 10 conventional loans under their name when investing in real estate. (Of course your eligibility depends on your lender's requirements and your financial standing). Its actually not uncommon for couples and business partners to apply for conventional loans individually so that they can acquire even more properties over time together.

Ultimately, when investing in turnkey real estate, it's up to the investor to decide the best purchase method for their situation, but our team of licensed real estate portfolio advisors help clients all the time choose the best option for their needs. If you have questions regarding turnkey investing, or financing a turnkey purchase, give our team a call today (877) 371-2625.

About this Transformation:

The investors for this property found us through Fortune Builders, a real estate investing education program. This property was renovated for our Memphis Invest client, here's more info about the house:

- 4 bedrooms, 2 baths

- 2,017 sq. ft.

- House was Built in 1971

- Installed New Furnace

- Installed New AC

- Installed New Roof

- Installed New Garage Motor

- Repaired New Garage Door

- Installed New Dishwasher

- HVAC, Plumbing and Electrical repairs as recommended by licensed contractors.

Let Memphis Invest transform your financial future!