Portfolio diversification is one of the keys to a successful real estate investment career. When new investors call us for the first time, one of the things we discuss from the get-go is the fact that we are not a real estate broker—we are in the business of building portfolios.

Portfolio diversification is one of the keys to a successful real estate investment career. When new investors call us for the first time, one of the things we discuss from the get-go is the fact that we are not a real estate broker—we are in the business of building portfolios.

With that in mind, we understand that a diverse portfolio is invaluable to your success as a real estate investor. As you grow and acquire new investment properties, the question of diversification becomes bigger.

But really—why does it matter? And is there more to portfolio diversity than buying property in another city?

Here’s what you need to know.

The Big Reason Real Estate Investment Portfolio Diversification Matters

If we’re using a gambling analogy, not diversifying your portfolio isn’t dissimilar from going “all in” and betting everything that you have in a single hand. When your portfolio hinges on a single investment or a single market or, for some, a single industry, your success or failure hinges on the performance of that one market, industry, or investment.

Diversity is the key to risk mitigation. When you branch out into different markets and build your portfolio to including many investment properties, in the case of a real estate investors, you are protecting yourself from losing everything in an “all in” scenario.

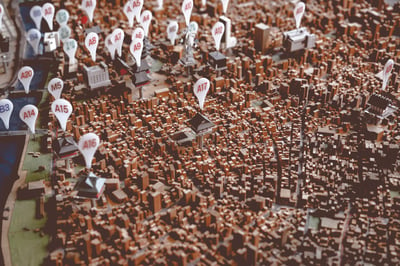

There are many ways in which diversification helps a real estate investor and ways in which you can achieve it, but the biggest and most obvious is by location. Diversifying your market helps you hedge against economic and environmental shifts that can threaten your investments.

For example, if the local economy in your investment market starts to suffer and jobs move away, your population will likely shrink, resulting in vacancies. These economic shifts can take years to recover from, depending on their severity.

Likewise, natural disasters, though not totally common, are something to consider. Example: a high-risk investment would be beachfront property, where hurricane season could threaten to devastate your investments every year. Could these be lucrative vacation rentals? Absolutely! But you wouldn’t want them to comprise your entire portfolio.

Part of investing wisely is having a smart strategy. But how do you know how and where to diversify your portfolio?

4 Key Investment Portfolio Diversification Tips

Keep Your Portfolio Balanced

Portfolio diversification alone won’t mitigate your risk by itself. The volume of properties without regard for the individual risk of those properties isn’t going to help! If you are introducing new properties that are all high risk, all you will end up with is a risky portfolio. It would be like buying beach houses in Florida just to buy more beach houses in South Carolina. You are in different markets, but you haven't really diversified your risk.

What you need in a solid real estate portfolio is balance. Are you diversifying in the right way? Are the properties that you are buying filling the right need in your overall strategy? These are the questions to ask.

When forming a balanced portfolio as a buy-and-hold investor, you want to comprise your portfolio largely of properties that have low vacancy rates and turnover, solid cash flow, and a strong, upward market with a diversified economic base. Essentially, you want to invest in a market that has the strength to withstand economic turmoil that could come its way.

When we look at a market like Houston, for example, there have been many instances over the past several years where experts have predicted doom, but the strength of economic diversity in the market has allowed Houston to not only survive every obstacle but grow in spite of them.

These are the sorts of markets investors need. You want strong, well-balanced markets to hold the majority of your portfolio while you can take chances on more risky investments as you see fit down the line.

Seek and Maintain Quality

One thing that you will notice is that you can find the best opportunities in the world in the best markets in the world, but if you don’t maintain the quality of those opportunities, your portfolio won’t amount to much. As a real estate investor, you are uniquely investing in an income-generating asset. As such, maintaining the quality and income-earning potential of that investment in the long-term is paramount.

You do this by placing priority in quality property management services who value not only the property but the relationship and integrity of the experience that they deliver to the residents living in your investment properties. It is through this that you ensure long-term success regardless of market.

Move When You’re Ready

In our desire to diversify, we can rush to scale our portfolio. It is important to remember, however, that no investor is in the same place as another financially or strategically. What may be a good move for one investor might not be suited to you. Moving too soon or jumping on an opportunity just because it’s there—not because it’s the right one—can cause problems for you down the line.

Rather than scaling before you are ready just for the sake of trying to diversify as quickly as possible, sit down and figure out what makes sense for you strategically.

Collaborate with a Portfolio Advisor

One of the best assets an investor can have is a portfolio advisor—someone with years of experience in the real estate game and knowledge of the markets. They can help you navigate not just the where and the when, but they can help you develop a personalized plan for your specific goals and resources.

For a turnkey real estate investor with Memphis Invest, that’s exactly what you have. Trying to diversify across multiple markets on your own can be challenging to say the least. But when you can lean on expertise and a wealth of resources, it all starts to fall into place. Take advantage of a portfolio advisor to learn what makes the most sense for your investment portfolio.

Learn more today about how you can craft an airtight real estate portfolio.