As real estate investors, we’re always looking for  opportunities to secure our financial future. Many of us are using the passive income we gain through our real estate investing to save up for retirement: but have you thought about using your retirement savings to boost your investments and save more in the long run? With a self-directed IRA, you just may be able to do it!

opportunities to secure our financial future. Many of us are using the passive income we gain through our real estate investing to save up for retirement: but have you thought about using your retirement savings to boost your investments and save more in the long run? With a self-directed IRA, you just may be able to do it!

What is a Self-Directed IRA?

The Basics

A self-directed individual retirement account (SDIRA) is a specialized type of IRA that allows holders to invest in a wider pool of opportunities—real estate included—entirely by their own volition. Unlike a regular IRA, you’re not constrained to investing in stocks, bonds, and mutual funds. You invest with your self-directed IRA rather than money out of your own pocket, and all profits go directly back into your retirement savings.

As with a regular IRA, all contributions to a self-directed IRA is tax deductible. Transactions within the account are also tax-free while in the account: you only have to fool with taxes once you decide to withdraw. If you with withdraw before the age of 59 ½, you’ll be subject to a 10% penalty. Otherwise, you’ll only then be responsible for federal taxes on the account.

What IS Allowed

Self-directed IRAs can be used to diversify your portfolio in real estate, limited partnerships, franchises, private stocks, gold, and more. One of the big advantages of a self-directed IRA is simply in the freedom to invest in more and diversify your portfolio with your IRA account—and only in the investments you want to pursue.

That said, there are still restrictions on how your self-directed IRA can be used:

What ISN’T Allowed

As with traditional IRAs, you can’t invest in Life Insurance Benefits or collectibles (such a baseball cards, art, wine, cars, etc.). However, the big things that aren’t permitted where SDIRAs are concerned has to deal with you, and not your investments.

You cannot:

- Self-deal. “Self-dealing” refers to the IRA owner, lineal family, spouse, or other disqualified person using IRA funds for their direct benefit in the present, rather than building up IRA funds for the future. Some examples of self-dealing include:

- You (the IRA owner) lives in or works in a property owned by your SDIRA.

- You use SDIRA funds to invest in your own company.

- A family member rents a property owned by your SDIRA.

Who Are Disqualified Persons?

Disqualified persons prohibit your SDIRA from directly or indirectly selling, exchanging, or leasing a property; lending money or credit; transferring or using IRA income and/or assets; or funding goods, services or facilities. While you own your SDIRA, you cannot receive benefits from the account until you collect it at retirement.

Disqualified persons are:

- You, the IRA owner

- Your spouse or children (and their spouses)

- Your parents, grandparents, or great-grandparents

- Grandchildren and Great-Grandchildren (and their spouses)

Also excluded are services providers of your SDIRA, including the custodian, CPA, and financial planner. Entities (corporations, partnerships, LLCs, trusts, and estates) may also be disqualified is 50% or more is owned directed or indirectly by you or a service provider. A partner who holds 10% or more in a joint venture in one of these entities is also disqualified.

In general, the IRS defines a prohibited transaction as:

"...any improper use of your IRA account or annuity by you, your beneficiary or any disqualified person. Disqualified persons include your fiduciary and members of your family (spouse, ancestor, lineal descendant, and any spouse of lineal descendant)."

Remember: all SDIRA owners must follow all IRS regulations. It is best to consult with your legal and financial professionals.

You may be thinking: Okay, so my SDIRA can’t directly benefit me or my family. So why is it a good option for real estate investment? It’s the point to grow my passive income? What’s the advantage?

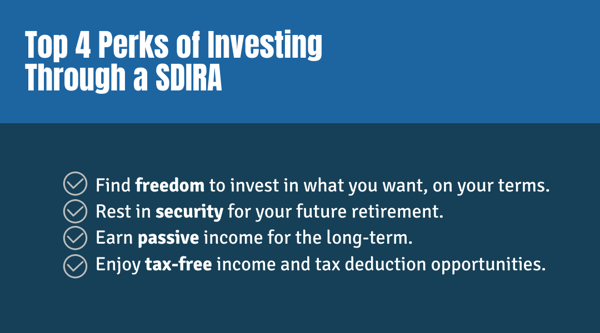

Why Is It Good for Real Estate Investors?

It’s Passive

Investing in real estate by traditional means is also passive, but the differentiation here is that the SDIRA effectively contains your investment funds. You use SDIRA money to fuel your real estate investments, and then the passive income you earn goes right back into the SDIRA—passively building up your retirement funds in one neat place.

Big Tax Advantages

Tax advantages are a big incentive to use a self-directed IRA for your investments. Not only do you enjoy transactions within your account tax-free until retirement, but there are opportunities for tax-deductions as well. In addition, some self-directed IRAs allow you to pass assets to beneficiaries after death with little to no tax implications, meaning you can help ensure financial security for future generations.

Wider Investment Opportunities

Again, the biggest advantage of a SDIRA over a traditional IRA is the diversity of your investment options. Obviously, you can invest in real estate, but you can also turn to other investments to diversify your portfolio and mitigate risk.

Retirement Funding, Secured

The entire point of your self-directed IRA is the secure finances for your retirement. But it should also be noted that your SDIRA is protected under federal bankruptcy laws, meaning that your assets stay secure for the future. As far as efficiency in saving for your retirement through investing goes, it doesn’t get much better than a self-directed IRA, if only because it remains contained in the account. No, you don’t get the advantage of immediate profits, but you work more efficiently to secure your future.

What accounts are eligible?

Does a self-directed IRA sound attractive to you? There’s good news! Anyone is eligible to open a self-directed IRA. You may be wondering...if that’s the case, why haven’t I heard about it before? Why aren’t more people taking advantage of a SDIRA?

Truth be told, this type of IRA has largely flown under the radar, but they’ve been around since traditional IRAs were created in 1974. The IRS has always - always - allowed investments that go beyond the traditional stocks, bonds, and mutual funds.

You likely haven’t heard of it because most banks and brokerage firms only allow traditional investments. For a self-directed IRA, you’ll likely have to specifically seek out an alternative investments firm.

Who are the major players in the industry?

Before we list some of the big names in the alternative investments industry, we should go over the a few definitions, as many companies will vary in structure, and picking what’s right for your investment strategy is crucial for an amiable, efficient partnership.

Custodians

These are the most common, and generally what you will want to look for when you wish to own a self-directed IRA. Custodians are either a bank, credit-union, or non-bank custodian that has been approved by the IRS, such as a broker dealer with IRA approval. Custodians are subject to strict oversight, both at the state and federal level. They are not advisors, and as such, are not permitted to give tax, legal, or investment advice to their clients. They also can’t promote or endorse specific investments or types of investments. They are there to hold your account only, until you claim it at retirement.

Third-Party Administrators

Administrators still require an identified custodian for your SDIRA account, but their primary function is administrative. As a role, administrators exist in a similar capacity to custodians (in that they hold your account and do not render advice), but they do ensure that you are following all IRS guidelines and offer guidance through any transactions you choose to take.

Unlike custodians, administrators are not approved by the IRS, are not regulated at the state or federal level, and are not allowed to custody assets. Custodians, by contrast, are. Think of administrators (and facilitators) as an intermediary between you, the account holder, and a custodian.

Facilitators

The difference between an administrator and a facilitator is in their core functions. Like administrators, facilitators play by different IRA rules than custodians. They aren’t approved or regulated by the IRS either. Functionally, facilitators are there mostly to help owners set up single-member LLCs and C Corporation IRAs.

Why does it matter, you may ask?

Because administrators and facilitators are not subject to the same oversight as a custodian, you may inadvertently engage in a prohibited transaction that the IRA catches later—which means being slapped with a big fine.

It’s your responsibility at the end of the day. The Retirement Industry Trust Association (RITA,) is the voice of the Self-Directed IRA Industry. Here you can see all of your qualified Self-Directed IRA options. We’ve listed some of the big-name players in the world of self-directed IRAs below.

Remember: these are not recommendations or endorsements. We encourage you to research each company carefully before choosing.

Notable Alternative Investments Businesses

Custodians

Third-Party Administrators & Facilitators

How would an investor get started?

Vet a SDIRA Company

While we’ve provided a good list to get you started in looking for a SDIRA custodian, administrator, or facilitator, doing your homework before entrusting your financial future a company is absolutely crucial. There are disreputable companies out there. While it’s not impossible to move your funds if you wind up dissatisfied, there may be fees and headaches involved with the process.

So what are the most crucial qualities in a good SDIRA company?

Experience — self-directed IRAs may have been around for awhile, but companies that actually specialize, let alone allow them, are relatively new. In a field with so many legal trappings that could result in financial disaster, knowing that you have a experienced team in your corner is invaluable.

Knowledge — another facet of experience is knowledge. Not only do you hope that your company has years of experience under their belt, but you also want them to be up on current law, industry trends, and generally knowledgeable of their industry. Don’t be afraid to dive deep and interrogate them to see if they really know their stuff.

Communication — In the world of investing, things can happen fast. You need to know that your transactions will be completed smoothly and quickly, with ample communication in between. If you have trouble reaching your SDIRA company, you may have a problem—or at the very least, more than your share of frustrations.

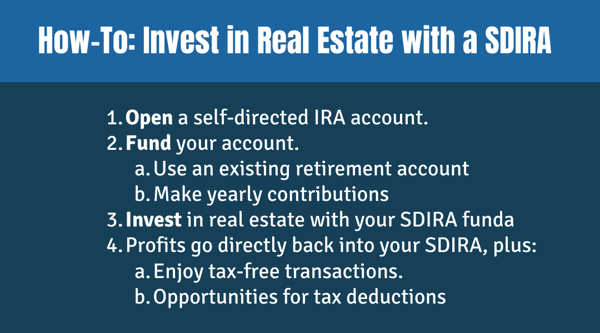

Open a Self-Directed Account

Once you’ve vetted your custodian, administrator, of facilitator, it’s time to open an account. That’s it. That’s step two! Anyone can open a self-directed IRA account. The catch only comes if your chosen company has certain minimum investment requirements. Still, there aren’t limitations on who can open an account.

* Important Reminder! What Can Be Self-Directed

You are not limited to self-directing Traditional & Roth IRAs folks. For the self-employed individual & those with a multitude of entities there are self-directed SEPs, SIMPLEs, Solo-401k, Roth Solo-401K's, and for those with more participants Self-Directed Safe Harbor 401K's as well.

Two accounts often overlooked are HSAs, Health Spending Accounts. If you have a High-Deductible health plan, you should absolutely have a self-directed HSA. Second, CESAs, Coverdell Educational Savings accounts that can be applied not only for higher education, but for K-12 as well.

Fund Your Account

So you’ve set up your SDIRA. Now it’s time to get funded. There are two primary ways of doing this:

- Roll Over Funds from a 401(k), other IRA or retirement account

If you already have a retirement account in the works, roll it over into your account. This is the easiest way to start quickly. Of course, you may not have enough in that account to fund the investments you’d like to. That’s why, among other alternatives, you can:

- Make Annual Contributions

There are, however, limits on annual contributions. These are set by the IRS. For individual 50 and under, the limit is $5,500 annually. For those over 50, the limit is $6,500 annually.

There’s potential to drastically increase this limit with a Roth SOLO-401k. If you are self-employed you better look into this account. For individual 50 and under, the limit is $34,000 tax-deferred & $18,000 tax-free. For those over 50, the limit is $34,000 tax-deferred & $24,000 tax-free. That’s over 3x the tax-free savings & 5x the tax-deferred savings.

Invest in Real Estate via Your IRA

In a regular IRA, your investments are largely picked for you, and very limited. The only common avenue of investing in real estate with an IRA was in buying shares of an REIT. A self-directed IRA means that you’re at the reins! Your custodian won’t (or shouldn’t) steer you towards any particular investment. They only process transactions. You determine what those transactions are.

One key to note is that when you invest in real estate with your SDIRA, all funding for the investment must come from your SDIRA. Not your personal bank account. That doesn’t just mean purchasing the property: it means everything you need to maintain it, repair it, and manage it. So it’s vital that you don’t overspend and that you have an ample cushion in your SDIRA.

This is especially important considering the limitations on your annual contributions. You can’t necessarily bail your SDIRA out when costs overreach your balance.

All expenses are paid for by the IRA, not you. All income goes to the IRA, not you. The property is owned by the IRA, not you. Keep this separation in mind—it’ll prevent you from getting tangled up in legalities.

*Note that this means rent checks must be payable to your IRA account, not your name.

What a Transaction Looks Like

Let’s say Marco decides to open a self-directed IRA account, which he decides to fund with his 401(k) from a former employer. Marco wants to invest in real estate with his SDIRA, so he identifies a property that he wants. He speaks to his custodian about making this transaction, and he makes an all-cash bid that is entirely covered by his IRA, and in the name of his IRA account.

Once the bid is accepted and the proper paperwork completed between Marco and his custodians, the property is now owned by his SDIRA account. From this point on, all expenses, including property taxes, property management, and maintenance, will be covered by his SDIRA account. Income will funnel back into the account, tax-free, thus building up his retirement funds.

Of course, Marco was lucky: he had enough money in his account to cover his transaction. But what do you do if your IRA doesn’t have enough funds to cover the costs of purchasing, managing, and maintaining your investment property?

What If I Don’t Have Enough in my IRA to cover an investment purchase?

You’re not totally out of luck. Outside of making your annual contributions to the account, you can:

Transfer from another IRA or qualified plan

Do you have another traditional IRA or retirement plan? If qualified, you can roll these funds over and into your SDIRA. Consolidating these funds might seem like putting all of your eggs in one basket, but remember: a big advantage in a self-directed IRA in that ability to diversify your portfolio on your terms and mitigate risk.

Borrow money (non-recourse loans only)

Because you cannot be personally responsible to pay for a loan associated with your SDIRA, only non-recourse loans (in which the property is the collateral) are acceptable to help with funding through your self-directed IRA.

Partner up

Partnerships, even with disqualified persons, are possible for the initial purchase of an asset. While this may seem like it’s breaking the rules, it isn’t: the stipulation is that you or a disqualified person does not already own the property. You can go in and purchase a portion using IRA funds, in the name of your account, while a partner (including friends or family) fund the rest. Expenses and income are divided proportionally to your share of the asset.

When and if you sell the property, your account will receive a percentage that matches with your initial contribution.

Sell another asset

Finally, you can sell assets that are already owned by your self-directed IRA account: these funds will go right back into your account, meaning you can pay attention to appreciated values and earn more than you paid at purchase.

Details Every Investor Should Know Before Getting Started

We can’t pretend that a self-directed IRA is a foolproof way to invest. Far from it: it can be an extremely risky endeavor, despite nice tax advantages and bankruptcy protection. Before you jump into real estate investment through your SDIRA, be aware of some of the potential pitfalls:

Risk of Fraud

The U.S. Securities and Exchange Commission (SEC) warns investors of the different kind of fraud can exploit the self-directed IRA system. Ponzi schemes and fraud are no less common here than elsewhere. Remember, too: not all custodians, administrators, and facilitators are created equal. Some companies will be better than others in terms of communication and experience: and a lack of either can be detrimental to you.

Here are additional resources & tools:

- Securities and Exchange Commission

- National Association of State Securities Administrators

- Financial Industry Regulatory Authority

As for fraud:

Warning Signs:

Unsolicited Investment Offers

Remember: this is a self-directed IRA. You are in charge of what you invest in. Whether it’s a random promoter or custodian subtly trying to steer you towards a particular investment, remember: they are not supposed to direct your investments or offer advice. Be wary of any unsolicited investment offer, no matter who it’s coming from.

Guaranteed Returns

As always, be on the lookout for any offer that sounds too good to be true. Astronomical return projections or promises of returns are big red flags as always.

Ask Questions

Whether it’s the company managing your SDIRA account or an investment promoter, ask questions. Don’t be afraid to dig deep and hit hard. Make sure all licensing is up to snuff and that all numbers are checked out and verified.

It Can Be High-Risk

While the freedom to direct your own investments is one of the major perks of a SDIRA account, it also comes with the obvious dangers that any investment does. Self-directed IRAs are suited for experienced investors with a proven track record of success, and not for anyone who is hinging their entire retirement or economic future on an IRA.

Because of the restrictions placed on annual financial contributions to your IRA, you only have so much room for error. A few bad deals can easily wipe out your entire account if you’re not careful. That said, if investors do their due diligence and make wise investment decisions, you’re not likely to run into catastrophe. But it’s worth repeating that being too cavalier with your SDIRA investments is a bad, bad idea.

Despite the risks, however, a skilled investor has a lot to gain from a self-directed IRA. They’re best suited for investors looking to passively secure their financial future, while also wanting a hand in what those investments are. For real estate investors, the opportunity is real!

Looking to invest in real estate?

One of the easiest ways to get started is by turning to turnkey real estate investment with Memphis Invest, where you can lean on our experience, extensive market knowledge, and proven reputation for excellence.

Are you Interested in learning how to Invest in three of the top

cashflow markets in the nation with Memphis Invest?