Whenever we see a headline proclaiming that yes, you too can become a millionaire, it’s natural to be skeptical. The majority of us have a pessimistic view of our money and our ability to make it work for us if we have no experience doing so. We don’t know if an investment will work out, if we can effectively grow our net worth, or whether or not we can construct the financial future we envision for ourselves.

Whenever we see a headline proclaiming that yes, you too can become a millionaire, it’s natural to be skeptical. The majority of us have a pessimistic view of our money and our ability to make it work for us if we have no experience doing so. We don’t know if an investment will work out, if we can effectively grow our net worth, or whether or not we can construct the financial future we envision for ourselves.

In many ways, this is a psychological self-preservation tactic. We feel doubly as bad about losing money as we feel good about earning it. Naturally, we do everything in our power to prevent losing money because it makes us feel a slew of negative and unpleasant emotions. We gravitate towards safety and security over any chance of losing that which we have earned.

While we think of saving and preserving our money without taking risks on investing as a rational and balanced decision, it is, in fact, a decision born in fear. We’re afraid of losing, afraid of failure, and afraid of the embarrassment that comes with it. The same can be said of many of our decisions as investors on the whole.

Oftentimes, what we believe to be objective decisions are actually motivated by an underlying fear of negative outcomes.

As a consequence, we suppress our incredible potential to multiply the assets we already have. This potential can take, for example, $100,000 or $250,000—sometimes more, sometimes less—and turn it into a million-dollar real estate portfolio.

Isn’t that where you would rather be?

The Value in Making Your Money Work

There are obvious reasons to make your money work for you. All of us have a desire to see our wealth build in some form or fashion, be it for an earlier or more comfortable retirement, to leave something behind for our children and their children, or to get out of the rat race.

Whatever the reason may be, it ultimately boils down to this: life shouldn’t have to be so hard.

It seems like everywhere we turn, the cost of living is going up, retirement funds are shrinking as life expectancy increases, relationships are strained by money woes, and more and more of us are working ourselves to death trying to just get by.

Investing—making your money work for you—is about playing it smart. It’s taking the assets that you have managed well and using them as a tool to free you from financial burdens.

If you were financially free, what would you do?

Taking Your Net Worth from $250,000 to $1,000,000

When you have $100,000 or $250,000 to invest, you have a few options at your fingertips.

There are three primary ways you can take your assets and use them to multiply your net worth: stocks, business, or real estate. There are pros and cons of each path, but there are some big reasons why real estate is likely your best bet.

Where stocks are concerned, investors have to take a slow-and-steady approach: waiting decades for their investments to reward them, if and only if the market has turned in their favor. They have to play their cards right and be incredibly patient. It’s methodical and demands expertise and fine-tuning to really play it right.

The other way to make it big with your money is to start or invest in a business idea or product. This is perhaps the path with the highest risk/reward ratio. Just look at Bill Gates or Mark Zuckerberg. We also have to realize that not everyone has winning ideas and that people lose a lot of money in the pursuit of a successful business.

It takes a special kind of person to be an entrepreneur and it’s not for the faint of heart. You have to be prepared to lay it all on the line. You might see little to no returns for years. It’s unpredictable and fraught with risks.

Could you be immensely successful in business and stocks? Absolutely.

However, when you look at a system that takes your assets and builds wealth in a relatively short amount of time with balanced risk, passive income, and appreciation potential...real estate really is the way to go.

3 Critical Phases for Building a Successful Passive Real Estate Investment Portfolio

1) Build Phase

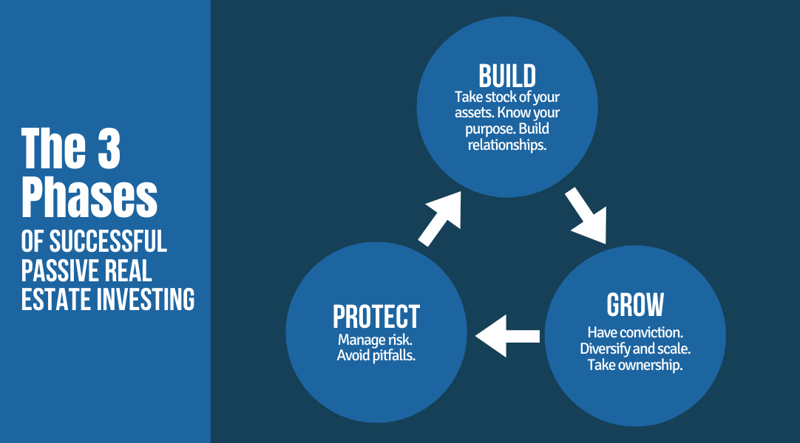

When it comes to building and maintaining a million-dollar real estate portfolio, there are three real phases involved. These phases are cyclical in nature. The build phase, the growth phases, and the protect phase. The build phase is where it all begins. This is the period of investing in real estate where you really begin to get your footing.

When you’re dealing with large amounts of money and looking for large returns on a long-term investment, this is a crucial phase. It’s foundational. Whether you are looking to invest $100,000 in real estate or investing $250,000 in real estate, you have to do so with commitment and conviction.

Success in real estate investing does not come to those who do so half-heartedly or with expectations of success without effort.

Here are your first steps towards a winning portfolio as a passive investor.

Evaluate Your Assets

First things first: know what you have and begin to develop a plan for how you want to use it. If you’re new to investing, there are two concepts to familiarize yourself with: asset analysis and portfolio analysis.

Asset analysis is the process of looking at your portfolio’s costs, opportunities, risks, and performance and adjusting it accordingly to maximize outcomes. Portfolio analysis, on the other hand, looks at the whole of your portfolio’s composition. It seeks to determine if your portfolio is appropriate for your specific needs and goals as owner and whether or not it is meeting your individual goals. When portfolio and asset analysis work together in tandem, they are powerful tools that equip real estate investors to craft that million-dollar portfolio in record time.

For investors, analysis of this scale can be conducted independently by a contracted firm, with guidance from a portfolio adviser from your turnkey investment provider, or another specialist.

When you’re starting to invest in real estate for the first time, however, you have no portfolio to analyze and your assets are not yet tied up in investments.

So what are you really looking at?

Before you invest, you must determine:

- How much money you want to put towards your investments to begin with.

- How much money you want to set aside as a safety net to absorb risk.

- Initial strategies for obtaining assets for your new portfolio.

- The risk you’re willing to tolerate and the conviction with which you will invest.

Once you’ve begun to outline not only your personal goals and mindset for investing, you will be able to more solidly develop a plan for investing. A problem that new investors often run into is that they have physical assets but they don’t take stock of the immaterial, personal assets that truly bring about success in this business. These are qualities like determination, conviction, discernment, and adaptability.

Having the right assets is only part of the equation. Being adept at applying and using those assets in the way that best benefits you and brings you the highest returns in the shortest amount of time is what really counts. That’s how you go from $250,000 to $1,000,000 in just a span of a few years.

Develop Your Investment Plan

Once you’ve taken stock of your physical assets and personal strengths, it’s time to actually plan what it is you want out of your real estate investments. While it may seem straightforward to set a certain monetary goal, it would behoove you to aim for specifics. Anyone who invests in real estate ultimately wants to see returns that increase their net worth.

Within real estate investment, there are different things to focus on that will determine how you actually invest and what steps you actively take as an owner. This can be a focus on cash flow, a focus on asset accumulation, or something else altogether. Regardless, it will affect your overall strategy and how you approach investing in real estate.

Having this goal in mind is paramount to success because it keeps you, as an investor, from focusing merely on buying just to buy or sinking money into properties just because you think it’s what is expected of you. Rather than investing in real estate for its own sake, you’re investing with a real purpose behind it.

When you have this purpose, you can invest safely and intentionally, which makes for a more cohesive portfolio.

Having a plan and a purpose also keeps you focused and on track towards another valuable goal: specializing. We’ll talk about that in the next phase.

Identify Partners and Providers

Investing in real estate for the first time can seem like a daunting prospect, especially when you’re looking to invest sums of money ranging from $100,000 to $250,000—maybe more. If you want to invest safely and protect your investment long-term, your best solution is to go through a turnkey investment company.

The advantages of a turnkey investment company:

One of the primary advantages of choosing to be a turnkey real estate investor is market access. Because property management is taken care of for you, you can invest out-of-state without fear. More than that, you have the assurance that your turnkey provider themselves are located in and investing in properties that are targeted for their income earning potential.

One of the primary advantages of choosing to be a turnkey real estate investor is market access. Because property management is taken care of for you, you can invest out-of-state without fear. More than that, you have the assurance that your turnkey provider themselves are located in and investing in properties that are targeted for their income earning potential.

Related Article: 9 Questions Every Investor Should Ask a Turnkey Investment Company

As a real estate investor, you are responsible for doing your own due diligence in any given market that you wish to invest in. The fact that a reputable turnkey company has invested themselves in that market, however, is a good indicator.

Turnkey investment companies offer a real estate investor significant advantages over traditional “hands-on” methods of investing in real estate. Turnkey investing, for the owner, means that your energy doesn’t go into the day-to-day operations but instead remains on big-picture portfolio strategy. You don’t have to stress about the details or knowing every minute detail of the business.

Your turnkey provider, ideally, owns a property management company who takes care of finding tenants, taking care of property issues and maintenance, dealing with tenant turnover, and anything required to ensure that your cash flow remains steady and maximized. You step into a more passive role where the day-to-day functionality of your investments are concerned and, instead, your chief concern is with being a true investor.

Trust Proven Investment Strategies

One of the biggest mistakes that investors make is trying to rely on trendy new investments versus sticking with what is proven and time-tested. This is true on Wall Street and it’s true in real estate investment. While yes, there is some merit to real estate crowdfunding, Bitcoin, AirBnB, and whatever new variation on stocks or investment types you can imagine, the truly successful investors out there will point to “boring” investments as their bread and butter.

One of the biggest mistakes that investors make is trying to rely on trendy new investments versus sticking with what is proven and time-tested. This is true on Wall Street and it’s true in real estate investment. While yes, there is some merit to real estate crowdfunding, Bitcoin, AirBnB, and whatever new variation on stocks or investment types you can imagine, the truly successful investors out there will point to “boring” investments as their bread and butter.

They keep proven investments at the foundation of their portfolio because they are reliable. Turnkey real estate is just that—time-tested and proven.

While a buy-and-hold investment strategy may not be “exciting” or promise you extravagant returns, it gives you something stable and trustworthy. Many real estate investors make the mistake of chasing the hottest markets without considering the long-term. A turnkey investor isn’t so much concerned with capitalizing on the rapid appreciation of a hot (and potentially volatile) real estate market but instead invests in stable, reliable markets that offer returns that they can count on throughout their investing career.

It’s with these reliable markets that you want to target and populate the bulk of your portfolio.

2) Growth Phase

Ride the Waves

The real estate market moves in cycles. Part of being a buy-and-hold investor involves a willingness to handle the ups and downs that come with a fluctuating market. Conviction is absolutely necessary for a passive investor’s success. If you’re constantly second-guessing your decisions or changing your mind, you’re going to find it difficult to gain traction in the best of times. Successful investors know that dips and slowdowns aren’t a reason to panic, sell, or pull the plug.

Because real estate is always changing, there’s no waiting for an ideal time to jump in and, for someone employing a buy-and-hold strategy, letting it ride is usually the best thing to do. There will come times when you may need to sell, but don’t let fear make the decision for you.

Oftentimes, investors make decisions out of a fear of losing money or a fear of embarrassment: not because they’re actually losing money. You must approach decisions impartially and objectively.

Diversify Your Portfolio

As with any investment, you want to keep your real estate portfolio diverse. You don’t want to rely on a single market to supply you with investment properties. Instead, branch out and target a number of markets that have consistent growth in the following areas:

- Population

- Job Opportunities

- Job Market Diversity

- New Home Construction

- New Businesses

- Property Values

These are good indicators of overall market health when investigating a market.

Diversity not only hedges your portfolio against risk, but it allows you to capitalize on positive fluctuations as well—whether these happen on a state, local, or regional level. When seeking out a turnkey investment company to partner with, it’s wise to investigate their market offerings as well. If you can minimize the number of companies you have to work with to acquire a diversified portfolio, it will be considerably easier when it comes to communicating and coordinating your goals, portfolios, and records.

Seek out a provider that is investing in markets that you’re interested in, yes, but more importantly, markets that they have researched extensively, and markets that are steady and reliable.

Become the Expert

In the build phase, we covered the value of having a purpose and a plan. Part of why this is so important is not only because it helps you stay focused, but it also helps you as you grow and gain experience as an investor. When you don’t have a plan, you’re more likely to jump from strategy to strategy when you think something may work better than what you’re doing now.

If you’ve dedicated yourself to a course from the get-go—for instance, passive investing or turnkey real estate—you’re going to gain a lot of experience in that method. This experience brings an investor plenty of advantages: it helps you invest more safely and securely, knowing that your experience helps you make better decisions and avoid costly mistakes. As you establish yourself and gain this experience, you also earn a reputation and a name in the community. When people talk about turnkey investing, they also talk about you!

Being an expert and having your name come up among peers is just good for business.

Scale Your Real Estate Investments Strategically

When planning on starting with $100,000 or $250,000 and putting it towards building a successful passive real estate portfolio, one of the key steps to take after you’ve established a trusted turnkey partner, identified and investigated markets of interest, and acquired your first few investment properties is to scale.

While asset acquisition may not be your primary goal, it is an essential part of the equation. If you want to maximize your returns in real estate investment, you have to create multiple streams of cash flow.

If you’re already pulling from great resources to begin with, scaling is fairly simple: it’s really only a matter of timing, ensuring that you’ve done your due diligence, and scaling in a way that is sustainable.

In real estate investment, with factors like leverage at play, you can quickly build up a net worth of a value worth your initial investment many times over in just a few years. When you’re a passive real estate investor, you have the added bonus of not relying on the appreciation of these properties to reap your rewards. You have passive income providing the lion’s share of the benefits.

3) Protection Phase

The final phase of passive real estate investment is ongoing. If you hope to build a successful real estate investment portfolio, whether your goal is $500,000 or a million dollars, whether you start with $20,000 or $200,000, you have to actively work to protect what it is you’re building. Successful real estate investors are always invested in their education, building the best team, fine-tuning their systems, and ensuring that everything is to the highest standard.

When we look at that on a practical level, what does it mean to preserve and protect your passive investment portfolio as it grows?

Maximizing Cash Flow, Minimizing Risk

A turnkey investor must be focused on minimizing risks. Risk management is one of the key components of investing safely in anything.

For the passive real estate investor, minimizing risk primarily comes in vetting your turnkey provider and continuing to grow and strengthen that relationship over time. It takes continuing your education and actually growing to know this business so that you can earn some authority over it.

Part of risk management also means having an active involvement in your investments and in their outcomes. A mistake some passive investors make is taking a “hands off” approach to investing. To grow a successful and profitable portfolio, you must be communicating with your turnkey company, engaging in asset and portfolio analysis, and working to see what does and doesn’t work and adjusting accordingly.

You’re at the point where you’ve created this portfolio, you’ve acquired properties, and you’ve had time to see how they’re performing. It’s time to really look, see where you’re exposed to risk, and deal with it. Where can things be better? Where are you losing money unnecessarily? How can you increase your income? These are the questions to ask, answer, and revisit over and over again.

Once you work to refine your portfolio, cut the fat, and reduce your risk, a true strategy begins to emerge that you can really click with—something personal to you, based on something time-tested.

This is key. While real estate investing and turnkey investing are long-held, tried-and-true investment strategies, we exist in unique times and markets as unique individuals in unique circumstances. It is a mistake to try to replicate someone else’s success or to model a formula too closely.

So much of investment success is born in experience.

A Real Estate Investor’s Personal Pitfalls

Lack of Patience

Building a successful portfolio takes time. Success doesn’t happen overnight, nor is success a guarantee in any investment. Many investors in all different industries make the mistake of growing impatient and restless with a perceived lack of payoff for their contributions. Either disappointed when the returns aren’t coming in fast enough, big enough, or at all, or when things go wrong, they pull out before their investments truly have a chance to pay off.

Being a buy and hold investor means having patience. It takes years, even decades, for some investments to truly build and pay off. While you may be fortunate in real estate and be able to scale and grow quickly, you have to be willing to be patient, too. You have to do due diligence and allow things room to grow.

Don’t pull the plug before you’ve given your portfolio a chance or let panic end an opportunity prematurely.

Trying to Do It Alone

While there are many potential pitfalls along the road to real estate investment success, one of the biggest among inexperienced investors—especially those who wish to invest hundreds or thousands of dollars from the very beginning—is simply trying to do it all.

Building a reliable and effective team is so critical to building up a sustainable and successful real estate portfolio.

Building your net worth and crafting a million-dollar real estate portfolio is difficult enough, but when you’re trying to target out-of-state markets, juggle multiple properties, deal with multiple streams of income, make deals, and handle all of the strategic planning and analysis that comes with it...it’s too much for one person! That’s not even touching the issue of trying to deal with property management on your own.

If you’re trying to invest in real estate and you think you only need property managers and you can deal with the rest yourself, think again. You need a team to rally around you not only for guidance but for support.

Seek out a turnkey investment company that doesn’t just care about selling you the property and offering bare-bones management services. Seek out a provider like Memphis Invest, who actually actively invests in your success.

Want to learn about turnkey investing and diversifying your portfolio? Talk to one of our licensed, real estate portfolio advisors today!