Now more than ever, real estate investors are looking for key opportunities in unsuspecting places. In these extreme real estate market conditions, we’re craving reliability and consistency. Beyond the usual suspects, real estate investors would do well to consider secondary and tertiary markets – those that have overcome pandemic-era odds and present fresh, promising opportunities for investors.

Oklahoma City, Oklahoma just happens to be one of those markets. Here’s what you need to know before you invest!

An Overview of OKC

Oklahoma City is not only the capital of Oklahoma, but it is the most populous city in the state. It is the 11th most populous city in the Southern U.S. and 22nd in the country. Oklahoma City is also known for its significant land area – covering 621 square miles. It ranks 8th in area size when accounting for consolidated city-counties and second only to Houston in terms of land area when excluding them. In terms of land area, Oklahoma City is the second-largest U.S. capital, only second to Juneau, Alaska.

Why does land area matter? In the pandemic era, available land and lower population densities are powerful incentives when considering both real estate inventory, buyer priorities, and health and safety guidelines. Oklahoma City proper has a low population density of 1,104 per square mile while the metropolitan area has a density of just 259 per square mile. There were 681,054 people living in Oklahoma City as of 2020, with 1,396,445 residents in the wider metropolitan area.

To put that in perspective, New York City has a population density of 27,400 per square mile. Houston has a population density of 3,630 per square mile. Oklahoma City ranks 193rd in terms of population density among 200 other U.S. cities.

In today’s day and age, that’s an advantage.

History

The city was founded in 1889 when the Oklahoma City area, known as part of the “unassigned lands,” was opened for settlement in “The Land Run.” Some 10,000 settlers came to the OKC area, which quickly grew in population. When Oklahoma was admitted to the Union in 1907, the capital eventually shifted from Guthrie to Oklahoma City. As a key stop along Route 66 as well as an interchange between interstates I-35, I-40, and I-44, OKC is a major transportation hub.

Demographics

Looking at statistics from the U.S. Census Bureau, we receive a snapshot of Oklahoma City’s demographic makeup:

- Over half (50.8%) of OKC residents are female

- 9% of residents are under the age of 18

- 4% of residents are aged 65 or older

- 7% of residents identify as white

- Between 2015 and 2019 there were 242,748 households in OKC

- The average OKC household consists of 2.60 individuals

- The median household income is $55,557 (2019)

Overall, Oklahoma City has seen a significant population boost since the 1990s, likely due to urban revitalization efforts begun in the 1970s and 1980s. Since the 2000 Census, OKC is estimated to have grown in population by 25%.

Oklahoma City’s Economic Background

Key Industries

Oklahoma City was long known as a massive agricultural center, though in the modern age, the economy has diversified significantly. Agribusiness still plays a pivotal role in the economy alongside the energy and aviation industries.

Aerospace & AviationThe aviation and aerospace industry has 265 firms employing over 38,000 workers in Oklahoma City. This high-paying, high-skill sector has only grown over the years. It is one of the best industries in the area for job creation, producing some $11.6 billion in goods and services annually.

The industry’s presence in Oklahoma City is largely credited to the presence of the Tinker Air Force Base, which is the largest single-site employer in the state, employing some 33,000 military and civilian employees. Tinker AFB contributes $3.6 billion to the local economy each year.

BiotechnologyBiotechnology/bioscience is the new industry on the block in Oklahoma City, but it provides some 51,000 jobs (and $2.2 billion in wages) while earning an annual revenue of $6.7 billion. Biotechnology spans a wide range of applications, the most notable being the development of life-saving medical treatments and medicines. Most bioscience applications are in the medical and pharmaceutical research fields.

Oil & EnergyOklahoma City is a global oil capital, with the state’s experience in energy going back over a century. The state boasts 5 petroleum refineries as well as the largest oil storage facility in the world. Oklahoma is the 3rd largest producer of natural gas in the United States as well. Windmill power and other green energy alternatives are on the rise in the state, too, and Oklahoma City is home to multiple Fortune 500 energy companies. Adjacent industries include geology, engineering, human resources, and accounting.

In some ways, the automotive industry – another major player in the Oklahoma City economic landscape, is related to the energy industry. As the transportation sector grows and innovates, OKC has uncovered an opportunity to seize a bright future in lithium. Lithium is utilized in batteries, both conventional, household types as well as those used in electric cars and light-use, battery-powered aircraft. Galvanic, an Oklahoma City-based exploration company, has purchased 100,000 acres in Arkansas that could generate 4 million tons in lithium carbonate equivalent. That could power some 50 million electric vehicles.

As it stands, most of U.S. lithium is imported. Australia and South America generate 90% of global lithium imports, and only 2% goes to the United States. The only lithium processing facility in the United States currently is in Nevada. Companies like Galvanic are exploring the opportunity for Oklahoma City to become the titan in U.S. lithium production.

AgribusinessWith three-quarters of Oklahoma land as designated farmland, it comes as no surprise that the agriculture industry remains vital to Oklahoma City and the state as a whole. With 3.4 million acres of farmland, Oklahoma has the 4th most farms in the country. Primary commodities are rye, beef, canola, cotton, and wheat. From direct agricultural businesses come adjacent industries, too, like research and development, food processing and packing, and manufacturing.

Key Feature: Economic Diversity

Any reliable investment market has a diversified local economy. As in one’s portfolio, economic diversification mitigates market risk. We’ve seen that markets that rely on a single industry to sustain economic development, the job market, and revenue are at the highest risk of collapse when said industry is put under pressure.

The example we often point to is the 1980s oil crisis that devastated Houston, Texas! It caused bank closures and untold economic losses. In the years since, the market there has diversified, easing the impact of oil industry ups and downs.

The same can be said for Oklahoma City. With one of the nation’s lowest costs of doing business and numerous business incentives, new and cutting-edge industries are attracted to the OKC market. In fact, Economy.com named Oklahoma City as one of the most affordable among 361 other metro areas in terms of business costs – accounting for the cost of labor, energy, taxes, and office space.

One of the major incentives for doing business in OKC (and Oklahoma in general) is the Oklahoma Quality Jobs Program, which offers cash payments that can total in the millions of dollars for qualifying companies that create and maintain job opportunities in the state. These payments can be up to 5% of payroll expenses over 10 years.

Major Employers in Oklahoma City, By Number of Employees

- State of Oklahoma (Government) – 47,300

- Tinker Air Force Base (Military) – 24,000

- University of Oklahoma – Norman (Higher Education) – 12,700

- INTEGRIS Health (Health Care) – 9,000

- University of Oklahoma Health Sciences Center (Higher Education) – 7,500

- FAA Mike Monroney Aeronautical Center (Aerospace) – 7,000

- Hobby Lobby Stores Inc (Wholesale and Retail) – 6,500

- Mercy Hospital (Health Care) – 5,540

- Amazon (Transportation) – 5,000

- City of Oklahoma City (Government) – 4,800

- The Boeing Company (Aerospace) – 3,600

- OGE Energy Corp (Utility) – 3,400

- OU Medical Center (Health Care) – 3,300

- SSM Health Care of Oklahoma, Inc. (Health Care) – 3,000

- University of Central Oklahoma (Higher Education) – 3,000

Key Performance: Recession-Proof

During the height of the Great Recession in 2009, experts began to call Oklahoma City “recession-proof.” This reputation stemmed largely from the city’s relative economic strength while the rest of the country seemed to flounder. In 2009, the unemployment rate in OKC was the 8th lowest in the nation and below 7 percent. At the time, real estate was increasing in value (contrary to many other markets) and foreclosures were the 2nd lowest in the U.S.

The common denominator between Oklahoma City and the Texas markets that also weathered the Great Recession well? Oil.

Other factors? NPR points to the “frontier spirit” still present in Oklahoma. It’s quintessentially American – the drive to thrive despite difficult circumstances and the unknown. As a result, many businesses were moving to Oklahoma City at the time. As a result, Forbes named Oklahoma City the top spot for budding entrepreneurs.

Of course, the “recession-proof” reputation didn’t begin and end with the Great Recession. We’ve also seen OKC remain tenacious throughout the COVID-19 pandemic and its recession. Business Insider named Oklahoma City among the top 25 recession-resistant places to live in the U.S. out of 264 evaluated cities.

By May 2021, Oklahoma City boasted an unemployment rate of just 4%. Between a low cost of living (54/100, with 100 being the national average), cutting-edge industries, an amicable tax structure, the best school districts in the state, and big-city amenities, OKC has been one of the best locations for freelancers and anyone able to work remotely.

Pandemic-Era Statistics

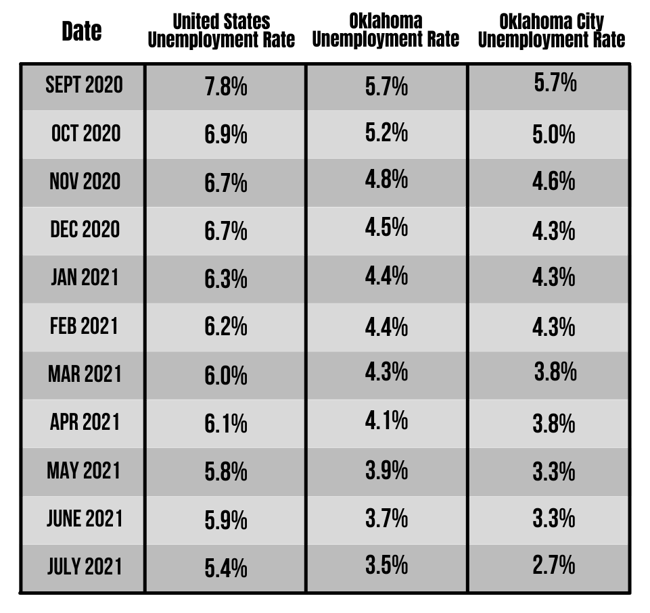

Although Oklahoma City did not escape the impact of the COVID-19 pandemic, it seems to have taken a softer economic blow than other markets. In Spring 2020, OKC saw a dramatic unemployment spike (though not as high at the U.S. total rate of 14.8% – the highest since the Great Depression). At first, the OKC unemployment rate seemed to drop in line with the U.S. rate. About halfway through the year, however, the unemployment rate in Oklahoma City and Oklahoma state began to drop much, much more quickly.

Here’s a quick comparison:

In almost a years’ time, the U.S. unemployment rate finally reached the same rate that Oklahoma City started with. Oklahoma and OKC also were more consistent than the U.S. overall. The U.S. experienced some back-and-forth ups and downs over the months while Oklahoma and OKC unemployment rates declined steadily. (Source: Dept of Numbers)

Although Oklahoma has been said to be among the slowest recovering states, the negative economic impact seems to have been less drastic to begin with. The OKC per capita income increased in 2020 and decreased in 2021 – though projections have it reaching $50,939 in 2022. The industry facing the most challenges in the pandemic seems to be the energy sector. Again, though, Oklahoma City’s economic diversity has prevented it from taking too large or vast a toll on the local economy.

Overall, Oklahoma City is poised for a post-pandemic boom. Ultimately, the city’s status as affordable, less dense, and business-friendly has facilitated ongoing business activity and growth (or, at least, recovery) in the face of the COVID-19 pandemic.

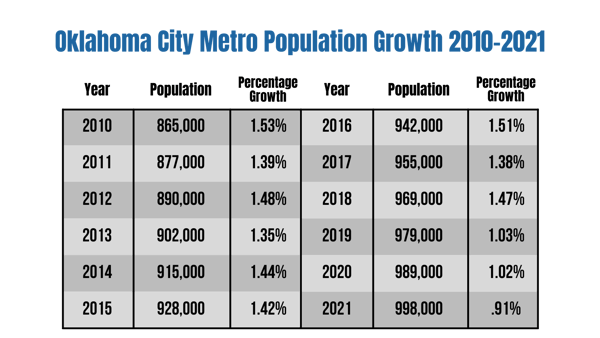

A key indicator for Oklahoma City’s relative health has been population growth. Data from the United Nations shows that Oklahoma City has never had a loss in population year-over-year since first recorded in 1950.

Although OKC metro population growth has not been astronomical, it has been relatively consistent over the past decade (and for many decades!). In fact, the U.S. Census Bureau reports a 12.9% increase in Oklahoma City population between April 2010 and July 2021 – compared to the U.S. growth rate of just 6.2%. Maybe Oklahoma City’s population growth hasn’t been so modest after all. It’s worth noting that while many markets experience metro growth and city population decline, both metrics have been growing for Oklahoma City.

This demonstrates the long-term stability and growth of the market – a key indicator for real estate investors to consider.

Oklahoma City Real Estate

The Oklahoma City real estate market experienced the same explosive demand as many Midwest and Sunbelt markets throughout the pandemic. A snapshot of the OKC market can be seen in this article published by The Oklahoman. All the usual pandemic-era suspects are present in the market: raging real estate demand, soaring home prices, bidding wars, and inventory shortages.

However, Oklahoma City does diverge from some of the frenzied markets in this way: it’s still relatively affordable.

USA Today reports that OKC has one of the most affordable zip codes in the nation. 73110, located east of downtown Oklahoma City, saw a median 2020 home price of just $97,500. As you would expect, most of the homes in this area are old – built pre-1969. Real estate investors don’t necessarily want or need to target the lowest of low prices, as this can ultimately be detrimental.

The good news is that OKC’s affordability doesn’t start and end with this one zip code. Overall, Oklahoma ranked as the 4th most affordable state in the country for housing. And even though OKC saw a 14% home price increase in a single year, the market is still remarkably affordable. With a median asking price of $229,495, Oklahoma City ranked 9th most affordable in the U.S. compared to 100 other cities according to RealtyHop.

The market is not only affordable compared to other major U.S. cities, but it’s affordable relative to local household income. This bodes well because housing affordability has been a major sticking point in markets across the country. Studies show that, as of September 2021, OKC homeownership costs take roughly 24.49% of annual household income. Traditionally speaking, 30% is the maximum recommended debt-to-income ratio for homeowners. OKC falls well below that threshold where many markets vastly exceed it, causing homeowners to over-leverage.

Key Statistics

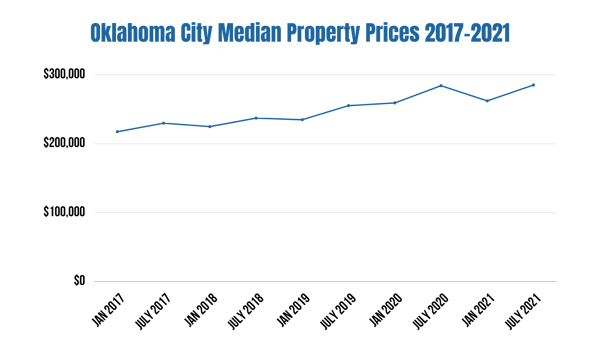

Appreciation in Oklahoma City is not limited to the 2020-2021 housing boom. While price growth has been more slow-and-steady in the past, it has been there. For real estate investors, that indicates longer-term positive appreciation trends.

It might seem alarming that median list prices have been yo-yoing since 2020, but the trend is largely upward. The fluctuations may indicate greater market self-correction than we see in other markets, too. Overall, a history of a stable and growing economic environment has made the housing market rather reliable.(Source: FRED – Federal Reserve Bank of St. Louis )

As we move into the fourth quarter of 2020, experts say now is the time to buy in OKC as competition cools and the market remains relatively affordable.

Influential Factors

Land AvailabilityOne of OKC’s biggest advantages over other real estate markets is land availability. Although new home construction has similarly lagged in Oklahoma, there’s much more available room for construction. In some markets, demand seems impossible to meet by traditional means because there’s just not any land left. We can see in OKC’s population density and wide sprawl that there is, in fact, room to expand.

We see that reflected in the fact that new home starts hit 665 in OKC in July 2020 – the highest number since 2013. The market is just in a better position to meet swelling pandemic-era housing demand.

Cost of LivingThe low cost of living in OKC is a major incentive for new population growth and investors alike. Because the market is relatively affordable for OKC residents, there’s increased housing stability across the board. This is valuable for retaining residents, both renters and homeowners, for the long haul. Oklahoma City doesn’t just have flash-in-the-pan pandemic allure. It has a history of stability and economic opportunity fueling market growth.

The OKC Rental Market

What about the Oklahoma City rental market? To put it succinctly, there are shortages across the board. Not only has the buying market been squeezed for inventory, but both single-family rental properties and apartment units have experienced plummeting availability.

Perhaps unsurprisingly, rental rates in Oklahoma City have grown by 32% since 2010. Like many areas, OKC has struggled to provide truly affordable, low-income housing options. Despite that, relative rent and property prices are lower here than in much of the country. Though renters only make up a 44% share of residents (the rest being homeowners), demand for rental units has only increased over the past decade and especially throughout the pandemic.

OKC Real Estate for Investors

Finding the right investment markets to build your portfolio can be an exercise in frustration, particularly in today’s volatile and unpredictable housing market. Oklahoma City offers a long history of stable growth across the board, from population and income growth to real estate development and reasonable prices.

The relative affordability to be found in the market makes it highly accessible to real estate investors, while a shortage of viable rental units presents an opportunity for investors to fill in the gaps. Although homebuilding efforts are in a better position here than in much of the country, the demand for properties – both for buying and renting – is unlikely to go anywhere as Oklahoma City facilitates an attractive environment for young professionals and families alike.

Don’t overlook this market. Despite some of its challenges, Oklahoma City is in the position to provide long-term rewards for investors – amid the pandemic and beyond!

Don’t miss out on one of the best investment markets on the map. Talk about OKC investment opportunities with your portfolio advisor today!