The Lone Star State is at the epicenter of real estate investor interest. Houston — along with Dallas, Austin, and Ft. Worth — has been a major economic and investment hub for over a decade.

The Lone Star State is at the epicenter of real estate investor interest. Houston — along with Dallas, Austin, and Ft. Worth — has been a major economic and investment hub for over a decade.

Before you decide to invest in Houston, Texas, get the facts. Here’s everything you need to know about Houston’s performance and investing potential.

An Overview of Houston, Texas

They say that everything’s bigger in Texas, and when it comes to Houston, they’re right. Houston spans an impressive 637.4 square miles, (10,062 sq mi for the whole metropolitan area) making it the largest U.S. city by total area. This is the number one city in Texas in terms of population and the fourth most populous in the whole United States.

The city proper has a population of 2,316,797 (2020) while the Houston metropolitan area boasts over near 7 million residents — only behind Chicago, Los Angeles, and New York City.

Founded in 1836, Houston quickly grew as a trading hub throughout the 19th century. Then, with the advent of railroads and bustling port activity in the 20th century, Houston saw explosive growth. This was especially true with the turn-of-the-century Texas Oil Boom.

While oil and energy still play a key role in the Houston economy, the city's cultivation of economic diversity has resulted in one of strongest economies of the modern age.

Make no mistake — Houston is a power player both in terms of economic fortitude and real estate investment opportunity.

Decade-Defining Traits of the Houston Market

Growing Population

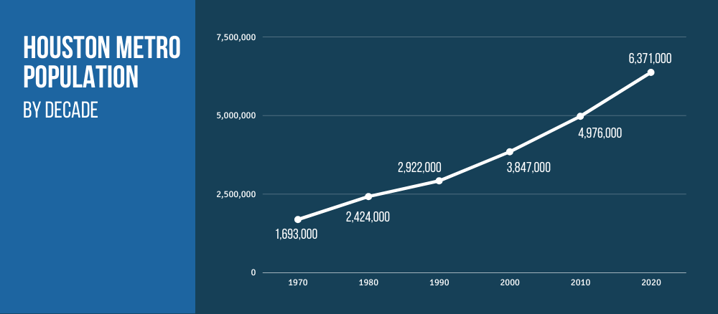

A growing population is a sign of a healthy, growing economy. It bodes well not only for jobs and industry but for real estate demand. When we track Houston’s population by decade, we see a clear and unyielding pattern of growth.

While the rate of growth has slowed from time to time, the historical records show that Houston has not had a population loss year-over-year since 1950.

So much of what promoted this rapid growth — particularly in the last decade or so — was Houston’s economic strength.

With a median age in the early 30s, Houston is a hub for young professionals and entrepreneurs looking to benefit from a vibrant job market and a more reasonable cost of living.

Unshakeable Economy

There have been several occasions in the past decade alone that had experts wondering whether or not Houston’s hot streak was finally coming to an end. What has become clear, however, is that you don’t mess with Texas — especially their economy.

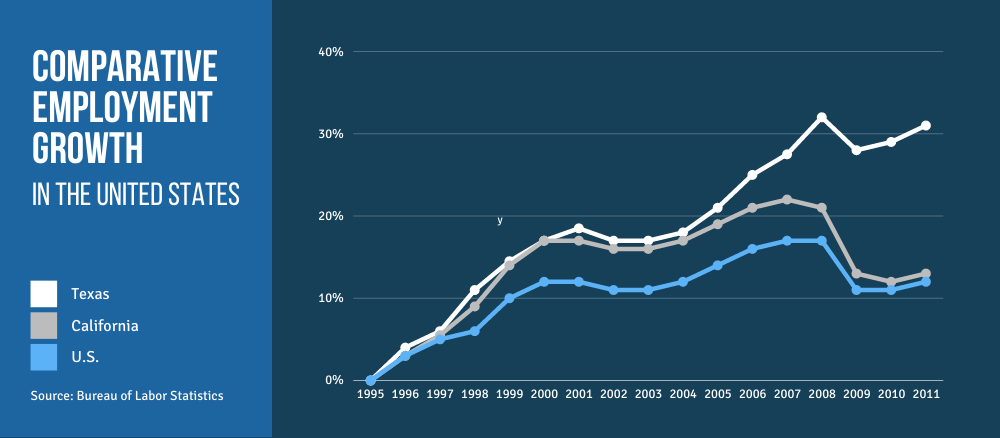

In 2013, experts reported that Texas boasted a job growth rate of 31.5% since 1995, compared to the national rate of 12% during the same timeframe.

Part of what has made Houston so strong is its increasingly diverse economy. While the city was largely founded on oil and energy, other major industries help sustain the city during various oil crises.

Houston is known not just for energy, but for advanced manufacturing, healthcare, aerospace and aviation, biotechnology, transportation, logistics, and technology.

That’s not even mentioning that the Houston metro area ranks #4 in the United States for Fortune 500 headquarters.

Even though the per capita income in Houston was just over $32,000 between 2015 and 2019 (with a household median income of $52,388), Forbes ranked Houston as #1 for paycheck worth in 2012. In the wake of the Great Recession, the fact that you got more bang for your buck in Houston led to a surge of industry and population growth, especially in comparison to other struggling U.S. metros at the time.

The Economy of Houston

Major Players

Houston has more than a handful of companies that provide more than 10,000 jobs each. Here are some of Houston’s top employers:

Over 20,000 Employees

- H-E-B

- Houston Methodist

- Memorial Hermann Health System

- UT MD Anderson Cancer Center

- Walmart

10,000 - 19,999 Employees

- ExxonMobil

- Shell Oil Co.

- HCA

- Kroger

- Landry’s

- Schlumberger

- UT Medical Branch Health System

- United Airlines

Other notable players are the University of Houston, Texas Children’s Hospital, JPMorgan Chase, GE Oil and Gas, Chevron, Baylor College of Medicine, and AT&T.

Of course, major employers do not tell the whole story of the Houston economy. Houston is one of only eleven U.S. markets that are home to more than 100,000 small businesses (that is, a business with fewer than 100 employees).

The vast majority of businesses in the Houston metro area are considered small: 119,005 out of 122,517 businesses, to be exact. From there, 73% of Houston small businesses would be called microbusinesses, with no more than 10 employees.

Overall, Houston has a GDP of $512.2 billion — ranking as the seventh among U.S. metros in GDP. If Houston was an independent nation, its GDP would rank just behind Belgium.

Global Trade

Houston has always been a titan of national and global industry. Texas leads the country in global trade, accounting for 16.5% of manufactured exports and 34.9% of non-manufactured exports in 2019. Houston is the highest-ranking export hub in the United States. The 50-mile Port of Houston is one of the busiest in the world and the busiest in the United States in terms of foreign tonnage.

In 2018, the Port of Houston saw over $159 billion in total direct trade value — impacting over 700,000 jobs.

Oil & Energy

Though Houston has greatly diversified its economic base in the past several decades, oil and energy still play a pivotal role. Houston is known as the Energy Capital of the World and is home to over 4,600 energy-related firms. Overall, the city employs a third of U.S. jobs in the industry, and employs the 4th largest concentration of engineers in the country. Houston’s proximity to the Gulf Coast has made all of the difference in the world, as new energy innovations such as hydraulic fracturing and deep-water offshore technology were developed in or are currently concentrated in Houston.

It’s not all about oil, either — although Houston refineries produce 2.6 million barrels of crude oil each day and account for 14.3% of U.S. production.

Houston is also leading the country in renewable energy sources, such as wind and solar power. It is estimated that Houston could power 1.7 million homes each year with solar energy. In addition, there are over 100 solar-related companies in Houston and more than 30 wind companies, representing over 136 active wind projects in Texas.

Historical Performance

If you were to define Houston’s economic philosophy, it is “learn from the past.” As real estate investors, we can look to past performance, crises, and how markets overcame challenges as an indicator of adaptability and future success. And Houston is one of the best examples of an adaptable market.

1980s Oil Crisis

The oil crisis that began in 1982, as Houstonia Magazine reports, almost “destroyed” Houston. At the time, the $35 per barrel price was a new high and, in the minds of many, the new standard. Banks were lending based on this standard. When prices collapsed to under $10 per barrel, Houston institutions were not far behind.

Between 1982 and 1987, Houston lost more than 211,000 jobs. Hundreds of thousands of homes were left vacant. There were 30,000 foreclosures in Harris County alone.

This oil crisis became the one by which other disasters were measured. Overbuilding combined with a newfound unemployment crisis caused real estate to collapse as banks shuttered. While every oil crisis hits the energy industry hard, the 1980s crisis hit the local economy more profoundly than any other.

So what did Houston do in the aftermath? Chron puts it this way:

“The searing experience also provided a lesson that political, business and civic leaders took to heart: The region's economy could not depend so heavily on one industry. Efforts to diversify the local economy got underway, and today, sectors like the large and growing health care industry are tempering the impact of the latest oil bust.”

Houston learned from their mistakes. The city rose up from the ashes of the 1980s oil crisis, learning not to be so dependent on oil and gas, and has diversified in the economy in the years since.

As a result, various oil price drops throughout the past several decades — some more intense than the 1980s drop — have not had consequences so devastating on Houston as a whole. Even if the oil and gas sectors struggle, it’s not the death knell it once was for Space City.

For example, Houston endured the 2015-2016 oil crash, an arguably larger oil bust than in the 80s, without really flinching.

Like real estate investors who mitigate risk through portfolio diversification, so much more of the Houston economy was independent of the oil industry. As a result, the economy was able to stay the course without repeating mistakes — and collapses — of the past.

Great Recession Recovery

Houston led the nation in recovery from the 2008 financial crisis. Some even said that Texas avoided the Great Recession altogether. While this isn’t entirely accurate, it is true that Texas markets — namely Houston — bounced back a lot quicker than other major U.S. cities.

Houston largely avoided the recession because, unlike California and other hard-hit regions, there wasn’t a housing bubble to begin with. Texas real estate is famously affordable, in part due to generous land-use policies. This allowed builders to meet existing demand affordably. In other areas, however, building efforts were more restrictive. This meant that inventory was far more challenged, pushing up prices while subprime lending ran rampant.

With inflated prices plaguing many markets, the housing market had a lot farther to fall when the bubble burst.

Houston largely avoided becoming a speculative market, as speculation (often from "flippers") is driven by a sense of scarcity, not abundance. Houston’s more tempered, even price growth meant that recovery was swift.

Of course, the Great Recession real estate market is not the only piece of the puzzle. In 2009, Forbes reported that:

“Until recently Texas, and particularly Houston, has been one of the last bastions of that great traditional American optimism — and for good reason. Over the past few years, Houston has outperformed every major metropolitan area on virtually every key economic indicator.“

Consequently, Houston has topped many of the lists for recession recovery. Because Texas markets (and Houston in particular) were more economically resilient in times of mass economic collapse, more and more people moved into the market to take advantage of job opportunities and an affordable cost of living.

The “Texas Growth Machine” saw job growth that vastly outpaced other states. In 2013, The Atlantic called Houston “unstoppable” as the nation’s #1 job creator.

When other markets were still struggling to recover their property values, Houston was blowing past pre-Recession peaks.

Overcoming Obstacles

In the years since, different crises and disasters have threatened to slow Houston’s growth.

Hurricane Harvey struck in 2017. Houston lost lives, suffered catastrophic flooding, and took a significant economic (an estimated $16 billion economic loss) and housing hit. At the same time, the city seemed to bounce back from the disaster, picking up its economic momentum where it left off.

As the New York Times reported, Houston lost tens of billions of dollars, but recovery was expected to be quick. And quick it was!

In addition to Hurricane Harvey, Houston has faced multiple busts in the oil industry. While jobs have been lost and a ripple effect impacted many businesses in the region, Houston didn’t flinch — another testament to the strength of a diversified economy.

As recently as 2021, Houston faced a historic ice storm that took 69 lives, saw over 4 million power outages, disrupted supply chains, and racked up an $18 billion price tag. The winter storm took the southern city by surprise. With infrastructure unprepared for the sustained winter weather, everything came to a grinding halt for days. Residents felt the impact for weeks after.

At the same time, experts feel optimistic about the future for Houston — even after the impact of COVID-19 on the economy.

Pandemic Performance

The coronavirus pandemic impacted every market imaginable, and it was no different in Texas. In some regards, it may have been worse.

The unemployment rate in Houston peaked at 14.4% in April 2020 — compared to the national high of 14.8% in the same month. Of course, the national unemployment rate had dropped to 6% in March of 2021 while Houston lagged behind in recovery at 8%.

Throughout 2020, Houston lost more jobs than in the Great Recession and the 80s Oil Crisis combined. The energy and retail trade sectors are expected to continue to lag even as vaccinations increase and the economy reopens. Remember, Houston has a huge number of small and microbusinesses — businesses that were significantly impacted by the pandemic.

At the same time, Houston ranked among the fastest-growing tech hubs throughout the pandemic. While Houston’s local economy took a hit, the city also saw in-migration from residents of more dense metro areas. Seeking sun and space, they came to Houston to take advantage of the cost of living and a better climate.

As with many real estate markets, the pandemic led to increasing housing demand and shrinking inventory.

Houston’s Hot Real Estate Market

A Decade of Growth

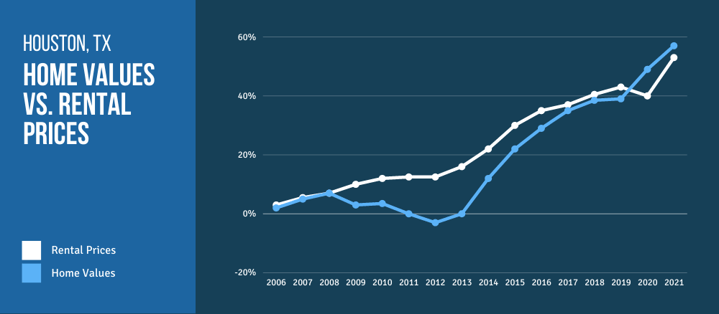

December 2011 closed in Harris County with a $145,000 median home price. In December 2020, that median price was up to $259,990. That’s a 79.3% increase in just under a decade. Obviously, Houston’s Great Recession performance played a significant role in the health and growth of its real estate market over the past decade.

By March 2021, the median home price was already up to $278,865 (a 7.3% increase from the end of 2020).

As a market known for economic opportunity and a low cost of living, it’s not surprising that Houston has remained one of the hottest and most in-demand real estate markets in the nation.

Sales have been steadily increasing — leaving the inventory-strapped market with a measly 1.7 months’ worth of inventory. Prices are up, demand is hot, and that’s been the case for Houston even before the pandemic.

But the winter storm didn’t slow the market’s break-neck pace. Low interest rates have been a driving force in housing demand as in the rest of the country. Houston, however, is seeing homebuyers snatching up properties at a record pace.

Many of these sales have been “move-ups” rather than first-time homebuyers — expected, given the increasing property costs. Tim Surratt, an industry expert, assessed the state of Houston’s real estate market:

"We're dealing with a lot of relocation buyers from New York. Anywhere in the Northeast where they're priced out of the market or they haven't been satisfied with their quality of life there. Of course, California [too] — It's a huge exodus to Texas.”

Quick Statistics

Types of Housing

Houston has a near-even split between the number of single-family homes and apartment complexes — 44% and 44.4%, respectively. Single-family homes are, however, more attractive than apartments, particularly in a post-pandemic world. Reports show that multifamily vacancies grew in 2020 while demand for single-family housing surged.

Age of Housing

New construction is increasingly more expensive than existing inventory. This has been in part due to inflation and in part due to supply chains disrupted by the pandemic. The majority of Houston-area homes were built between 1970 and 1999 (45.5%). This provides greater opportunities for investors to capitalize on established neighborhoods and rehab potential.

Rentals

Houston investors can expect a healthy combination of affordability and appreciation in the rental sector. The Greater Houston area sees 3-bedroom single-family properties renting within a $1,400-$1,700 range. Other areas see rents closer to a $2,000 average.

Overall, Houston rentals have increased by 12% over the past five years. This is a lower rate than we see in Dallas and Austin, which largely has to do with Houston’s relative affordability. It has incentivized many renters to transition into homeownership.

The Greater Houston MSA has a rent-to-income ratio of 28.3% — a perfectly respectable rate. This relative affordability — both in terms of housing costs and rental rates — is a significant advantage for real estate investors.

Though demand is high and competition is fierce, the potential for growth, especially in the full context of Houston’s real estate market performance over the years, is high.

What to Expect in Houston

So what can a real estate investor expect in Houston?

Opportunity — Despite the busy homebuying market, Houston is still predominantly a rental market. The homeownership rate is only 41.7%, while the rentership rate is 58.3%. The pandemic has made it more difficult but more desirable to live in a single-family home. Investors would do well to capitalize on this increased demand.

Competition — Others in the industry are calling Houston’s real estate market “cutthroat.” The wild demand has led to buyers losing the bid even when they’re waiving appraisal rights and bidding tens of thousands of dollars over the asking price. For real estate investors, this presents a challenging, if exciting, environment.

The Bottom Line

If you’re going after property in Houston, stick to your guns. Investors needn’t compromise on essential risk mitigation, like appraisals and inspections, or change their price-to-income ratios, to win the bid. It may take longer, but you will have a better, more sound investment in the end.

Of course, we recommend to capitalizing on opportunities available through turnkey investing. REI Nation has long operated in the Houston area. We’re experts in acquiring ideal investment properties and passing opportunities for ownership along to our investors — without the hassle, without the bidding wars, without the headache.

There are no signs of competition slowing down in Houston, Texas. A booming real estate market is thrilling and, while the economy may have a while yet to recover, Houston has proven time and time again its tenacity in the face of adversity.

They learn from the past. Real estate investors should, too.

.png)