When you ask someone about hot, happening real estate markets, there are a few places that come to mind right off the bat: New York City. San Diego. Los Angeles. East coast and west coast. Real estate investors imagine having their hands in such prestigious real estate markets with beach side properties and high-end apartment lofts in the middle of the country’s biggest, most bustling cities.

For the investors that get there and love it: great! But there are hidden gems among the many lauded real estate markets: they’re not just promising, they’re already booming. Opportunities for investors of all types abound, from turnkey investments and single-family homes to commercial real estate and high-demand apartments in the middle of a metropolitan downtown.

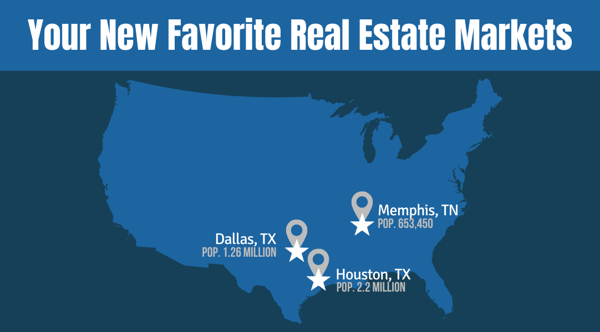

So instead of looking east and west, we’re setting our sights somewhere in the middle: Houston real estate, Dallas real estate and Memphis real estate. A close look at the market conditions, trends and contributing factors to the health of their local housing markets reveals these three to be not only great candidates for real estate investing, but models of post-recession recovery.

Introducing Three Great Real Estate Markets

Houston, Texas

Houston is the hottest market in the country, according to a number of leading real estate professionals. During the recession, Houston took a softer blow to their economy largely in thanks to the strength of the oil industry. As a result, the economy had less to recover from and, post-recession, many looked to Houston as a model of recovery and a destination for employment and stability.

This led to rising demand for housing both for homeowners and renters. With mortgage rates bottomed out, home prices began to climb, and they’ve only continued to climb since. Rental prices followed suit, as they did in the rest of the country, and as a result, challenges have emerged for Houston’s real estate.

Construction has not been able to catch up with demand, and in combination with a tight inventory, many homeowners are being priced out of the market. The question many have is whether or not Houston’s current pace will cause it to collapse on itself, given enough time without balancing back out. So far, Houston has weathered the bumps in the road and exceeded expectations for sales and growth.

Dallas, Texas

Dallas faces some of the same challenges that Houston does. Though even less dependent on the oil industry, it certainly still plays a role in the local economy. Like Houston, Dallas took a softer blow from aftermath of the latest recession and housing bubble disaster. Right now, they’re experiencing high job growth, a revitalized downtown, and the fastest growing home prices in the country.

Tight inventory on top of relentless demand has unfortunately caused many home buyers to be priced out of the market (again, like Houston). Demand is high across the board, but the demand for affordable properties is even higher. Apartments in particular are in high demand in the face of such a fierce housing market.

Memphis, TN

Memphis tends to be the underdog of the three cities we’re investigating. Both Houston and Dallas have national attention for their real estate markets, but Memphis is usually overlooked.

While it’s true that Memphis isn’t quite in the same league as other metropolitan hubs in terms of size, it’s certainly not to be overlooked. Memphis is a cultural hub in the South, hosting great barbecue, legendary music and, you guessed it, a very promising real estate market with a 4% year-to-date increase in home sales. Homes that, once again, remain affordable with moderate price increases so far in 2015.

Now that we’ve given an overview of these three markets, it’s time to really get down to the nitty gritty. In order to give as comprehensive view of these real estate markets as possible, we’re looking at a variety of factors: home sales and prices, inventory and construction projects, rental statistics, job market data, and predictions for the future.

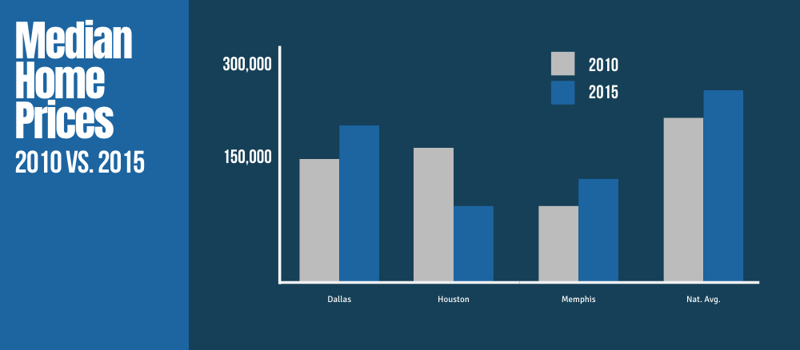

The Forces Behind Area Home Prices

To understand the relevance of median home prices today as a measure for market health, recovery and growth, it’s important to keep in mind the effects of the 2007-2009 U.S. recession. In 2008, home values began to drop, and continued to do so nationwide for the next several years. For the purposes of our data, we sampled 2010 median home prices, coming at the tail end of the full-blown recession and a few years into the drop in home values.

Houston has a median price increase of $65,000, Dallas had a $73,000 increase and Memphis’ $32,000 increase was just under the national average of $41,000 between 2010 and 2015.

Houston has a median price increase of $65,000, Dallas had a $73,000 increase and Memphis’ $32,000 increase was just under the national average of $41,000 between 2010 and 2015.

In addition, despite the fact that nationwide home values were on the decline through 2012, values in the Dallas and Houston metropolitan areas actually increased according to the U.S. Census Bureau.

Estimated median property value (in current dollars)

|

2007 — 2009 |

2010 — 2012 |

|

|

United States Average |

$191,900 |

$174,600 ↓ |

|

Houston-Sugar Land-Baytown, TX Metro Area |

$148,100 |

$149,200 ↑ |

|

Dallas-Fort Worth-Arlington, TX Metro Area |

$139,400 |

$140,700 ↑ |

|

Memphis, TN-MS-AR Metro Area |

$135,300 |

$134,400 ↓ |

Though Memphis saw a decrease in property values, it was a significantly lower drop than experienced in other parts of the country, at a mere $900. In Jacksonville, FL property values plummeted by $36,800 in the same span. Values in Los Angeles dropped by nearly $125,000. Other parts of Florida and California experienced similarly large drops.

These coveted parts of the United States seemed to be on shaky ground...so why were things going so much better in Houston and Dallas? Why was the drop in home value so small in Memphis?

Driving Home Prices Forward

Taking Inventory

One of the biggest contributing factors to the rise in home prices, particularly for Dallas and Houston, is the issue of inventory. It’s a seller’s market and competition for properties is fierce. Inventory is tight and construction has yet to provide any relief despite Houston’s having more new home starts than the entire state of California in 2013.

Houston has the strongest growth in construction than any other market, but it still hasn’t been enough to keep pace with demand. A shortage of labor and quality lots is still hindering optimization in construction.

Houston only has an inventory of 3.4 months currently in 2015 — and improvement above last year’s 3 months, but still far less than the national 5-month average. Dallas is facing a similar problem: just earlier this year, they faced a meager 2.1 month’s worth of inventory. One housing analyst described Dallas’ inventory as the lowest he’s seen in his entire career. As long as demand is high and job growth strong while construction struggles to keep up, that tight inventory isn’t going to expand any time soon.

Memphis is having a similar dilemma in terms of inventory, but construction in Memphis isn’t so much not keeping up as it is slowing down. The lack of suitable lots has led builders to file fewer permits over the past few years. The shortage of lots has turned some builders into developers, just so they can eventually build again. This lack of suitable space is tightening inventory, which has contributed to a more tempered, modest rise in prices.

For the most part, Memphis has seen fairly consistent numbers in inventory — only fluctuating gradually for the past two years in a predictable pattern, with inventory dropping to low points in January and picking back up in April.

Across all three cities, demand is on the rise largely in thanks to jobs, which are attracting young professionals. Some have worried that the rapid growth of home prices would hit a point where it started to deter home-buyers. The numbers tell a different story.

Home Sales Show No Signs of Stopping

Like a runaway train, the housing markets in Dallas and Houston have no shortage of momentum. Even the factors that some predicted would slow them down (the various dips and crashes in the oil industry) haven’t cause disaster or really hindered the real estate market in any discernible way.

Houston

The summer home buying season did not disappoint in Houston. Home sales topped in Houston in June, not only for the year, or even since the recession, but in the entire history of sales recorded in a single month by the Houston Association of Realtors at 7,935 single-family home sales.

What did Houston do? It turned around and topped themselves in July with 8,147 single-family home sales. In July, homes priced under $150,000 saw a drop in sales, while properties priced above $150,000 increased in sales by as much as 18%.

If we track home sales over the past few years in Houston, we see steadily increasing gains. Scott David of Metrostudy reports that, “Houston’s resale market closed on 83,224 single-family homes from Mar 2014 through Mar 2015…[representing] the second largest volume of resale closings since we’ve been compiling the statistics back to 1990...”

Year-over-year, home sales have steadily increased through the years along with economic recovery.

Dallas

Despite Dallas doubling the national rate in home price increases in June at 8.2%, the city, like Houston, only continued to make more sales this summer. July saw a record-breaking 7,038 homes sold. Experts point to a steadily decreasing unemployment rate as one of the contributing factors in the gains in value and sales. Of course, the sales for new homes lagging behind, largely due to obstacles in construction. The construction sector is having considerable difficulty keeping inventory in line with demand as the job market attracts more and more people to the area.

Because of this, home sales would no doubt be even more if there was more inventory to go around. As it is, some areas of the city have a meager 1.5 months worth of inventory. Supply, particularly at lower, more reasonable price points, has been a hurdle for Dallas. Inventory continues to sit at or near record lows.

Because of this, experts expect that the Dallas housing market will continue to be under pressure until something changes.

Memphis

In some regards, Memphis is acting like a smaller-scale, much calmer cousin to Houston and Dallas. Still, some of the same positive trends are happening in regards to home sales. In July of this year, there were 1,695 total home sales, up 12.6% from July of 2014. Similarly to Dallas and Houston, however, new home sales were considerably lower than existing home sales.

Memphis’ suitable lot problem and general lack of new inventory means that only 44 of those sales were newly constructed homes...down 53% from last July.

Still, sales overall were strong while home prices also increased modestly. The issue of inventory still bears watching, but the data doesn’t show cause for alarm.

What About Renting?

Across the United States, the number of households renting has been on a constant increase. For real estate investors, there are plenty of opportunities countrywide to invest in promising, growing markets. Not only are the number of people renting going up, but demand is also driving the price of renting up nationwide.

Of course, the issue with that currently is that rental prices are surging past that of wage growth, making even renting, which is usually presented as the prime alternative to home ownership due to lack of a down payment, unaffordable for many. While many millennials are interested in eventually buying a home, the spike in home prices combined with underemployment and the burden of student debt, has lead many renting for years after they would’ve liked to buy a home. The rise in rental prices is only making saving for a down payment that much more difficult.

In Houston, just over half of the population is made up of renters: 54.1%. Dallas is made up of 56.7% renters. Nationwide, 36% of residents are renters.

In Houston, apartment rental prices have spiked by over 20% in the past six months: averaging in at $1752 in May of 2015. Dallas comes just under at $1512.

Rental prices in Memphis are still agreeable despite sharp spikes in the rest of the country: they make up, on average, 21% of the occupant’s income. In May 2015, the average apartment price was $798. 21% is still a dash higher than current mortgage payments, but not at the 30% or more that constitutes a high rent burden.

With Price Hikes, Why Do People Still Rent?

Honestly, it comes down to a single reason: they don’t have much of a choice. Some people do choose to continue to rent, and enjoy renting, but the vast majority of renters do will have dreams of home ownership. On a basic level, a lot of renters simply don’t have the money they need for a down payment on a home.

A significant chunk of renters are millennials—today’s recent grads and thirty-somethings—and they’re facing considerable barriers to home ownership on the whole. The average student debt is $30,000. Unemployment hangs around 6% for millennials. Underemployment is a whopping 50%. There simply isn’t enough leftover for millennials between loan, credit card, and housing payments, to save up for a home. Some are even have to cut down on health care to afford rent.

Many believe that the lack of millennial home buyers is one of the major contributing factors to how slow the recovery of housing markets nationwide has been.

Right now in Dallas, it’s actually cheaper to buy than it is to rent, but millennials are increasingly balking at home ownership. Some are coming to the city for jobs and haven’t built up their equity yet, while others are single and don’t want to settle down and be tied to a home until they’re married and thinking about starting families.

While some worry that the declining rate of home ownership in Dallas is at odds with market recovery, in this case, it may be indicative of it. Apartment construction is at the highest it’s been in 30 years in Dallas with 35,000 apartments. Demand is there and it’s not slowing down.

Young people are flocking to the city for job opportunities. The number of people renting versus owning really isn’t a cut-and-dried meter for the health of a real estate market in this day and age. Hundreds of factor converge for the full picture.

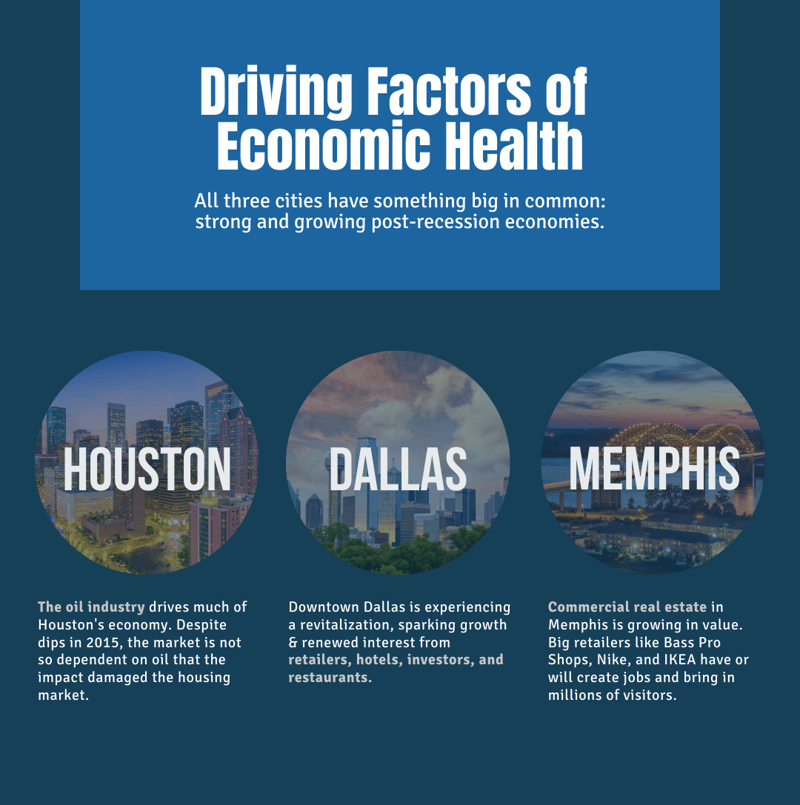

We’ve already touched a bit on the positive economic outlook in all three markets that has contributed to local market recovery and housing market strength, but there’s still a bit more in the details.

Housing Markets & Local Economy

Factoring in Unemployment

To put it simply, Dallas and Houston were simply ahead of the economic game when the recession began. They lost less and had a smaller distance to go to recovery.

Between 2014 and 2015, both Tennessee and Texas saw their unemployment rates drop (0.9 for Tennessee and 0.8 for Texas). Texas currently sits at a 4.2% unemployment rate while Tennessee’s sits at 5.7%.

In 2007, the unemployment rate in Texas was at 4.3%. It spiked up to 8.1% by 2010, while the national average was 9.6%. Some states had unemployment rates as high as 12% (Michigan and California) and 13% (Nevada) in 2010, according to the Bureau of Labor Statistics.

While not the lowest in the country, Texas and Tennessee both sat in the middle of unemployment rates and, today, have nearly returned to those pre-recession rates.

Business Brings People, People Bring Demand

One of the biggest draws to Houston and Dallas remains jobs. The same can be said for Memphis, which, as we’ve mentioned, is becoming a hotbed of activity for young millennials and the tech industry, in addition to their booming retail industry. Houston and Dallas are highly influenced by the energy industry (namely oil) and as a result, had an economic leg up on many other markets across the country.

As a result, more people started moving in.

In 2014, employment in Houston was considerably higher than the national averages in nearly every industry. That same year, CEO Magazine crowned Texas the best state for business, judged on “progressive business development programs,” low taxes and overall quality of living. Tennessee ranked number 4 in the same list.

The magazine noted that Texas saw 1.2 million net jobs created since the beginning of the recession in 2007 to 2014, while the rest of the states combined created 700,000. Tennessee earned its spot as not only by its productive manufacturing sector, but through low taxes, a lack of state income taxes and a well-educated workforce.

In Dallas, the increase of hiring, particularly for full-time jobs, had people flocking to the city in the years after the recession. In 2014, it was a 40% jump in the number of full-time hires. Businesses and consumers alike began to feel more confident as the local economy improved, which drew in workers and upped housing demand. When demand goes up, so do prices. The Dallas Fort-Worth area has regularly topped the charts for job growth in the past few years.

Meanwhile, Houston, if it were a nation on its own, it would rank 30th in size in the global economy. As one of the largest metropolitan areas in the country, a lot of eyes have been on Houston. Like Dallas, Houston has a go-to job market. Between 2007 and 2012, there was a 16% increase of college graduates coming to live in Houston: a 185,012 gain in the population. The city consistently tops lists for ‘best places’ for college graduates, particularly for job and wage opportunities. Even back in 2013, Houston had one of the highest rates of job growth in the nation at 3.8%.

Memphis, though on a much smaller scale than Houston and Dallas, has experienced similar patterns: an environment that attracts young professionals and strong industries, particularly in manufacturing, technology and retail. Just this year, Memphis was named as one of the best cities for millennials by Cushman and Wakefield: citing the superb balance of work/play/life as one of the biggest perks to the city. Memphis, unlike Houston and Dallas, remains extremely affordable for most. On top of that, high-tech entrepreneurship is growing, along with the presence of large retailers.

Just this year, the largest Bass Pro Shop in the country opened in the Memphis Pyramid, Nike expanded their Memphis distribution center by 2.8 million square feet, making it the largest Nike facility in the world. Swedish retail giant IKEA, after rumors of a store coming to Memphis, finally applied for a formal $16 million building permit. In general, commercial real estate in Memphis is doing very well, experiencing high demand and low vacancy rates.

With these factors in mind, it’s no surprise that Houston and Dallas both have seen such a spike in home prices. Jobs alone, however, don’t drive prices up by themselves.

Oil: The Elephant in the Room

One of the biggest concerns about real estate (and economy in general) in Texas has everything to do with oil. Texas has long been closely tied to the energy industry. So when oil prices dipped earlier in 2015, dropping gas prices nationwide and resulting in energy industry layoffs in both Houston and Dallas, some experts worried that Texas’ economic fortune was at an end. The fears weren’t unfounded, but both Houston and Dallas seem to have transcended the effects of dropping oil prices.

The first significant drop didn’t slow down home sales in any real way, and any slowdown might have actually relieved the skyrocketing home prices and allowed construction to catch up a little. Since that first dip, more has happened here and there, but the market remains seemingly ironclad. With so many people concerned about the effect of oil prices on the economy in Houston and Dallas, why didn’t it leave as big of a footprint?

Let’s look at Houston:

Historically, Houston was rocked in the 1980s by an oil price nosedive. Values dropped by 67% in only four months. It resulted in failing banks, foreclosures, emptied malls, and other dramatic and crippling effects on Houston’s economy. Tax revenue bottomed out, resulting in the firing of sanitation workers that lead to a strike against trash pick-up. It was a complete disaster.

So it’s not a big surprise that a lot of people were concerned about the drop this year. So why didn’t the market flinch with this year’s 59% price drop?

Easy: Houston’s economy as a whole is not so tied to oil and energy as it used to be. Back in the 80’s, 87% of base-employment jobs were in the oil and gas industry. Today, it’s less than half: after the crash, new businesses in other industries popped up and diversified the economy enough to prevent everything from hinging on oil.

As such, the unemployment rate has remained low rather than all over the place as it was in the 80’s.

So while we can’t say that oil prices don’t or won’t affect Houston and Dallas, both markets have clearly demonstrated their tenacity and they don’t keep all of their economic eggs in one basket.

Models of Recovery & Exciting Investment Opportunities

As we’ve hopefully demonstrated, the success of the Dallas, Houston and Memphis real estate markets are rooted in a combination of factors. While we don’t like to speculate on the future, we can point to trends and make inferences on the trajectory of these markets. At the end of the day, we know that demand is high, values are on the upswing, and the opportunities for investors to get involved are endless.

Even if you’re not keen on throwing elbows for a slice of these great markets, know that there are options still available to investors: namely in turnkey real estate investment. We here at Memphis Invest work in all three markets and cut out the need for you to get caught up in bidding wars over hot properties.

Let us invest in your success – check out our Turnkey Guide!

*This report, all data and graphics are Copyrighted by Memphis Invest, GP. Any use of this information is allowed with proper citation.