The real estate market moves in cycles. We come to expect the natural ebb and flow of the real estate market. There will be both times when profit is easy and other times when it becomes more of a challenge. Though buy-and-hold real estate investors are less impacted by the real estate cycle (as their investments are designed to serve in one’s portfolio for decades), it makes selecting the right markets and the right investment properties no less important.

The real estate market moves in cycles. We come to expect the natural ebb and flow of the real estate market. There will be both times when profit is easy and other times when it becomes more of a challenge. Though buy-and-hold real estate investors are less impacted by the real estate cycle (as their investments are designed to serve in one’s portfolio for decades), it makes selecting the right markets and the right investment properties no less important.

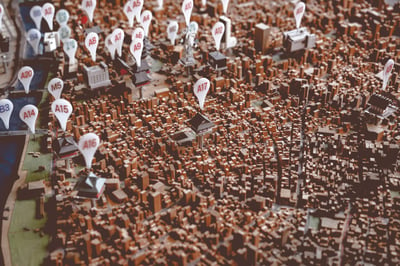

Looking at Business Insider’s list of 13 places where you probably shouldn’t buy real estate anytime soon, we see a distinct pattern emerging. Many of the entries on the list are California markets, in New York City, Florida, and other top markets. In several of these markets, median home prices are above a million dollars — some multi-million.

While not all of these markets are “primary,” many are or are at least adjacent to a primary market (such as being in the suburbs). Primary markets tend to be attractive due to their high home values, vast populations, and real estate demand.

Secondary markets, however, offer more in the way of long-term stability for real estate investors.

Classifying Real Estate Markets

Before we discuss the benefits of investing in secondary (and even tertiary) real estate markets, we need to define our terms. It’s important to note that the definitions of particular markets vary expert by expert. As a general consensus, there are primary, gateway, secondary, and tertiary markets. While some try to fit these into categories based on population alone, it is far more accurate to aggregate information such as population growth, economic growth, occupancy rates, real estate availability, and more.

In simple terms, primary markets are large, “hot,” markets such as New York City and San Francisco. Some would say that a population of over 5 million qualifies it as a primary market. We can assume then, that secondary and tertiary markets are a bit smaller in scale.

A gateway market is typically understood to be a coastal city (or a city with a high level of international trade and access). It can also be understood that these gateway cities have a highly diversified economy. Cities like Dallas, Houston, and Austin would qualify as gateway cities despite not being coastal.

With that in mind, why are secondary markets and gateway markets so important? Why are primary markets just not worth your time?

3 Reasons Secondary Markets Make Ideal Investments

Home Values Don’t Yo-Yo

As Business Insider points out, the markets you don’t want to invest in are those that are cooling considerably or have a tendency to fluctuate wildly. With home values dipping in some major real estate markets and their surrounding areas, it’s important to consider how home values shift over time. A real estate investor, regardless of strategy, looks to growth and stability in their property values. Where flippers will try to jump into markets at their peak, passive investors look for stability and, in turn, the promise of growth.

In markets where values sharply drop or rapidly fluctuate, there is a lot more risk to consider. The last thing an investor wants is to be underwater.

Secondary markets are simply less volatile — making them the better choice as markets fluctuate. Just look at the Great Recession! It was secondary markets that weathered the storm effectively, while over-inflated primary markets took the biggest hits.

Be sure to check out: The Housing Market Now VS the Great Recession

Overall Market Cost

In secondary and tertiary markets, it is only natural that home values are lower. The market may not be as populous as a primary market, but that comes with several advantages, the primary of which is the cost of living. While a turnkey real estate investor isn’t living in the market themselves, they can benefit from lower costs of maintenance and lower-priced properties. This allows investors to better diversify their portfolios and save money.

Net Migration

Since the Great Recession, we have seen a profound shift in migration patterns. For both millennials and seniors, migration patterns have slowed in general. This is reflective of stagnant wage growth and debt crises combined with expensive markets. What we’ve seen is a net out-migration from some large and expensive primary markets in favor of secondary markets like Charlotte, Houston, Austin, and Dallas.

There were losses in cities like NYC, Chicago, Los Angeles, and San Diego.

For real estate investors, population growth is one of the contributing factors to rental demand and value. Minding the in and out-migration patterns of a market are key in understanding your opportunities as an investor.

With increased accessibility, stability, and affordability, it is no wonder that secondary and tertiary markets are popular among buy-and-hold investors.

Invest in some of the nation’s top markets for passive investors with Memphis Invest.