Learn how to get started investing in passive, turnkey real estate investments today with the Top Turnkey Real Estate provider. Click Here To Download A Free E-Book Detailing Your Steps To A Successful Portfolio!

How to Lend Private Money In Real Estate Successfully

Increasingly, real estate investors are looking for alternative ways to invest their money in the real estate investing game. Portfolios are diversifying, new methods of investing are taking center stage, and it always seems like there’s something new shaking up the market.

Investing is always changing: but how we fund our investments has mostly stayed the same. While crowd funding is certainly the new kid on the block, there have been three primary methods for putting down those first payments:

There are plenty of perks to turning to private money lending, both as a borrower or lender: but there are also pitfalls on both sides. We’re going to look at both.

Why Turn to Private Lending?

All real estate investors who rely on private money lending have different reasons for preferring it over bank loans. Some enter as borrowers looking for alternatives after loss of bank trust, or lack of mortgage approval. Lenders often do so as another method of passive income in addition to their own investment projects.

Still, the perks boil down to one on either side:

For Borrowers: Speed

Private money lending is an all-around less complicated, quicker process than obtaining a formal bank loan. Investors can usually receive their private loan in a matter of days! Not only that, but these loans don’t hinge on the investor’s credit rating, making it an avenue to circumvent the effects of a less-than desirable credit rating or other difficulties in obtaining a loan by traditional means.

For Lenders: Profitability

Because private loans are short term (usually lasting no more than 2 years), lenders benefit from a maximized interest rate (around 10%) and faster repayment. It can be an excellent strategy for passive income in additional to your own, more involved real estate investments. You’re just making investment possible for someone else, and both parties reap a profit and grow wealth.

Who are Ideal Private Money Lenders?

Of course, not all lenders and borrowers are created equal. The best private money lenders are the ones that trust you and have access to a lot of capital. But building up these relationships if you don’t already have them established can be a long, challenging process.

Typically, investors have three pools of lenders to target:

- Primary — Friends and family

- Secondary — Associates of friends and family

- Third Party — Accredited investors, networking connections, strangers, etc.

The trade off is usually a balancing act between ease-of-access and convincing someone to lend (higher in the primary circle) and access to capital and increased investment know-how (higher in the third party circle). Who investors choose to target for private money lending is dependent on personal circumstance and preference.

Here’s more on the “circles” of private money lenders.

The most important part of any private money lending deal is keeping your word. While it’s not like a bank loan where your credit is on the line, your personal reputation certainly is.

Lenders Beware

Remember that if you enter the market as a private money lender, there are dangers out there. Search “real estate investment scams” in the news sections and hundreds of articles will come back with stories of scammers promising returns if investors fork over hefty sums to get started. Some turn around and use that money to feed gambling habits while others start a cycle of fraud and theft that never seems to end.

as a private money lender, there are dangers out there. Search “real estate investment scams” in the news sections and hundreds of articles will come back with stories of scammers promising returns if investors fork over hefty sums to get started. Some turn around and use that money to feed gambling habits while others start a cycle of fraud and theft that never seems to end.

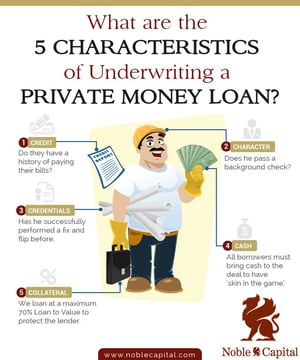

I found this fantastic infographic from Noble Capital that illustrates 5 good steps to follow when underwriting a private loan.

There is no shortage of fraudulent borrowers out there. While acting as a private money lender can be enormously profitable as passive income, it has high risk. When lending, always make sure you trust the borrower not only as a person, but as a real estate professional. Don’t lend to people you suspect will misuse your money of bungle the deal. Trust your gut.

Memphis Invest, GP has been working with private lenders within our own network for the better part of 12 years and have heard horror stories of the exploits of our lenders' other borrowers. It is far easier to find one good person to lend with and build a lasting relationship, than to try and build a network and constantly look for a borrower willing to pay higher returns. With those returns come higher risk and that is always the biggest hurdle for private lenders.

While not every private money lending deal will end ideally, steering clear of outlandish promises and borrowers without a verified track record of success will certainly mitigate your risk. Scammers can be crafty in creating their fronts, so be sure that you do your research before writing that check.

Have you utilized private money lending as part of your investments? Share your experience in the comments.