The trajectory of the real estate market has been a subject of debate over the past year. Investors, realtors, and other experts are always trying to predict what’s next; however, the new realities introduced by the COVID-19 pandemic make predicting that much more challenging.

The trajectory of the real estate market has been a subject of debate over the past year. Investors, realtors, and other experts are always trying to predict what’s next; however, the new realities introduced by the COVID-19 pandemic make predicting that much more challenging.

There is encouraging news for the future. Not only have half of all U.S. adults received at least one COVID vaccination shot, but the housing market is finally being wrangled in by increasing inventory.

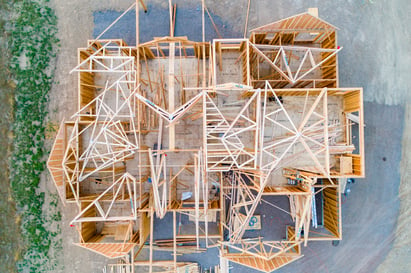

On the other hand, as we’ve discussed before on our blog, the housing shortage was exacerbated by COVID-19 market issues. Not only did sellers pull their listings from the market, but disruptions in the construction sector — from labor to supply chains — caused new home construction to lag.

Even though the construction sector is largely back in action, rapidly increasing costs of construction materials are being passed on to the homebuyer. When you combine that with price hikes due to the imbalance of supply and demand, we see a market that, overall, is quickly becoming unaffordable for many, many Americans.

Even though we are most certainly in the midst of overheating markets nationwide, we don’t report on the state of the market to fan the flames of fear.

For real estate investors, staying informed on the state of the real estate market brings us to better, more thoughtful decision-making and evaluation.

Inventory is Beginning to Recover

Housingwire points to some encouraging statistics that may ease the temperature of the U.S. real estate market. They highlight a Census Bureau report that demonstrates a 15.3% monthly increase of new single-family housing starts between February and March.

February was challenging, in part due to the particularly severe winter storm that crippled large portions of the U.S. South for extended periods of time. However, March has brought warmer, more favorable weather all around. Well, if not favorable, at least the kind of weather that our cities are used to!

Reports say that the homebuilding pace is the highest since 2006 — before the Great Recession. With the end of the COVID-19 pandemic insight along with these increased homebuilding efforts, what can real estate investors expect from the market?

And, more importantly... what fears can we help lay to rest?

When Supply Starts to Meet Demand, Expect:

Price Growth Stability

Over the past year, prices have risen rapidly in most real estate markets, especially for suburban single-family homes. While this is good news for sellers and property owners, it has made buying a home an uphill climb for many. Even rock-bottom interest rates were not enough to make purchasing possible for many hopeful homeowners.

The biggest relief that will come from increasing housing supply is stability in property prices. That is, as supply increases, we will see a return to a more realistic and balanced market. Home listings and sales prices will more closely reflect the true value of properties.

We can be tempted into believing that red-hot markets provide the best opportunities. And, for some investors, they do. However, our bread-and-butter investments are those that demonstrate long-term stability over short seasons of extreme demand and price growth.

Decreased Market Competition

It’s more challenging for homebuyers and investors to - should they find a good deal - win the bid at all.

Intense market competition has drastically reduced the average property’s time on the market and therefore the ability to negotiate. With a rising trend of all-cash offers and bids well over the list price, house-hunting seems to bring nothing but frustration and buyer’s remorse.

As supply increases, demand will ease. Instances of bidding wars will decrease and buyers will have a little more breathing room to evaluate properties before submitting a bid.

When Supply Starts to Meet Demand, DON’T Expect:

Decreasing Rental Demand

A common fear among buy-and-hold investors is increasing vacancy rates. In the past, a more buyer-friendly real estate market may have resulted in a shrinking pool of potential rental residents. After all, why would people rent if they could buy?

This isn’t the case in the modern real estate market. Many people choose to rent for the sake of convenience, location, and lifestyle. We’re more mobile than ever, and owning a home is no longer a priority for many Americans. It just isn’t viewed as the strong investment it once was. And for good reason — you’re much better off with an investment property than relying on the appreciation of your personal residence.

There are more renting households than ever — 43 million as of 2017 — with nearly 1,000,000 new households added each year between 2010 and 2017. Renting is no longer a cost-related compromise, but a lifestyle that an increasing number of mid and high-range earners are choosing.

In short, investors needn’t worry that a “normal” housing market will hurt their investments.

A Market Crash

Rumors of a market crash have been swirling for years. After all, we’ve been seemingly stuck in the market cycle for nearly a decade. A crash is overdue...right?

Investors don’t need to fear that a stabilizing market will necessarily result in a crash. Demand and supply falling more in sync won’t result in plummeting home values. If anything, we’ll get a clearer picture of the real value of properties.

While prices would ordinarily drop if supply exceeded demand, demand is likely to persist. Between the surge of overdue millennial homebuyers and still-enticing mortgage rates, demand is unlikely to wane that much.

Take advantage of hand-selected turnkey investment properties at REI Nation. No house hunting. No bidding wars. Just investment success!