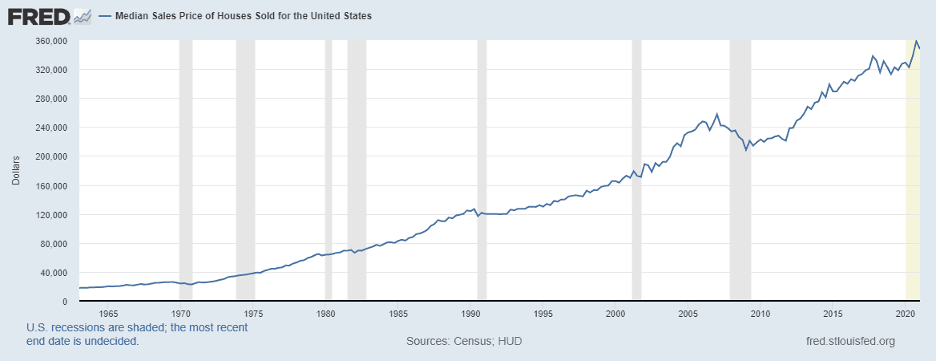

At one time, it was thought that owning a home was a great investment. While this is true in a sense thanks to real estate being a hedge against inflation, your home alone isn’t something to hang your financial hat on. The truth of the matter is more complex: appreciation rates shift based on national, even global, economics, market-specific characteristics, and individual property qualities.

At one time, it was thought that owning a home was a great investment. While this is true in a sense thanks to real estate being a hedge against inflation, your home alone isn’t something to hang your financial hat on. The truth of the matter is more complex: appreciation rates shift based on national, even global, economics, market-specific characteristics, and individual property qualities.

With so many factors potentially impacting what your property is worth, knowing the ins and outs of appreciation – and how to maximize your property values – is essential for any homeowners and certainly for real estate investors.

How Real Estate Appreciation Works

On its own, without any improvements or diligent maintenance, properties are in a natural state of depreciation. Therefore, physical buildings are depreciable assets that you can glean tax benefits from. However, real estate overall actually appreciates in value over time, in part because real estate is attached to land and in part due to outside economic forces, such as inflation.

Appreciation is the increase in value of a property, be it a home or investment, over a period (typically years). This increase in value allows owners to sell the property for a profit or increase their equity (the difference between the property’s value and its mortgage debt). Increased equity is beneficial should you want to refinance the property – particularly for a cash-out refinance.

Calculating real estate appreciation is simple. Multiply the initial cost of the property by a yearly or month-over-month appreciation rate. For example, between Q4 2020 and Q4 2021, the national United States appreciation rate was 17.54%. To calculate a property’s growth in value, then, you would multiply the closing price (or value at the same time the previous year) by 17.54%. For a home purchased for $160,000 in Q4 2020, it would be worth $28,064 more by the next year.

It's important to note, however, that this is not typical for appreciation rates. We’ll get more into that later!

Forced vs. Natural Appreciation

There are two methods of property appreciation: natural and forced. Natural appreciation typically takes years of holding the property for a significant payoff – that is, if you are also on top of maintenance and in a favorable market and location. Natural appreciation is seen most obviously in coastal markets, where even dated properties are selling for ten times their purchase price.

Even derelict properties in some areas of California, for example, can go for millions of dollars not because of the property but because of the land and the high demand for it. However, the average owner shouldn’t rely solely on natural appreciation.

Thankfully, you can also force appreciation by making improvements to your property. Everything from increasing square footage to aesthetic improvements can make a quick difference. Forced appreciation is the strategy employed by flippers – they buy extremely cheap, run-down properties and renovate them with a quick sale and profit in mind.

.jpg?width=650&name=The%20Grind%20graphics%E2%80%94rectangle%20(5).jpg)

Ideally, owners approach appreciation with both methods in mind. They perform intentional and timely renovations (including aesthetic updates) and regular maintenance while intending to hold the property so that it may benefit from natural appreciation. This also gives owners leeway to wait to sell until their equity is maximized and market conditions are best for sellers.

The State of U.S. Property Appreciation Today

The U.S. real estate market has had a few abnormal years largely due to the COVID-19 pandemic and its ripple effects on Americans, their housing preferences, supply chains, and the construction sector. At other times, the average national appreciation rate per year is between 3% and 5%. Over a ten-year period, owners could generally expect between 30 and 50% of added value to their properties.

For a $200,000 home, this would result in $70,000 of added value over a decade on the low end.

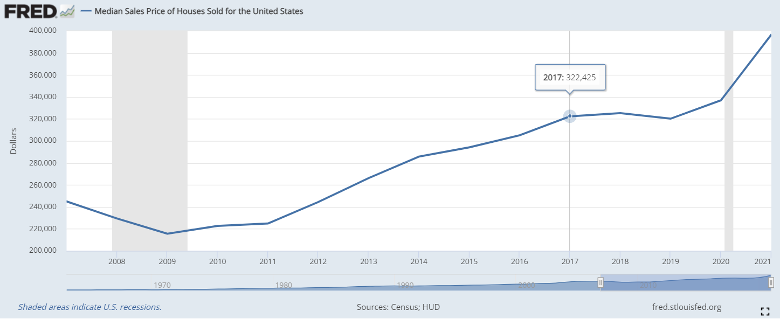

However, that average has not been the case since 2020. While between March 1992 and December 2021 the average YoY appreciation rate was 5.2%, appreciation hit a YoY high of 18.4% in September 2021. Home values skyrocketed throughout 2020 and peaked in 2021 with rates remaining above 15% in 2022.

The point is this: don’t bank on appreciation rates continuing as they have during the COVID era. Typically speaking, appreciation rates keep pace with or exceed inflation rates. High appreciation rates are no surprise, then, as we’ve seen the highest inflation rates in 2021 than in the past thirty years. But again, the current state of affairs is by no means typical.

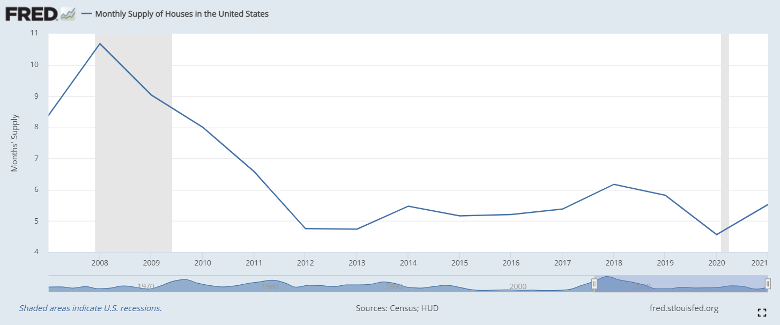

Short Supply Driving Appreciation Rates

One of the primary drivers of skyrocketing home values is short supply. FRED economic data shows that housing inventory dropped dramatically in 2020 (down to a 3.5-month supply). It has not been uncommon for individual properties to sell within their first month on the market.

This short supply happened for a variety of reasons:

- Pandemic fears resulting in active home listings pulled from the market.

- Stalling construction sector and supply chains decreased inventory of new construction.

- Increasing demand due to a wave of migration from densely populated metro areas.

Of course, there has been a persisting issue of short supply after the Great Recession took a toll on the construction sector. Ever since the 2010s, it has been a struggle for inventory to meet demand. The COVID-19 pandemic only exacerbated this problem.

Surging demand and low inventory naturally led to a price surge and a market characterized by bidding wars and lightning-fast home sales.

Annual Month’s Supply of U.S. Houses VS Median Sales Price:

Markets Poised for the Most Appreciation by 2030

As Fortune points out, real estate lives up to its reputation as a hedge against inflation. Where inflation eats away at stocks like the S&P 500, it tends to help real estate values. The problem we’re facing now, though, is an “affordability crunch.” In many ways, we’re waiting to see what the market does when push comes to shove.

With that said, they predict that coastal markets that have suffered throughout the pandemic will experience a resurgence by 2030. Of course, the markets with the most to gain are at the highest risk because, as markets and valuations heat up, so do construction efforts. Ultimately, this can result in oversupply, which can both decrease the rate of appreciation or outright reverse it.

For investors, a more moderate and low-risk market (largely located across the Sunbelt), is the better choice for risk management. While the potential for appreciation may be limited, by comparison, investors can expect steadier, more predictable outcomes. Plus, the Sunbelt greatly benefits from land availability – and land is what largely drives property values more than the properties built on them.

The Advantages of Appreciation for Investors

Real estate investors shouldn’t bank on one factor for building wealth. Cash flow alone or appreciation alone aren’t enough. It’s combined where investors stand to make the greatest gains. Because investing in real estate (through single-family rentals) demands that the properties are kept in good condition, with regular maintenance and periodic updates, appreciation is kept on track. At the same time, investors earn passive income via rent payments.

Together, overall equity grows – as does potential resale value in the future. Appreciation is an essential factor in making sure investing in real estate is a worthwhile endeavor.

Danger: Don’t Overestimate!

One of the big mistakes owners make in the early years of their homeownership is overestimating their rate of appreciation. Rocket Homes points out that those who have owned a property for six years or less are prone to overestimate their home value growth. In fact, those who had owned their home for less than a year overestimated by 150% on average. By contrast, those who have held the property for longer periods – between 7 and 10 years – tend to underestimate it.

In the current market, it’s easy to get an overinflated idea of how much your property may be worth. If you want to be sure, you need an appraiser to assess your real numbers. These misconceptions come about because of the environment in which the properties were purchased – highly competitive with accelerating home values.

If you’re looking to flip or sell, a realistic picture of your property’s real value is critical. In most cases, you’re going to benefit from holding the property for the long term. While now may seem like the best time to sell, your property is likely to gain more value in the years to come than it holds right now. That time will also give you a chance to build equity through the paydown of your mortgage balance (ideally through passive income from rent). That increase in equity on two fronts means maximized profits for you, the seller – or a significant boost in your overall net worth if you continue to hold.

Factors that Influence Property Appreciation & Value

Even if natural appreciation is largely out of our control, knowing what drives fluctuations in property values is key in selecting the right properties in the right markets – those poised for reliable growth.

Market Supply & Demand

Supply and demand is the classic influencer of an asset’s value. We all know how it works: low supply with high demand, prices go up. High supply with low demand, prices go down. While the concept is simple, its real-world application is more complex. Here’s a quick rundown of what we’ve seen in the housing market over the last decade or so:

- A speculative housing market leading up to the Great Recession, combined with cavalier lending, created a foreclosure crisis that flooded the market with inventory. Because the market was in so bad a state, home values dropped and sent many homeowners underwater with their mortgages.

- Real estate investors were largely responsible for restimulating the housing market by buying foreclosed properties. This began to bring recovery to property values.

- The Great Recession caused a large share of construction businesses to shutter or merge. This slowed down new home construction in general.

- Though the real estate market rebounded in terms of value, inventory never caught up to renewed demand in the 2010s.

- 2020 brought the COVID-19 pandemic which further stunted new home construction and reduced overall market inventory.

- Frenzied demand for housing, brought on by shifting COVID priorities, remote work, and historically low interest rates, drove prices up.

- Prices are now beginning to hit a fever pitch and, as the fed raises interest rates, demand is evening out. This allows prices to cool and new construction to catch up to demand.

The danger, of course, is when there’s a sudden and drastic inverse of the supply/demand relationship. As it is now, demand remains stronger but tempered by the high cost of purchasing a home, particularly during a recession and now, inflation.

Supply and demand varies by market. Investors do well to know the historical months’ supply in their investment markets along with price trends.

Let’s take a look at the statistics published by Visual Capitalist that charts twenty years of home price changes throughout the U.S. While it may be most attractive to focus on cities with the highest rates of change (those outpacing the national average), it doesn’t mean that those with lower rates of change are “bad” markets. Not necessarily.

One of the advantages that Texas markets saw after the Great Recession, for example, was a quicker recovery. This was in part because of its strong economy but also due to a more balanced real estate market. The higher you are, the farther you fall. With that said, the region with the slowest price growth was the Rust Belt – states like Ohio, Michigan, Wisconsin, and Illinois.

Location Details

Say it with us: location, location, location!

A property’s value is influenced by its location on both general and very specific levels. Generally, markets with a strong economic backbone combined with growth in population and household income are going to be best for long-term investing. Zooming in, individual features like neighborhood and proximity to amenities (or detriments) can help or hurt property values. For example, a home in a good school district and an established community is likely to appreciate well. The same can be said for properties positioned in an area with development in the works.

However, be aware of features that may be considered unsightly or nuisances to would-be buyers and renters: a junkyard across the street, proximity to train tracks or highways, distance from amenities, and commercial or industrial zone proximity can lower your appreciation potential – not to mention what you may be able to ask for rent.

Another detail not to forget: the size of the lot. When it comes to real estate, the physical property plays second fiddle to the actual acreage you own. Land is where the real value is – particularly so where it is a rare commodity. This is why, for instance, densely packed metropolitan areas fall prey to sky-high real estate prices whereas more sparsely populated areas in the South and Midwest are more reasonably priced.

.jpg?width=650&name=The%20Grind%20graphics%E2%80%94rectangle%20(6).jpg)

Property Improvements

Of course, the property still plays a part in the value of your assets. The good news is that this is something very much within your control. Property improvements, from full renovation work to simple appliance upgrades, along with regular maintenance, make all the difference when you’re looking to sell or rent out a property.

With that said, you’re not necessarily going to get a good ROI from every improvement. Square footage is the biggest money-maker next to upgrades to heating, plumbing, and structural integrity. Some expensive (even necessary) improvements may not get you the value boost you’d hoped: new HVAC, windows, flooring, roof, etc.

Know this: renovations don’t have to be expensive to be effective. While we recommend something durable and quality, that doesn’t necessarily mean paying top dollar. Minor repairs can make all the difference in the world and kitchen and bathroom upgrades are easy wins.

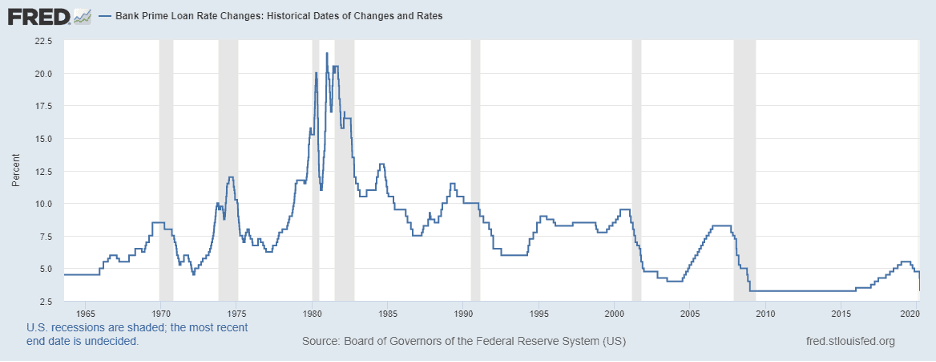

Curbing a Market Crash with Interest Rates

Headlines are finally bringing some relief to worried investors and would-be homebuyers: the market is finally cooling down. Between double-digit appreciation, inflation, and rising interest rates, margins have grown far less forgiving over the past two years.

Interest rates hit their lowest level in at least 30 years in January 2021 with a U.S. 30-year fixed mortgage average of 2.65%. Only in 2022 have rates consistently crested above 3.5% since March 2020. Current U.S. 30-year fixed mortgage averages sit at 5.11%. Historically speaking, this is still quite a low rate (the highest average over the past 30 years was 18.53% in 1981).

The problem is that, due to inflation, homes are more expensive. That means that that 3 or 5% rate significantly impacts interest payments, often adding up to thousands of dollars.

Rising interest rates, however, have been very necessary for curbing the potential for a market crash. Between higher rates, higher prices (and down payment demands), and strict lending standards, the buyer pool has shrunk, thus reducing demand and balancing the market bit by bit.

Historical Interest Rates VS Median Property Sales Prices

How to Force Appreciation Effectively

You want to make the most of your properties here and now. While there are factors outside of your control, there are ways to force appreciation or preserve and boost value over time. Whether you’re flipping or looking to buy-and-hold, you can maximize your home equity and rental income:

- Provide new amenities, services, and optional extra fees (ie. Pet policies) for residents.

- Stay on top of maintenance demands, big and small.

- Make renovations where they count – kitchen, bathrooms, square footage, storage space, etc.

- Install energy-efficient appliances and fixtures.

- Complete interior and exterior renovations to update aesthetics and improve overall property condition.

- Build an addition, finish an attic or basement, or add a deck to increase square footage.

A flipper will benefit only from forced appreciation, while a buy-and-hold investor will benefit from the forced appreciation that leads to natural appreciation.

Working in Tandem with Cash Flow

For investors, of course, we must reiterate that appreciation alone will not win the day. Statistics show that the biggest appreciation benefits kick in when owners hold the property for twenty years or longer. That’s just not typical in today’s market climate for homeowners or investors. While appreciation is always a good thing, it only really builds your wealth in a significant way if you’re also benefitting from passive cash flow.

Rent Payments + Forced Appreciation + Natural Appreciation = Maximized Equity

To be as effective in growing your net worth as possible, you must make calculated, informed decisions on each and every detail of your investment properties: from its market to the smallest of finishing touches on a renovation.

Key Takeaways

To sum up, appreciation trends have been wildly exciting for the past few years. And while the market may be headed towards a cooldown, it will be an overall positive for investors. Reined in appreciation rates mean a more balanced market.

A more balanced market means an easier market to buy in, relieving some of the pressure of the mounting affordability crisis. And for investors, remember this:

- Real estate investment is a long game. The conditions now will not be the conditions of the future and you must prepare accordingly.

- What your properties are worth (now and in the future) comes down to your decisions. Where you invest, what properties you target, the renovations you perform, the quality of consistent maintenance efforts and management, etc. all play a pivotal role. Some things you can control and some you cannot. So control what you can.

- It’s easy to overestimate. When making calculations, be sure you’re working with accurate numbers. It’s better to err on the side of caution by finding the limits of your financial risk and placing investments well under that risk threshold.

Don’t take real estate appreciation for granted. Take the necessary steps to secure and maximize your property’s worth!