Its never too early to start planning for taxes! It may be tax day 2016, but we have a fantastic webinar with Amanda Holbrook, formerly with Memphis Invest and currently a superstar at Specialized IRA services, to help you get planning for next year!

1 min read

5 Ways Real Estate Investors Can Reduce Tax Liability & Increase Savings

By Chris Clothier on Fri, Apr 15, 2016

4 min read

4 Methods for Real Estate Investors to Utilize Big Data

By Chris Clothier on Fri, Apr 15, 2016

If you invest in real estate, there is a trend that you need to know about. For real estate investors, and real estate professionals in general, big data is slowly transforming how we do real estate, especially when it comes to the buying and selling process. But it goes deeper than that, too.

Big data, more than anything, is making things more accessible, more transparent, and less risky for real estate investors. But how, exactly? What does it mean for investors?

Defining Big Data

Forbes has one of the best definitions of big data we’ve seen:

"Big data is a collection of data from traditional and digital sources inside and outside your company that represents a source for ongoing discovery and analysis."

This data can be high-volume or high-velocity to be “big,” and it’s only worth anything to you if it’s accurate. After all, making decisions based on bad data will wind you up in a world of trouble.

7 min read

How and Why To Diversify Your Real Estate Investing Portfolio

By Chris Clothier on Tue, Apr 12, 2016

I don't know about you, but my email in-boxes get overwhelmed on a daily basis.

Every day I receive unsolicited “advice” emails wanting to inform me of the latest and greatest when it comes to real estate investing and wealth. It is truly overwhelming to read many of the emails and see how outdated much of the advice is.

5 min read

Stop Sabotaging Your Real Estate Investing Success!

By Chris Clothier on Fri, Apr 8, 2016

As human beings, we’re all prone to making excuses for ourselves. Everyone deals with insecurities and fears—it’s natural. For anyone looking to have a successful business of any kind, getting past the excuses born out of these fears and negative thoughts is a crucial first step.

4 min read

The 5 Stages of Finding Your Real Estate Niche

By Chris Clothier on Thu, Apr 7, 2016

Getting into the business of real estate is an infinitely rewarding journey. Investing now means building up a solid financial future: something you, your family, and future generations can depend on and enjoy.

Investing in real estate, however, isn’t as simple as just starting. It’s a business that demands a lot of education and time to be done right and profitably, and, really: the stakes can get high. Should that deter you from starting? Absolutely not! The reward is worth the work it takes, and many times over.

Investing in real estate just isn’t a get-rich-quick scheme, and if that’s what people are expecting, they’re in the wrong place!

Beyond getting started, there are questions you as an investor have to answer for yourself: what kind of investor do you want to be? There are endless opportunities out there to fit the particular style that captivates and excites you.

16 min read

Single or MultiFamily: Which is the Better Real Estate Investment? An in-depth study

By Chris Clothier on Tue, Apr 5, 2016

In residential real estate investment, there’s always contention between investors that prefer single-family investment properties and those that prefer multifamily investments.

We’ll go ahead and say this: absolutely every investor will have their own preferences. Every type of investment will have its own pros and cons, and what attracts certain people may not sway others. What might be your deal-breaking flaw might not be someone else’s.

That said, there are some very clear advantages and disadvantages between single and multifamily properties that should be considered. As a real estate investor, you may want to experiment and try it out for yourself!

Many investors choose to start with single-family properties simply because the barrier to entry is lower. Some prefer to invest in both, while others prefer to deal exclusively in multifamily housing. Others specialize in something else altogether!

4 min read

The Real Estate Investor's Guide to Beating Procrastination

By Chris Clothier on Sat, Apr 2, 2016

Ah, procrastination. It’s a big bugaboo for at least 20% of people in the United States, according to psychologists. Most of us think of procrastination as just putting off work, but it can be more than that. Procrastination means coupons expire, gift cards go unused, and the laundry gets done only when the clean clothes run out.

Procrastination is missing out on opportunity. If you’ve ever struggled with procrastination personally or professionally, it can be stressful and frustrating—especially when you don’t know why you keep doing it.

For the real estate investor, seizing opportunity is at the forefront of your responsibilities. Overcoming your patterns of procrastination will take time and small, consistent efforts. When you examine why you procrastinate and discover what gets you motivated, you’ll finally be able to achieve your true potential as a real estate investor.

4 min read

5 Business & Finance Podcasts Worth Listening To

By Chris Clothier on Thu, Mar 31, 2016

Who doesn’t love a good podcast? If you haven’t decided to start listening to podcasts, we encourage you to give them a shot. They’re great when you’re traveling, commuting, or even doing low-focus tasks that allow you to listen.

We live in a world where pretty much anyone can start their own radio show over the Internet, and while there are definitely some duds out there, there are some real gems, and ones that real estate investors can learn from.

These are just a few business and finance podcasts we’ve found that you might want to check out!

3 min read

Want To See First-Hand The Biggest Turnkey Real Estate Company in the U.S.? Here's Your Chance...

By Chris Clothier on Sun, Mar 27, 2016

April 29th & 30th, 2016 in Dallas/Ft. Worth, Texas...

We're Bringing The Team To Texas To Meet Our Clients and New Investors!

Memphis Invest Is Bringing Our Team To Our DFW Metroplex offices in Grapevine, Texas and you are invited!

12 min read

Passive Income at Its Best: Navigating Turnkey Real Estate Investing

By Chris Clothier on Wed, Mar 23, 2016

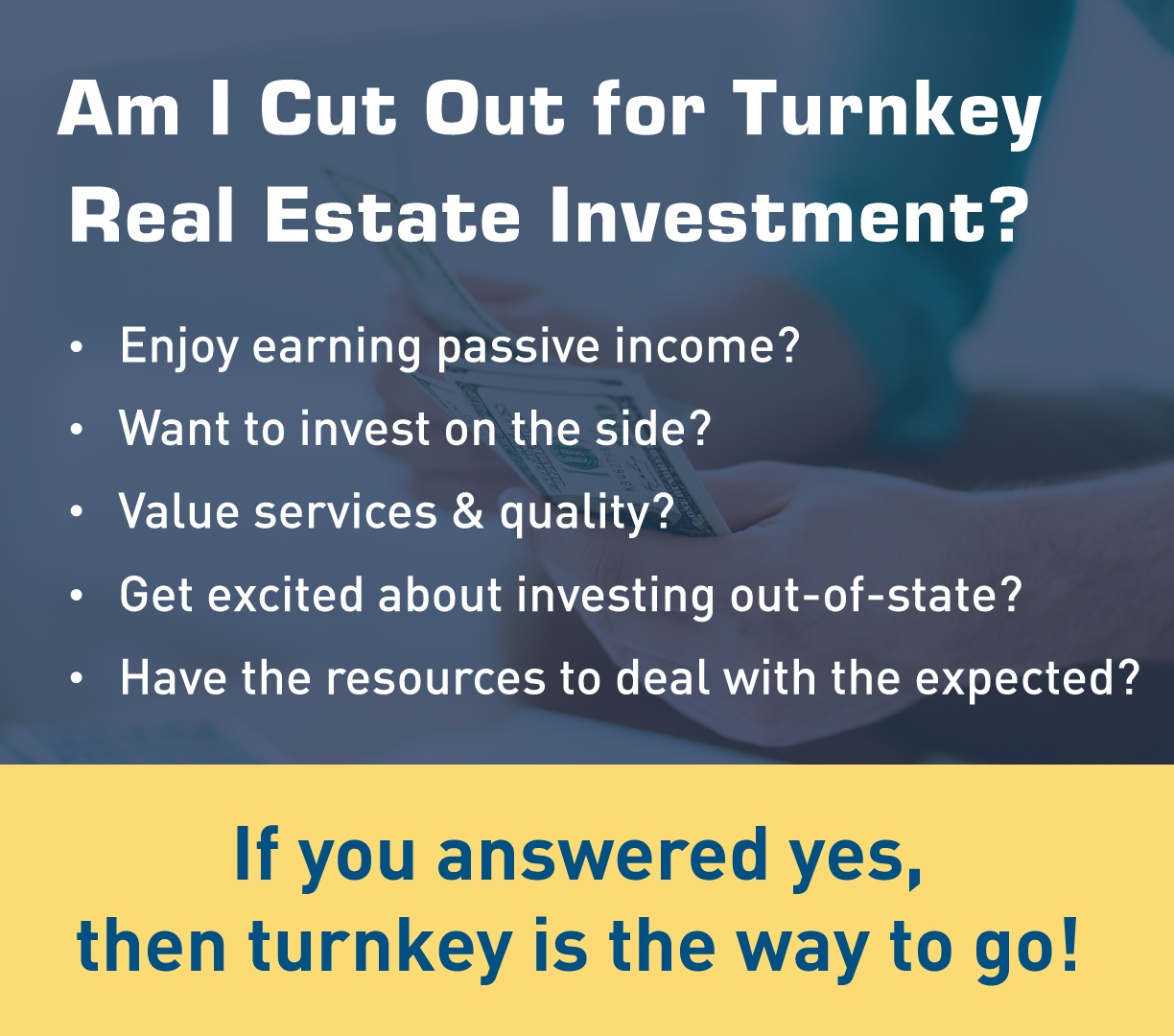

Every week, more and more first time investors head onto the road to learning about their options and getting started in real estate. There is a lot to learn. What is even better is the fact that there are millions of experienced investors in both real estate and other markets that are making moves daily to get into the real estate investing game. That’s great! But hey—there are a ton of options out there in real estate. It’s not enough to decide that you want to be a real estate investor. You have to think about what kind of investor you really want to be.

You can go the fix and flip route for a hands on approach, you can assume the role of landlord for a handful of properties or apartment units, you can dig deep into commercial real estate, or look to land and development...There are plenty of ways to invest.

One way, however, offers opportunities to earn passive income in the most passive way possible. Is there still work involved? Absolutely. All investments require, well, investment. But if you’re in the market for a more hands-off approach to investing, turnkey real estate just might be right for you. So much of deciding what kind of investments to pursue just depends on what you as an individual enjoy and value.

To help you decide, we’re diving deep and looking at the the ins and outs of turnkey real estate: what it is, how it works, what you have to gain, and what red flags you should watch for to ensure the best outcome for your financial future.