A clear trend in Memphis real estate has become apparent in the last few years. Due to a combination of factors, the inventory of available housing has been on a sharp decline. According to figures from a recent article in The Commercial Appeal, the inventory of houses for sale has decreased from 13,300 in January of 2008 to fewer than 6,000 in January of 2013.

3 min read

Reduction in Available Housing a Memphis, TN Real Estate Trend

By Chris Clothier on Tue, Apr 2, 2013

3 min read

Memphis Real Estate Foreclosures Dropping?

By Chris Clothier on Thu, Feb 14, 2013

I know it sounds a bit crazy, but when talking about Memphis real estate and the role that foreclosures have on the market, there are some words that just don't seem to go together. Take for instance using ‘Stable’ and ‘Foreclosure’ in the same line... or sentence for that matter. It sounds a bit oxymoronic, right? I am fairly sure, although not entirely positive, that is a word!

2 min read

Memphis Real Estate Sales Show Big Growth To Start 2013

By Chris Clothier on Thu, Feb 7, 2013

Memphis Area Association of Realtors Reports Big Growth

The Memphis Area Association of Realtors (MAAR) showed a tremendous increase in year over year sales for January to start 2013. The association released data entered into the MAAR data property records database showing over 1,250 sales for the month of January which was a 46% increase over January of 2012. The total number of properties sold was also an 8.9% increase over December of 2012.

3 min read

How To Increase Rental Investment Property Value

By Chris Clothier on Fri, Feb 1, 2013

Many Memphis real estate investors are buying their investment property as a long-term buy/hold strategy. The properties should produce a consistent return on investment, but the main strategy should not be waiting for value increases and then selling for a profit. Memphis is simply not a market where appreciation is the main investment prerogative.

7 min read

Memphis Invest: A Look Back At 2012...A Look Ahead to 2013!

By Chris Clothier on Mon, Jan 21, 2013

White Board Real Estate Investing Plans

Whenever we speak to real estate investors around the country, always sharing the story of our great city Memphis, Tennessee and more importantly what is happening with our real estate investing company, we tell investors that there is no White Board hanging on a wall with a business plan outlining the path to where we are today. It would make a great story if that were the case, but the reality is that we made some very good decisions early on and put ourselves in position to take advantage of opportunities when they presented themselves. Recognizing those opportunities and taking advantage of them has been the hard part. When you mix good decisions with the right opportunities and a little luck, you get a small, family-owned company that has grown from a handful of employees to a Inc. 500/5000 fastest growing company employing almost 40 employees, nearly 300 vendor employees, managing 1,600 plus investment properties with a value approaching $150 Million for over 600 real estate investors! And there is more to come...

Dotting "I's" and Crossing "T's"

We have always considered ourselves as business men first and real estate investors second. With such rapid growth over the past two years, like any good business owners would do, we have been on a constant search to surround ourselves with excellent people who can help guide our growth. In addition to simply looking for great talent and even better advice, we have also had to adopt new rules and the guidelines of a large and growing company by developing HR best practices, vacation policies, travel schedules, new computer systems, a more diverse roster of partner companies from closing attorneys to insurance providers, along with letting go of contractors who simply could not keep up to our standards.

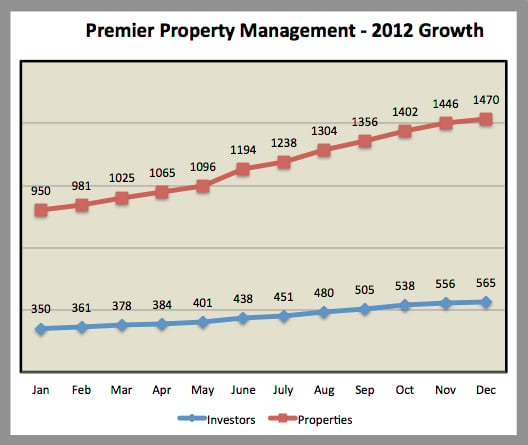

We have also committed our company and staff to sharing data publicly so that interested real estate investors along with our current clients can track and compare our data with their results. Data such as property management numbers graphed and reported monthly, sales numbers reported quarterly and beginning during the 4th quarter of 2012, renovation permits reported monthly. The permits was a big issue to us as our contractors pulled over 400 permits on properties in 2012. Of course, not every property needs a permit and not every action taken on a property has to be permitted. None the less, we have begun reporting the numbers of permits that contractors are pulling monthly on properties we are renovating and managing. None of this is required and certainly not necessary to conduct business. We do it as a way of providing transparency for our clients, interested investors and unfortunately, because sometimes we have to do it to set the record straight!

With all of the changes that the company has undergone in 2012, we thought now would be a perfect time to look back at those changes, report some final numbers and take a look at where we expect to go in 2013. Be sure to let us know what you think at the bottom of the article!

New Faces & A New City

We will remember 2012 for several reasons, but mainly because it wore us out! Very quietly in the fourth quarter of 2011 we began exploring opening a second office in another city. Dallas, Texas was a natural fit for us since it is where we had lived for so many years and we had family and business ties to the area. We opened an office in Dallas during the Spring of 2012 and opened Dallas Invest, GP and had a fantastic year. We were able to complete 55 transactions, open our property management company, hire three full time employees, host two small tours of our properties to help us work out the kinks in the new city and over-all finish with what we felt had been as smooth a process as possible. We have been repeatedly asked about the website DallasInvest.com and all I can say is it is coming, but not until the time is right for rapid growth in Texas and we are not quite ready yet. We still have some work to do to ensure that the investment process and the customer service experience are the highest level possible.

4 min read

Bass Pro Shops Gives Investors A Reason To Cheer For Memphis

By Chris Clothier on Sun, Jan 6, 2013

So now we know that the Bass Pro Shops plan to be right on track with the opening of the Memphis Super Store in Downtown Memphis Pyramid and just in time for the Holiday season of 2013. I think this gives Memphis real estate investors a big reason to cheer. The positives of a project like this one go far beyond simply economics. As Memphis continues to reach out and recruit more major international companies to relocate to Memphis, having family friendly attractions that also add to the tourist draw of the city can do nothing but improve the cities positives. That growth makes for a stronger over-all real estate market in Memphis.

2 min read

An Interesting Development in Distressed Real Estate Investing

By Chris Clothier on Wed, Dec 19, 2012

Preachers encouraging squatters? A recent NBC news report revealed an unusual development in the housing market. In one Atlanta neighborhood, residents and church members have seen a rise in distressed property that is foreclosed and then abandoned, growing dilapidated and becoming what neighbors call "crime magnets." In order to preserve their neighborhood, residents have encouraged families to move into distressed property, fix it up, and keep the neighborhood clean and safe. This approach is being encouraged to prevent neighborhoods from sliding further into disrepair and decline while also trying to bring in families from shelters and off the streets, especially during the winter months. I can't say that I agree with this approach, but I understand where they are coming from. I also think there may be another option.

5 min read

Premier Property Management Memphis | November Rental Numbers

By Chris Clothier on Sat, Dec 15, 2012

Premier Property Management Memphis Performance

Another month has come and gone and it feels like the Memphis real estate market continues to heat up on multiple fronts. There are definitely conflicting numbers being released by different groups all wanting to paint the real estate picture in Memphis a certain way. Home sales are up and sale prices are up. But, foreclosures and short sales are also up and while it appears homes are selling for slightly higher prices, the pace is still way off from what a normal housing market looks like.

2 min read

The Effect of the Housing Market on Investment Real Estate

By Chris Clothier on Sun, Dec 9, 2012

Real Estate Investing

NBC News reports that the housing market recovery is well on its way. Indeed, more people are buying houses, inventories of distressed properties are down, and prices are moving slowly upwards.

Interestingly, according to NBC, "Current homeowners accounted for 54 percent of October’s non-distressed market, up from 50 percent in June," while first-time home sales are actually declining. "Unfortunately, first-time home buyers are seeing just the opposite, largely left out of this surge in sales and prices. Their share of the market, usually up in the 40 percent range historically, fell to 34.7 percent in October."

3 min read

The Changing Face of Home Renters

By Chris Clothier on Fri, Sep 28, 2012

There is an interesting shift occurring in the real estate market. Regardless of low mortgage interest rates, low housing costs, and strengthening housing market, there are some current or former homeowners who have been changed by the housing crisis. According to a recent AOL real estate article, this group of home renters with "vehement opposition to homeownership could continue to color the discourse about housing for years to come." Here in Memphis, this new segment of the population contributes to the continued high demand for quality Memphis real estate as well as quality single-family home rentals nationwide.