"Flipper" is more than just the name of a famous television dolphin, folks. And if you are one (the real estate variety, not the TV dolphin kind), then Memphis, Tennessee, is the place to be right now. Memphis has long been a hot bed for the long-term buy and hold real estate strategy, but there is room on that list for other opportunities. With the real estate climate heating up and the opportunities staying hot, Memphis has moved up on another real estate list.

Chris Clothier

Recent Posts

2 min read

Real Estate Strategy: Flipping Homes, Memphis Style

By Chris Clothier on Sun, May 5, 2013

3 min read

Memphis In May With Memphis Invest...1 Week out!

By Chris Clothier on Fri, May 3, 2013

Memphis Invest Team Getting Fired Up!

We are super excited that we are only 1 week away from what has become a signature event for our company and a whole lot of fun. We have been asked a lot this past week about being able to attend if you have not registered and the answer is yes...but, we really need you to register first so we are able to prepare for the size of the crowd.

6 min read

Memphis Responds to T.J. Simers on Grizzlies - Clippers NBA Matchup

By Chris Clothier on Sun, Apr 28, 2013

We Could Invest In Real Estate Anywhere...We Choose Memphis!

There is something special about Memphis and the people who live here.

I've been lucky enough to live in three great cities in my life. I grew up in Dallas, Texas and loved every minute of it. Being born in Texas, I still claim to be a Texan and I guess I always will. I still have family, friends and business associates in the the Dallas Ft. Worth metroplex and as many of you know, my family recently started DallasInvest.com as our second city of operation. What a great city and a fantastic place for single-family rental investments. But that is a story for another day. Today is all about Memphis.

4 min read

Memphis Real Estate | 1st Quarter Results From Memphis Invest

By Chris Clothier on Mon, Apr 22, 2013

Memphis Invest, GP and related company Premier Property Management Group released 2013 First Quarter Results on Sunday April 21st and a positive trend for the real estate investment company and their clients continues. Demand for investment property and opportunity continue to remain strong in both Memphis and Dallas and portfolio performance as well as client satisfaction remain high. Sales at Memphis Invest, GP grew year over year 110% and tracked even compared to the 4th quarter of 2012. As demand from existing clients continues to pick up, we expect to see growth throughout the year.

3 min read

Memphis Invest Shares 3 Small Business Groups Helping Entrepreneurs

By Chris Clothier on Wed, Apr 17, 2013

Starting a small business -- or growing the one you already own -- can be a daunting task. The small business owner must wear many different hats, and he or she must do so with resources that are often in short supply. Memphis Invest has been blessed to come through the last few years of massive growth as an extremely strong company and we wanted to write an article showing other Memphis business owners a few organizations where they can get help and guidance. Being honored last year as one of Inc. Magazines 500/5000 Fastest Growing Companies was huge for us and we'd love to see more Memphis small businesses on the list!

3 min read

Tips For Lowering Real Estate Taxes

By Chris Clothier on Wed, Apr 10, 2013

For counties and municipalities across the country, property taxes are the gift that keeps on giving. In both good and bad times, American cities and counties seem to find a way to burden their residents by raising these pesky levies. Since mortgage lenders often automatically shunt future property tax payments into escrow accounts each month, many equity-building homeowners don't even focus on the fact that they're paying hundreds or thousands of dollars per year to their local governments. This year, Shelby County, Tennessee, which is the county where Memphis is located, is assessing the value of every property and adjusting rates. Some are going up and some are going down. Event though we manage close to 1,600 single-family rental properties in Memphis, it makes sense to think about our own homes tax appraisal.

2 min read

Memphis Named As #1 In Another Real Estate List...

By Chris Clothier on Sun, Apr 7, 2013

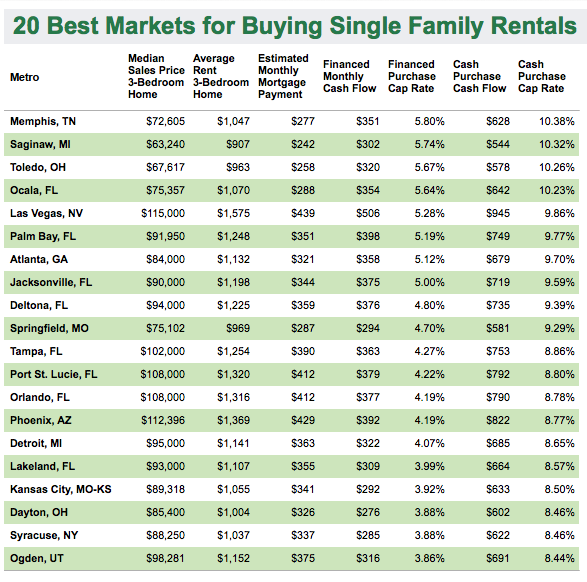

Memphis, TN. Named #1 City For Single-Family Rentals

Realtytrac, the California based on-line foreclosure marketplace has quickly become a fantastic data aggregation site as well and their recent release naming the Top 20 markets to buy single-family rentals made a lot of headlines. Using data, Realtytrac names the 20 Top Markets by price point and income potential. At Memphis Invest, we realized several years ago that there were certain dynamics that made Memphis unique when compared to many cities around the country. This has been fairly well documented by the number of times Memphis appears on man Top lists for everything ranging from affordability, retirement, starting a business, starting a family, receiving health care...and now for investing in single-family homes.

3 min read

Reduction in Available Housing a Memphis, TN Real Estate Trend

By Chris Clothier on Tue, Apr 2, 2013

A clear trend in Memphis real estate has become apparent in the last few years. Due to a combination of factors, the inventory of available housing has been on a sharp decline. According to figures from a recent article in The Commercial Appeal, the inventory of houses for sale has decreased from 13,300 in January of 2008 to fewer than 6,000 in January of 2013.

2 min read

Latest Joe Calloway Book Features Memphis Invest

By Chris Clothier on Fri, Mar 29, 2013

Latest book release from Joe Calloway features Memphis Invest

In 2012, Memphis Invest studied the book "Becoming A Category of One" by Joe Calloway. InAugust of that year, I picked up the phone and called Joe Calloway and invited him to come to the offices of Memphis Invest and address our staff. Joe, a member of the International Speakers Hall of Fame, was very well known as a speaker and business consultant whose client list was quite extensive and his expertise was about customer and employee engagement. We had asked Joe to visit with our staff and participate in our staff meeting. It was the final week of our studying his book and we wanted to give the staff a little extra jolt...a little reminder of all the principles we had studied in the book.

1 min read

Memphis Business Journal Names Finalist For 'Business Of The Year'

By Chris Clothier on Fri, Mar 22, 2013

Memphis Invest Nominated for Small Business Award

Memphis Invest, GP was very honored this week to be formally nominated for the Memphis Business Journal Small Business Awards for the second year in a row!

2012 was an incredible year of growth for our company not only in terms of volume and properties, but most importantly in processes and people. So many changes and adjustments had to be made as we continued to grow at breakneck speed and yet the entire team did an outstanding job of keeping pace and working through the changes. In addition, Memphis Invest, GP was named to the Inc. 500/5000 list of America's Fastest Growing Companies in 2012. The honor and the recognition by other business men and women here in Memphis means a lot to the Clothier family personally and to all of our staff.

We were honored in 2011 to be selected by the Germantown Chamber of Commerce as the Small Business of the Year and to be nominated for this award given by the Memphis Business Journal two years in a row is a real testament to not only the company and the business model, but really to the team. With 41 full time employees and a committed group of partners providing excellent services, Memphis Invest has built an incredible group working for their clients. We are really excited to see what 2013 brings and hopefully it brings the actual award!

Here is a full list of the 5 companies as finalist for the award for 26-60 employee category:

Small Business of the Year, 26-60 employees

- Greenway Home Services

- Herbi-Systems Inc.

- HOG WILD-Real Memphis Barbeque LLC & A Movable Feast Catering

- masterIT LLC

- Memphis Invest GP

We are honored to be mentioned with all the other fantastic Memphis companies.